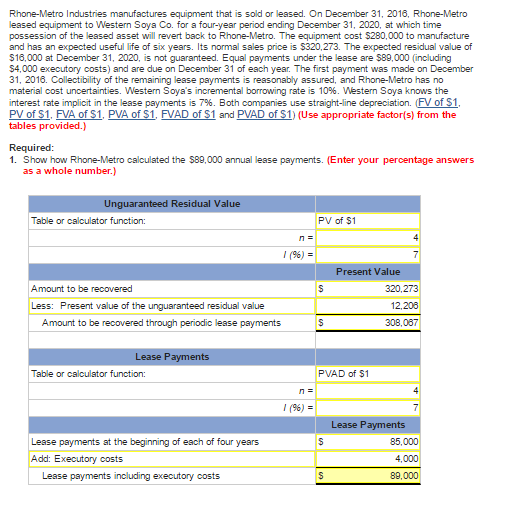

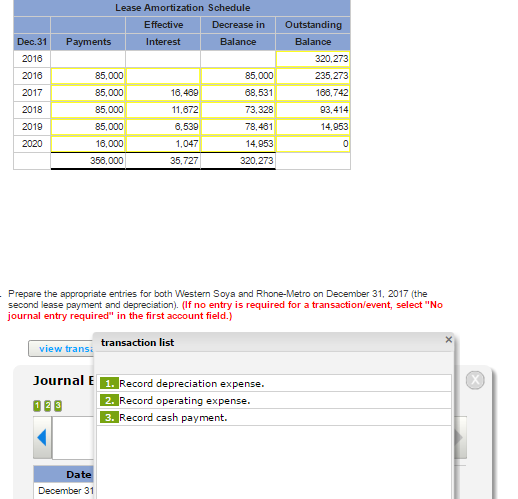

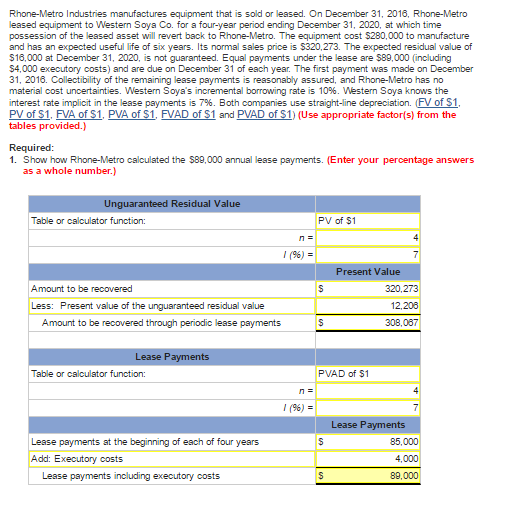

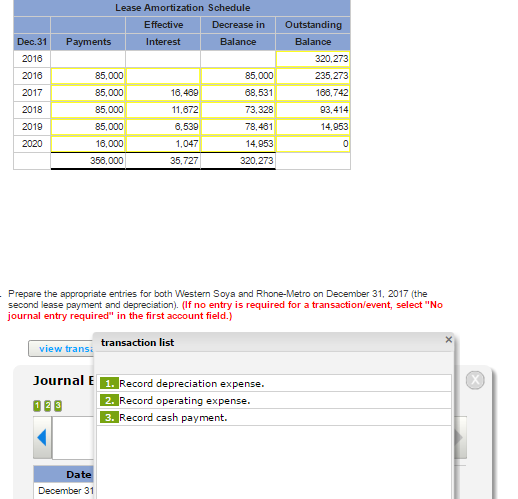

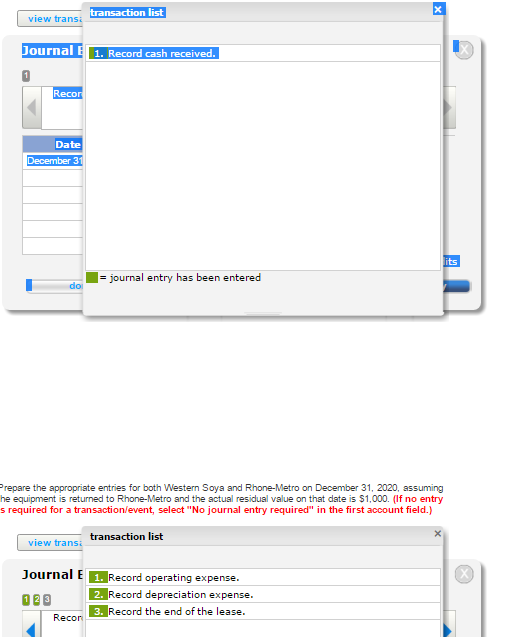

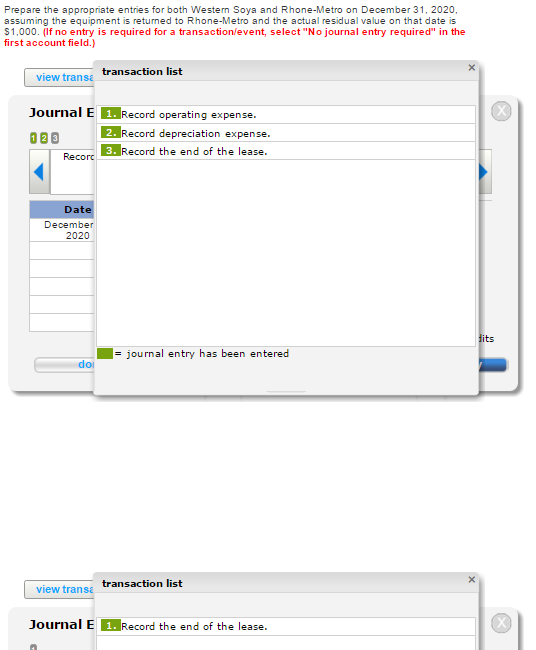

Rhone-Metro Industries manufactures equipment that is sold or leased. On December 31, 2016, Rhone-Metro leased equipment to Western Soya Co. for a four-year period ending December 31, 2020, at which time possession of the leased asset will revert back to Rhone-Metro. The equipment cost $280,000 to manufacture and has an ex usefi life of six years. Its normal sales price is S320,273. The expected residual value of pected ul S16,000 at December 31, 2020, is not guaranteed. E qual payments under the lease are S89,000 (including $4,000 execu costs) and are due on December 31 of each year. The first payment was made on December 31, 2016. Collectibility of the remaining lease payments is assured, and Rhone-Metro has no material cost uncertainties. Western Soya's incremental borrowing rate is 10%. Western Soya knows the Both companies use straight-line depreciation. FV of $1 erest rate implicit in the lease payments is 7% PW of $1, FMA of $1, PVA of $1, EVAD of S1 and PVAD of S1) (U se appropriate factor(s) from the tables provided.) Required 1. Show how Rhone-Metro calculated the S89,000 annual lease payments. (Enter your percentage as a whole number.) Unguaranteed Residual Value Table or calculator function PV of $1 Present Value Amount to be recovered 320,273 Less: Present value of the unguaranteed residual value 12,206 Amount to be recovered through periodic lease payments 308,067 Lease Payments Table or calculator function PVAD of $1 Lease Payments Lease payments at the beginning of each of four years 85,000 costs 4,000 Lease payments including executory costs S S0.c00 Rhone-Metro Industries manufactures equipment that is sold or leased. On December 31, 2016, Rhone-Metro leased equipment to Western Soya Co. for a four-year period ending December 31, 2020, at which time possession of the leased asset will revert back to Rhone-Metro. The equipment cost $280,000 to manufacture and has an ex usefi life of six years. Its normal sales price is S320,273. The expected residual value of pected ul S16,000 at December 31, 2020, is not guaranteed. E qual payments under the lease are S89,000 (including $4,000 execu costs) and are due on December 31 of each year. The first payment was made on December 31, 2016. Collectibility of the remaining lease payments is assured, and Rhone-Metro has no material cost uncertainties. Western Soya's incremental borrowing rate is 10%. Western Soya knows the Both companies use straight-line depreciation. FV of $1 erest rate implicit in the lease payments is 7% PW of $1, FMA of $1, PVA of $1, EVAD of S1 and PVAD of S1) (U se appropriate factor(s) from the tables provided.) Required 1. Show how Rhone-Metro calculated the S89,000 annual lease payments. (Enter your percentage as a whole number.) Unguaranteed Residual Value Table or calculator function PV of $1 Present Value Amount to be recovered 320,273 Less: Present value of the unguaranteed residual value 12,206 Amount to be recovered through periodic lease payments 308,067 Lease Payments Table or calculator function PVAD of $1 Lease Payments Lease payments at the beginning of each of four years 85,000 costs 4,000 Lease payments including executory costs S S0.c00