Question

Rich Company's unadjusted book balance at October 31, 2014 is $2,750. The following information is available for the bank reconciliation. Outstanding checks, $650 Deposits in

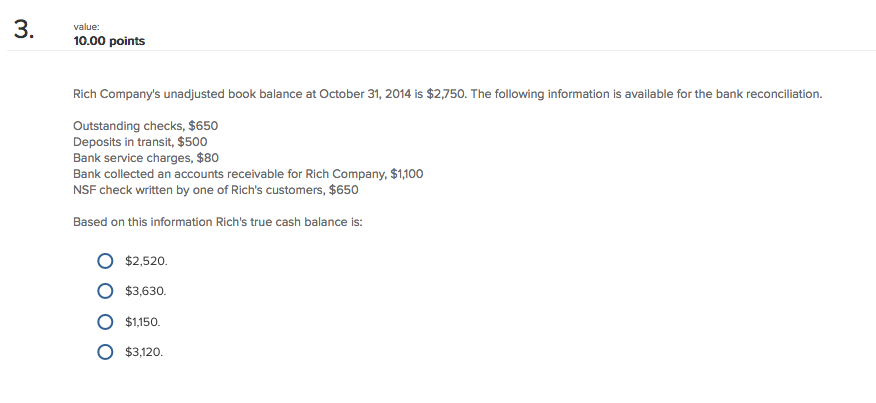

Rich Company's unadjusted book balance at October 31, 2014 is $2,750. The following information is available for the bank reconciliation. Outstanding checks, $650 Deposits in transit, $500 Bank service charges, $80 Bank collected an accounts receivable for Rich Company, $1,100 NSF check written by one of Rich's customers, $650 Based on this information Rich's true cash balance is:

a. $2,520.

b. $3,630.

c. $1,150.

d. $3,120.

------------------

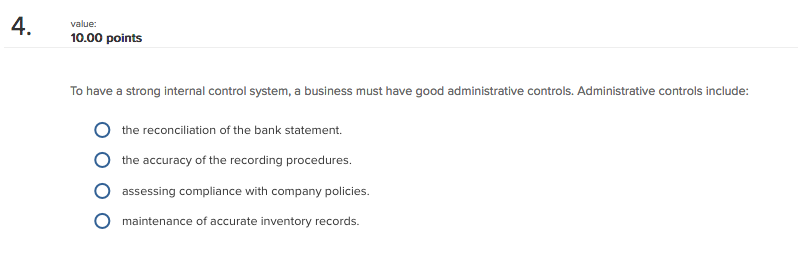

To have a strong internal control system, a business must have good administrative controls. Administrative controls include:

a. the reconciliation of the bank statement.

b. the accuracy of the recording procedures.

c. assessing compliance with company policies.

d. maintenance of accurate inventory records.

3. 10.000 points Rich Company's unadjusted book balance at October 31, 2014 is $2,750. he following information is available for the bank reconciliation Outstanding checks, $650 Deposits in transit, $500 Bank service charges, $80 Bank collected an accounts receivable for Rich Company, $1100 NSF check written by one of Rich's customers, $650 Based on this information Rich's true cash balance is: O $2,520. O $3,630. O $1.150. O $3120Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started