Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Richard and Beryl Edwards are married. Richard was born on January 1st and is 58 years old; Beryl is 56 years old. The couple

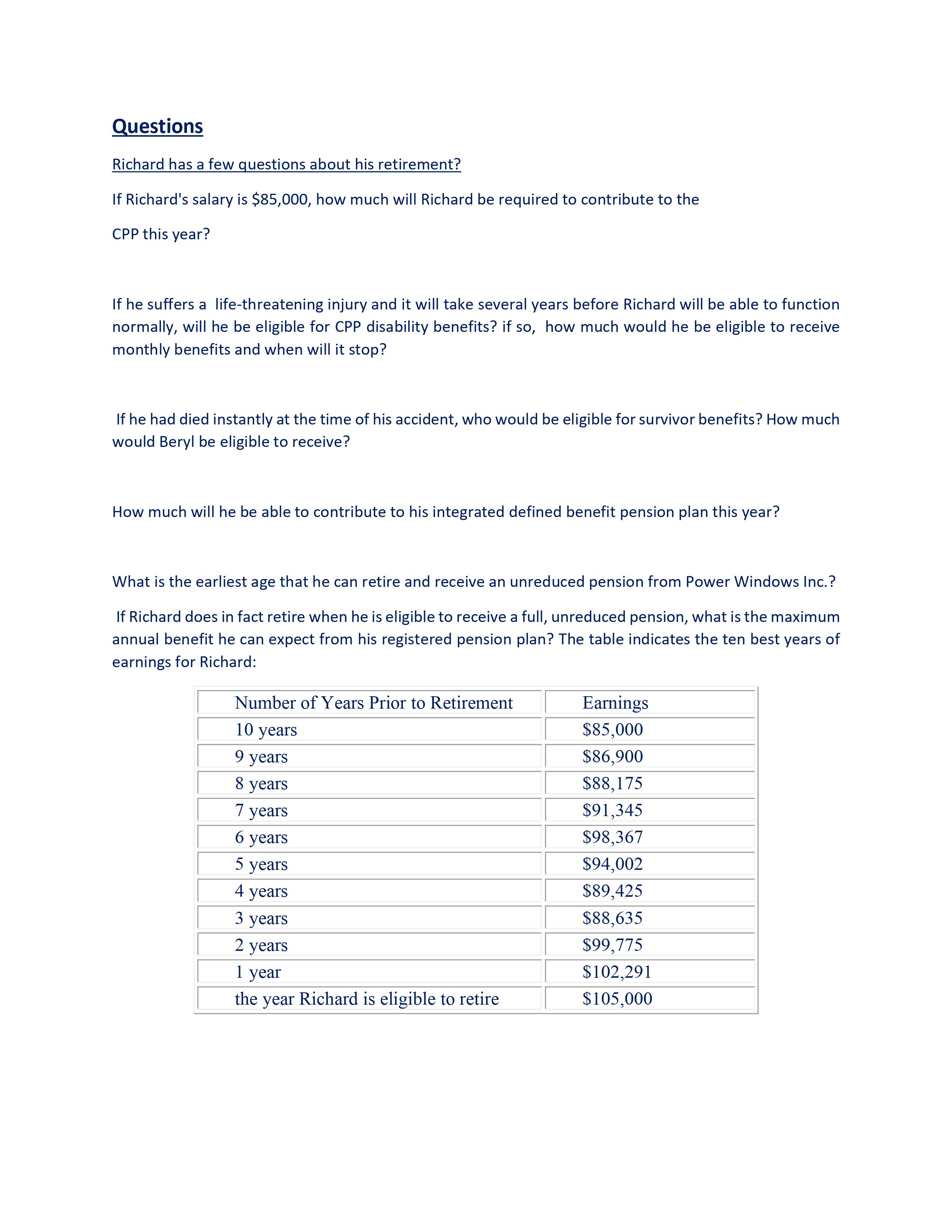

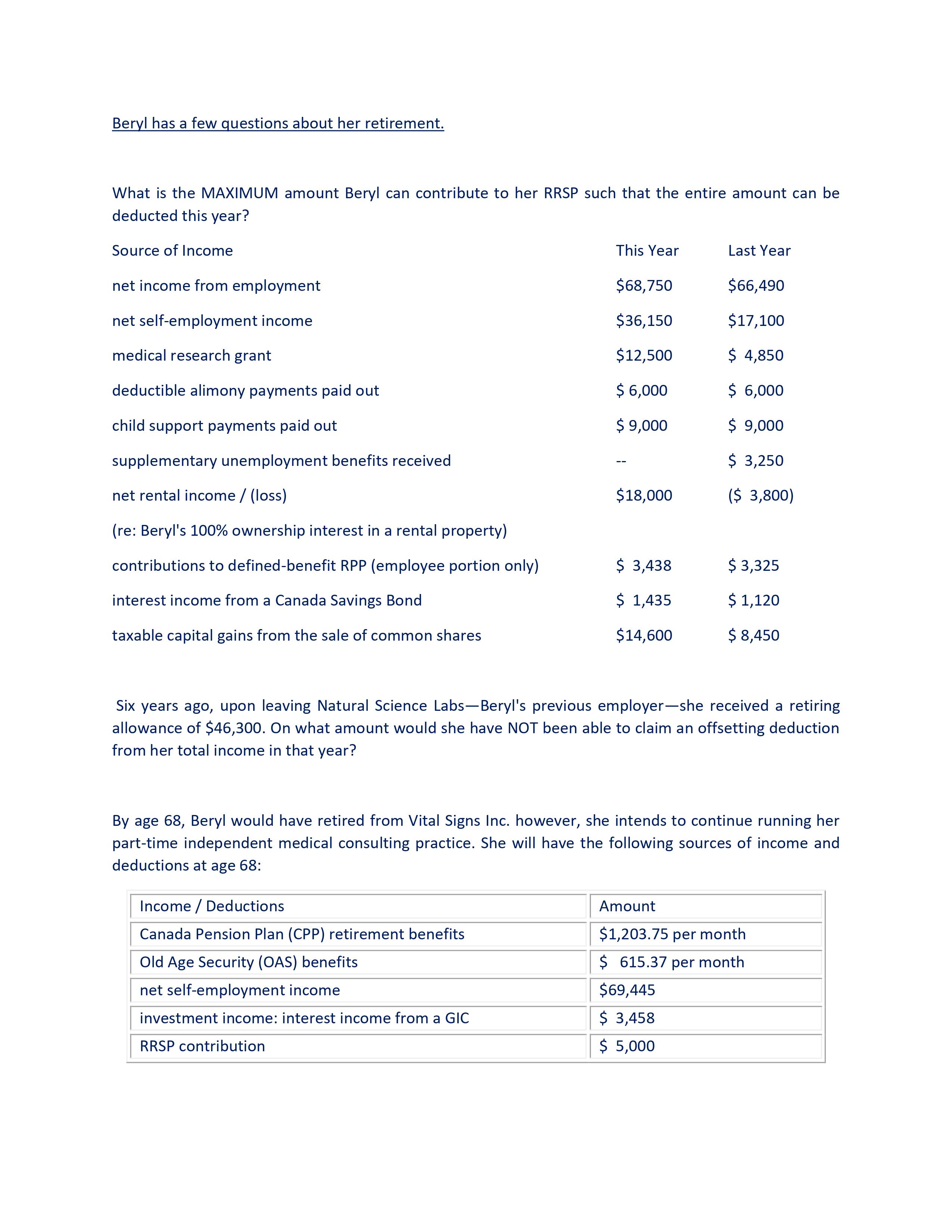

Richard and Beryl Edwards are married. Richard was born on January 1st and is 58 years old; Beryl is 56 years old. The couple has been married for seven years. Initially, they lived in the house that Richard had owned for the past 12 years. However, two years ago, Richard sold his house as he was finding it too difficult to maintain the property. Since that time, the couple has rented an apartment. Richard was born in England and immigrated to Canada with his family when he was 14 years old. At age 20, he returned to England where he lived for 13 years before moving to Canada permanently. Richard has a 19-year old daughter named Susan from a previous marriage. Susan is a full-time student committed to a long-term education plan: she will complete a four-year undergraduate university program followed by a three-year law program. Her plans will not change regardless of what events may take place in her life outside of school. For Beryl, this is also her second marriage. She has a 15-year old son named Roger from her previous relationship who lives with his father. Following the divorce from her first husband, Beryl has been paying court-ordered alimony payments of $6,000 per year. She was also required to pay $9,000 in child support payments until Roger reaches the age of majority. Employment Richard is an engineer for Power Windows Inc. He was hired by the firm when he was 33 years and six months of age. This year his salary will be $85,000. Beryl has worked as a medical technologist for Vital Signs Inc. for the past six years. Based on the medical research she conducts, she also works part-time as a self-employed medical consultant. Prior to being hired by Vital Signs Inc., Beryl worked for Natural Science Labs for 22 years starting her employment in 1985. She became eligible to join the RPP sponsored by Natural Science in 1987. Richard's Registered Pension Plan Richard is a member of Power Windows' defined benefit registered pension plan. He joined the plan on July 1st when he was 35 years and six months of age-two years after he was hired by the company. The The plan is integrated with the Canada Pension Plan (CPP) as follows: on earnings up to the yearly maximum pensionable earnings (YMPE), the contribution rate is 9.3%; on earnings in excess of the YMPE, the contribution rate is 10.9%. The RPP is a best-earnings plan where a 2% unit percentage is applied to the average of the best five years of pensionable service. Assume the money purchase limit when Richard retires will be $30,000. Beryl's Registered Pension Plan Beryl's employer, Vital Signs Inc., offers its employees membership in a defined benefit pension plan. It is a contributory plan where employees contribute 5% of their salary. Pension benefits are based on 1.5% of the employee's average earnings over their career. When Beryl was hired, she had to wait two years before she became eligible to join the RPP. The normal retirement age under Beryl's plan is age 65. Beryl's Registered Retirement Savings Plan and Other Assets Beryl has a self-directed RRSP to which she only recently has begun making regular contributions. The plan has a market value of $89,000. She failed to maximize her contributions in previous years and consequently, she has accumulated a carry forward of $36,000. Assume the RRSP contribution limit for this year is $27,830. Beryl has 100% ownership of a townhouse which she has rented out for the past ten years. This is a property that she purchased before she met Richard and it has always been used as a rental property-she has never occupied it as her principal residence. Canada Pension Plan (CPP) Richard's CPP contributory period began when he immigrated to Canada at age 33. There have been no interruptions to his CPP contributions during his contributory period. The year's maximum pensionable earnings (YMPE) is $64,900, the year's basic exemption is $3,50 and the employer and employee contribution combined rate is 11.40%. The fixed or flat-rate monthly CPP disability amount is $510.85; the maximum monthly disability benefit is $1,413.66. The maximum monthly CPP retirement benefit to which Richard would be entitled based on his contributions to this point is $604.63. The flat-rate monthly CPP survivor's pension amount is $199.31 for a spouse of a deceased contributor under age 65. Questions Richard has a few questions about his retirement? If Richard's salary is $85,000, how much will Richard be required to contribute to the CPP this year? If he suffers a life-threatening injury and it will take several years before Richard will be able to function normally, will he be eligible for CPP disability benefits? if so, how much would he be eligible to receive monthly benefits and when will it stop? If he had died instantly at the time of his accident, who would be eligible for survivor benefits? How much would Beryl be eligible to receive? How much will he be able to contribute to his integrated defined benefit pension plan this year? What is the earliest age that he can retire and receive an unreduced pension from Power Windows Inc.? If Richard does in fact retire when he is eligible to receive a full, unreduced pension, what is the maximum annual benefit he can expect from his registered pension plan? The table indicates the ten best years of earnings for Richard: Number of Years Prior to Retirement Earnings $85,000 10 years $86,900 9 years $88,175 8 years $91,345 7 years $98,367 6 years $94,002 5 years $89,425 4 years $88,635 3 years $99,775 2 years $102,291 1 year the year Richard is eligible to retire $105,000 Beryl has a few questions about her retirement. What is the MAXIMUM amount Beryl can contribute to her RRSP such that the entire amount can be deducted this year? Source of Income net income from employment net self-employment income medical research grant deductible alimony payments paid out This Year Last Year $68,750 $66,490 $36,150 $17,100 $12,500 $ 4,850 $ 6,000 $ 6,000 $ 9,000 $ 9,000 $ 3,250 $18,000 ($ 3,800) child support payments paid out supplementary unemployment benefits received net rental income/(loss) (re: Beryl's 100% ownership interest in a rental property) contributions to defined-benefit RPP (employee portion only) $ 3,438 $ 3,325 interest income from a Canada Savings Bond $ 1,435 $ 1,120 taxable capital gains from the sale of common shares $14,600 $ 8,450 Six years ago, upon leaving Natural Science Labs-Beryl's previous employer-she received a retiring allowance of $46,300. On what amount would she have NOT been able to claim an offsetting deduction from her total income in that year? By age 68, Beryl would have retired from Vital Signs Inc. however, she intends to continue running her part-time independent medical consulting practice. She will have the following sources of income and deductions at age 68: Income/Deductions Canada Pension Plan (CPP) retirement benefits Old Age Security (OAS) benefits net self-employment income investment income: interest income from a GIC RRSP contribution Amount $1,203.75 per month $ 615.37 per month $69,445 $ 3,458 $ 5,000 Assuming an OAS claw back threshold of $79,845, how much of Beryl's OAS benefit will be subject to the OAS clawback when Beryl is 68 years old? They would like advice on their retirement planning. When Richard is 71 and Beryl 69, they would like to have a combined income of they would like to have a combined after-tax income of $90,000 income from pensions and investments. Richard and Beryl would like to know if this is a reasonable expectation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started