Question

Richard Orgain, President of Farmville Fiber Corporation, called to order a meeting of the Finance Committee on September 7, 2007 at 2:30pm. The purpose of

Richard Orgain, President of Farmville Fiber Corporation, called to order a meeting of the Finance Committee on September 7, 2007 at 2:30pm. The purpose of the meeting was to review a $20 million capital budget proposal for the production of polyester fiber.The company was currently a leading manufacturer of rayon and nylon fiber for tire cord in the United States. This market was shrinking, however, because of competitive inroads made by polyester fiber manufacturers. Top management of Farmville Fiber felt that an entry into polyester fiber and also move it into the production of polyster fiber for other end users.

On December 31, 2006, the Farmville Fiber Corporation of Virginia completed its 27- year of uninterrupted growth in sales and earnings per share. During the period 1980-2006, almost all of Farmville Fiber's sales consisted of rayon and nylon fibers.About 70% of these sales consisted of rayon and nylon tire cord for use in the production of automobile tires. Polyester, the "Third Generation" man-made fiber after after rayon and nylon, had shown very rapid growth since the mid 1980's.The meeting was attended by Richard Orgain, president of Farmville Fiber; Lucy Bone, a member of the board of directors; Tessie Barnes, vice president in charge of new products; and Ray Rogers, Controller.Orgain called the meeting to order, gave a brief statement of its purpose, and then turned the floor over to Tessie Barnes.

Barnes opened the meeting with a presentation of the cost and cash flow analysis for the polyester project. To make the discussion simple, she passed out copies of the projected cash flows to those present. The project called for an initial investment of $19 Million. About $14 million would be used to buy machinery and equipment for the production of polyester fibers, $4 million would be needed to modify nylon fiber production facilities which would be utilized to produce polyester fiber, and $1 million would be used to cover the cost for market testing which was completed in november 1988. The product had an expected useful life of 10 years with no salvage value on retirement.

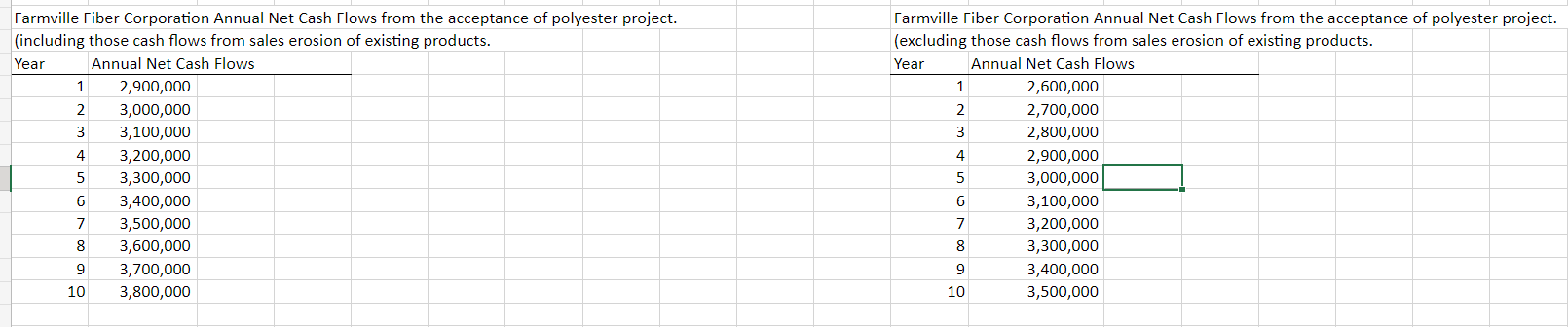

Barnes caution that the annual net cash flows should not be taken at face value because they included those net cash flows that could be diverted from both rayon and nylon fibers.Thus, she also produced the annual net cash flows that excluded those net cash flows from sales erosion of existing products.Furthermore, she stated that these net cashflows would be more appropriate because they were incremental future cash inflows and project cash flows must be estimated on an incremental basis.

Orgain noted that the nylon fiber's production facilities were to be used at only 60% of capacity and these facilities were to be used to produce polyester fiber. He said that the pro-rata allocation of plant facilities, based on the share of capacity used, should have been included in the proposed cash outlay for the project. His reasoning was that if an outside firm tried to rent it from Farmville Fiber, it would be charged somewhere in the neighborhood of $7 million. Barnes replied that they were sunk costs and such sunk costs were irrelevant to capital project evaluations.

Lucy bone contended that if the opportunity cost of idle capacity was a sunk cost, the cost of $1 million already spent for marketing testing should have also been treated as a sunk cost as well. Barnes responded that it was not a sunk cost because the company spent $1 million specifically to test the feasibility of polyester fiber and the cost was directly associated with the polyester project.

Ray Rogers asked if there had been any consideration of additional working capital necessary to support the increase sales. Barnes said that this project would require $2 million in additonal working capital but it was not considered as an outflow because it would never leave the company.

2. Calculate the payback, profitability index, NPV and IRR for this project, for cash flows including the sales erosion in Exhibit 1 and the cash flows excluding the sale erosion in Exhibit 2 respectively.

3. Does NPV and IRR always offer consistent results? Under what circumstances they will offer different results? If this happens, which criteria should be trust, NPV or IRR?

Farmville Fiber Corporation Annual Net Cash Flows from the acceptance of polyester project. Farmville Fiber Corporation Annual Net Cash Flows from the acceptance of polyester project. (including those cash flows from sales erosion of existing products. (excluding those cash flows from sales erosion of existing products. \begin{tabular}{|r|r|} \hline Year & Annual Net Cash \\ \hline 1 & 2,900,000 \\ \hline 2 & 3,000,000 \\ \hline 3 & 3,100,000 \\ \hline 4 & 3,200,000 \\ \hline 5 & 3,300,000 \\ \hline 6 & 3,400,000 \\ \hline 7 & 3,500,000 \\ \hline 8 & 3,600,000 \\ \hline 9 & 3,700,000 \\ \hline 10 & 3,800,000 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline Year & Annual Net Cash Flows \\ \hline 1 & 2,600,000 \\ \hline 2 & 2,700,000 \\ \hline 3 & 2,800,000 \\ \hline 4 & 2,900,000 \\ \hline 5 & 3,000,000 \\ \hline 6 & 3,100,000 \\ \hline 7 & 3,200,000 \\ \hline 8 & 3,300,000 \\ \hline 9 & 3,400,000 \\ \hline 10 & 3,500,000 \\ \hline \end{tabular} Farmville Fiber Corporation Annual Net Cash Flows from the acceptance of polyester project. Farmville Fiber Corporation Annual Net Cash Flows from the acceptance of polyester project. (including those cash flows from sales erosion of existing products. (excluding those cash flows from sales erosion of existing products. \begin{tabular}{|r|r|} \hline Year & Annual Net Cash \\ \hline 1 & 2,900,000 \\ \hline 2 & 3,000,000 \\ \hline 3 & 3,100,000 \\ \hline 4 & 3,200,000 \\ \hline 5 & 3,300,000 \\ \hline 6 & 3,400,000 \\ \hline 7 & 3,500,000 \\ \hline 8 & 3,600,000 \\ \hline 9 & 3,700,000 \\ \hline 10 & 3,800,000 \\ \hline \end{tabular} \begin{tabular}{|r|r|} \hline Year & Annual Net Cash Flows \\ \hline 1 & 2,600,000 \\ \hline 2 & 2,700,000 \\ \hline 3 & 2,800,000 \\ \hline 4 & 2,900,000 \\ \hline 5 & 3,000,000 \\ \hline 6 & 3,100,000 \\ \hline 7 & 3,200,000 \\ \hline 8 & 3,300,000 \\ \hline 9 & 3,400,000 \\ \hline 10 & 3,500,000 \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started