Answered step by step

Verified Expert Solution

Question

1 Approved Answer

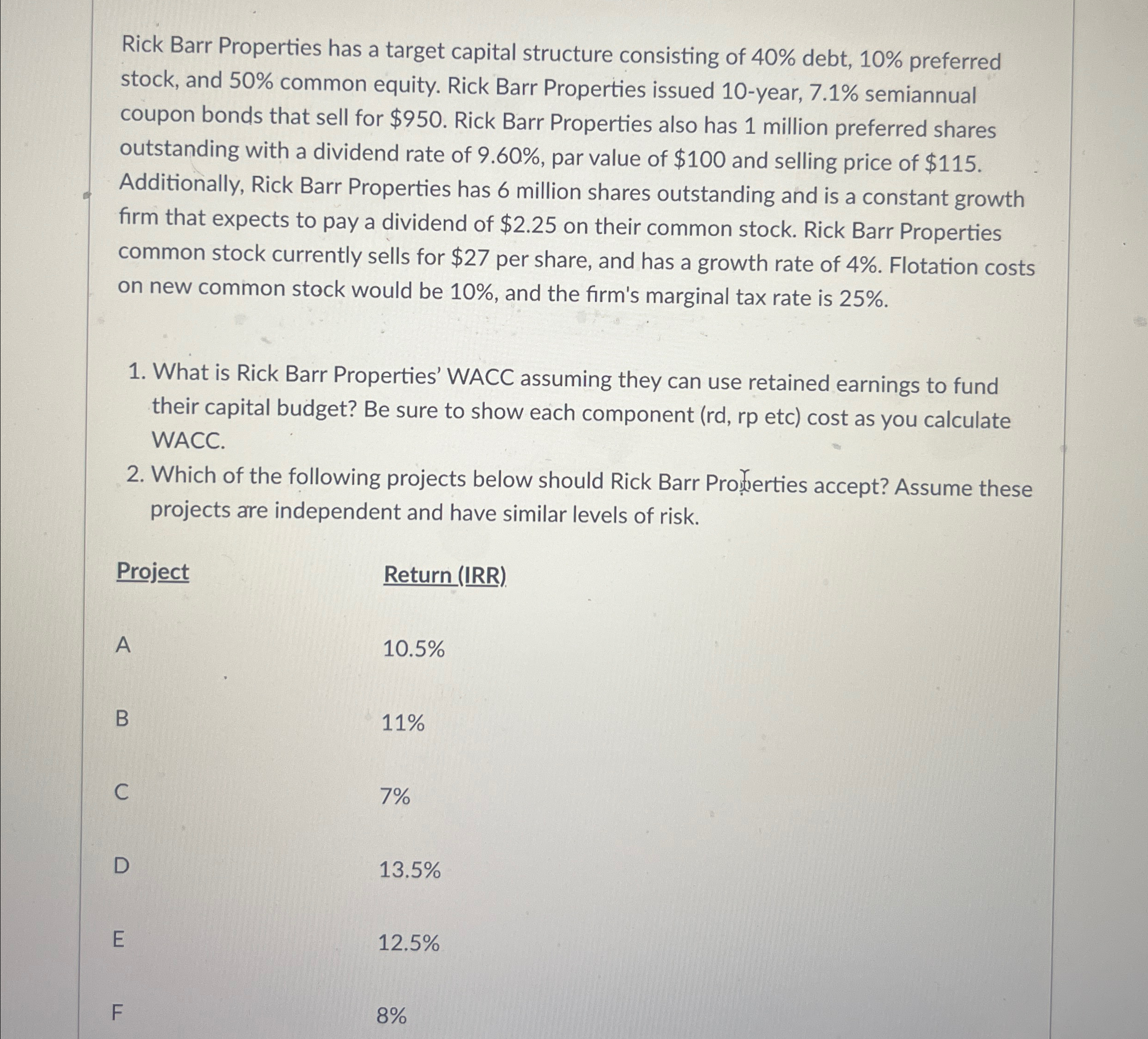

Rick Barr Properties has a target capital structure consisting of 4 0 % debt, 1 0 % preferred stock, and 5 0 % common equity.

Rick Barr Properties has a target capital structure consisting of debt, preferred stock, and common equity. Rick Barr Properties issued year, semiannual coupon bonds that sell for $ Rick Barr Properties also has million preferred shares outstanding with a dividend rate of par value of $ and selling price of $ Additionally, Rick Barr Properties has million shares outstanding and is a constant growth firm that expects to pay a dividend of $ on their common stock. Rick Barr Properties common stock currently sells for $ per share, and has a growth rate of Flotation costs on new common stock would be and the firm's marginal tax rate is

What is Rick Barr Properties' WACC assuming they can use retained earnings to fund their capital budget? Be sure to show each component etc cost as you calculate WACC.

Which of the following projects below should Rick Barr Prowerties accept? Assume these projects are independent and have similar levels of risk.

Project

Return IRR

A

B

C

D

E

F

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started