Answered step by step

Verified Expert Solution

Question

1 Approved Answer

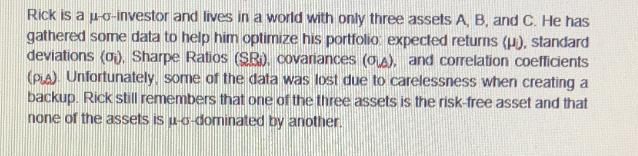

Rick is a u-o-investor and lives in a world with only three assets A, B, and C. He has gathered some data to help

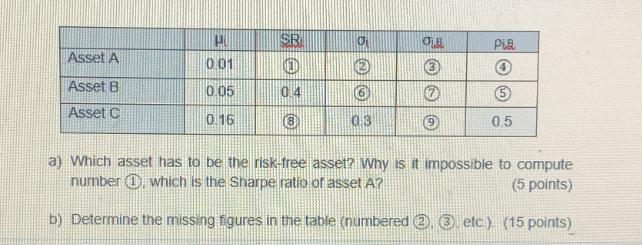

Rick is a u-o-investor and lives in a world with only three assets A, B, and C. He has gathered some data to help him optimize his portfolio expected returns (p), standard deviations (0) Sharpe Ratios (SR), covariances (0), and correlation coefficients (PLA) Unfortunately, some of the data was lost due to carelessness when creating a backup. Rick still remembers that one of the three assets is the risk-free asset and that none of the assets isu-o-dominated by another. Asset A Asset B Asset C HU 0.01 0.05 0.16 SR O 0.4 0 03 OLE 3 PLE 4 5 05 a) Which asset has to be the risk-free asset? Why is it impossible to compute number, which is the Sharpe ratio of asset A? (5 points) b) Determine the missing figures in the table (numbered, etc.). (15 points)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

a The riskfree asset must have a Sharpe ratio SR of infinity positive infinity because it is riskfree which means it has zero standard deviation The f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started