Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Consider the integral form of the American put option price at time t as T rK, du e-(-) N(-d(x, Bu, u t) ) P(x,

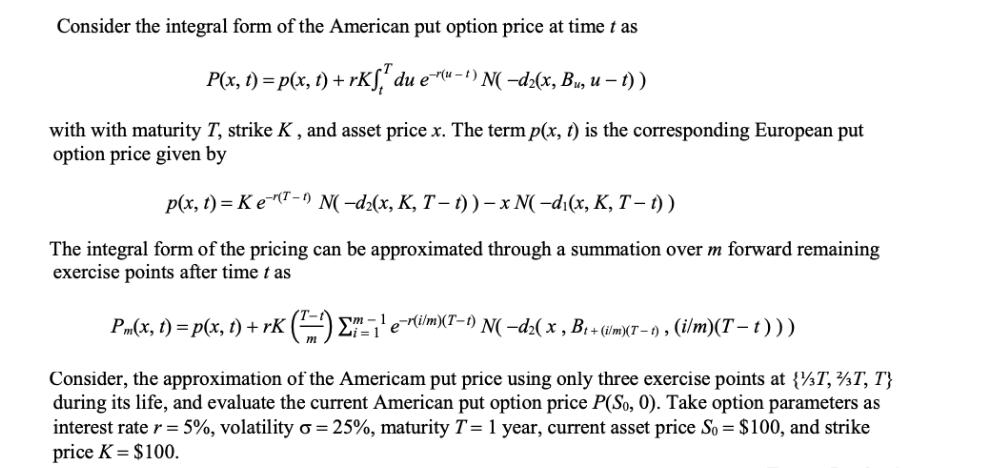

Consider the integral form of the American put option price at time t as T rK, du e-(-) N(-d(x, Bu, u t) ) P(x, t)=p(x, t) + with with maturity T, strike K, and asset price x. The term p(x, t) is the corresponding European put option price given by p(x, t)=Ke"T- N( d2(x, K, T t) ) x N( d(x, K, T1)) The integral form of the pricing can be approximated through a summation over m forward remaining exercise points after time t as Pm(x, t) = p(x, t) + rK () -=-1 e-(ilm)(T-1) N( d(x, B + (i/m)(T 1), (i/m)(T t ) ) ) m Consider, the approximation of the Americam put price using only three exercise points at {3T, 3T, T} during its life, and evaluate the current American put option price P(So, 0). Take option parameters as interest rate r = 5%, volatility o = 25%, maturity T = 1 year, current asset price So = $100, and strike price K = $100.

Step by Step Solution

★★★★★

3.52 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

which is to approximate the American put option price using only three exercise points at 17T 37T and 67T during its life To answer this question I wi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started