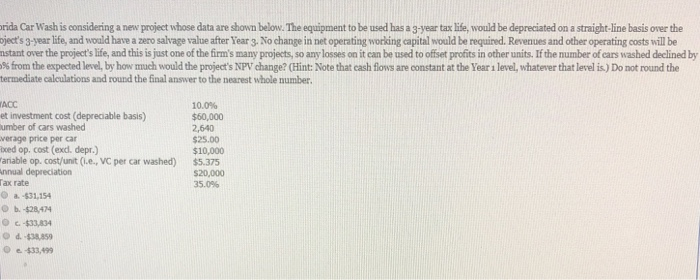

rida Car Wash is considering a new project whose data are shown below. The equipment to be used has a 3-year tax life, would be depreciated on a straight-line basis over the oject's 3-year life, and would have a zero salvage value after Year 3. No change in net operating working capital would be required. Revenues and other operating costs will be nstant over the project's life, and this is just one of the firm's many projects, so any losses on it can be used to offset profits in other units. If the number of ears washed declined by 5% from the expected leve by how much would the project's NPV change? (Hint Note that cash flows are constant at the Year i leve whatever that level is.) Do not round the termediate calculations and round the final answer to the nearest whole number ACC et investment cost (depreciable basis) umber of cars washed verage price per car ixed op. cost (exd. depr.) ariable op. cost/unit (i.e., VC per car washed) $5.375 nnual depreciation ax rate 10.0% $60,000 2,640 $25.00 $10,000 $20,000 35.0% a. 431,154 d-$38,859 O e $33,499 rida Car Wash is considering a new project whose data are shown below. The equipment to be used has a 3-year tax life, would be depreciated on a straight-line basis over the oject's 3-year life, and would have a zero salvage value after Year 3. No change in net operating working capital would be required. Revenues and other operating costs will be nstant over the project's life, and this is just one of the firm's many projects, so any losses on it can be used to offset profits in other units. If the number of ears washed declined by 5% from the expected leve by how much would the project's NPV change? (Hint Note that cash flows are constant at the Year i leve whatever that level is.) Do not round the termediate calculations and round the final answer to the nearest whole number ACC et investment cost (depreciable basis) umber of cars washed verage price per car ixed op. cost (exd. depr.) ariable op. cost/unit (i.e., VC per car washed) $5.375 nnual depreciation ax rate 10.0% $60,000 2,640 $25.00 $10,000 $20,000 35.0% a. 431,154 d-$38,859 O e $33,499