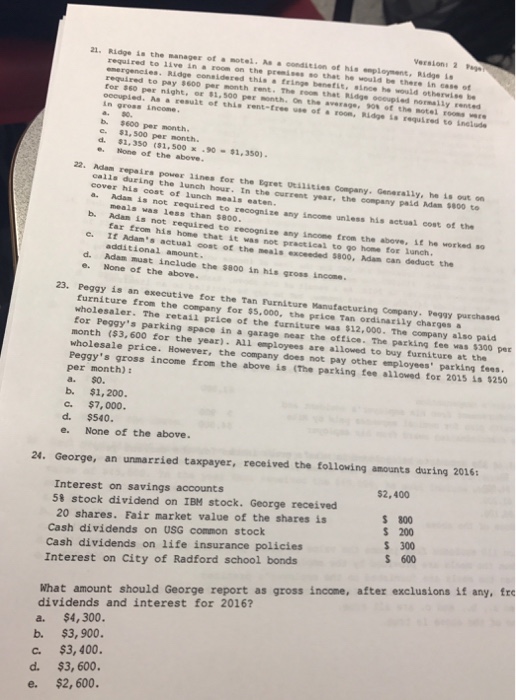

Ridge is a manager of motel. As a condition of his employment. Ridge is required to live in a room on the so that he would be there in case of emergencies. Ridge considered this a fringe benefit, since he would otherwise be required to pay $600 per month rent. The room that Ridge occupied normally rented for $60 per night, or $1, 500 per month. On the average, 90% of the hotel rooms ware occupied. As a result of this rent-free use of a room, Ridge is required to include is gross income. $0 $600 per month. $1, 500 per month. $1, 350 ($1, 500 x 90 = $1, 350). None of the above. Adam repairs power lines for the Egret Utilities Company. Generally, he is out on calls during the lunch hour. In the current year, the company paid $800 to cover his cost of lunch meals eaten. Adam is not required to recognize any income unless his actual cost of the meals was less than $800. Adam is not required to recognize any income from the above, if he worked so far from his home that it was not practical to go home for lunch. If Adam's actual cost of the meals exceeded $800, Adam can deduct the additional amount. Adam must include the $800 in his gross income. None of the above. Peggy is an executive for the Tan Furniture Manufacturing Company. Peggy purchased furniture from the company for $5,000, the price Tan ordinarily charges a wholesaler. The retail price of the furniture was $12,000. The company also paid for Peggy's parking space in a garage near the office. The parking fee was $300 per month ($3, 600 for the year). All employees are allowed. To buy furniture at the wholesale price. However, the company does not pay other employee's parking fees. Peggy's gross income from the above is (The parking fee allowed for 2015 is $250 per month): $0 $1, 200. $7,000. $540. None of the above. George, an unmarried taxpayer, received the following amounts during 2016; Interest on savings accounts $2, 400 5%stock divided on IBM stock. George received 20 shares. Fair market value of the shares is $800 Cash dividends on USG common stock $200 Cash dividends on life insurance policies $300 Interest on City of Radford school bonds $600 What amount should George report as gross income, after exclusions if any, dividends and interest for 2016? $4, 300. $3, 900. $3, 400. $3, 600. $2, 600