Question

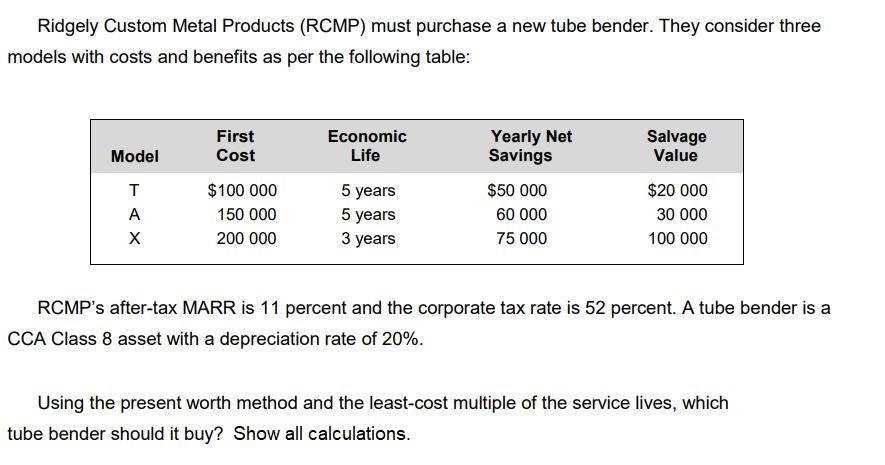

Ridgely Custom Metal Products (RCMP) must purchase a new tube bender. They consider three models with costs and benefits as per the following table:

Ridgely Custom Metal Products (RCMP) must purchase a new tube bender. They consider three models with costs and benefits as per the following table: First Cost Economic Life Yearly Net Savings Salvage Value Model T $100 000 5 years $50 000 $20 000 A 150 000 5 years 3 years 60 000 30 000 200 000 75 000 100 000 RCMP's after-tax MARR is 11 percent and the corporate tax rate is 52 percent. A tube bender is a CCA Class 8 asset with a depreciation rate of 20%. Using the present worth method and the least-cost multiple of the service lives, which tube bender should it buy? Show all calculations.

Step by Step Solution

3.62 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

45 madel x has the least equaled annudl cost of Jhe highest Savin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Essentials Of Business Statistics

Authors: Bruce Bowerman, Richard Connell, Emily Murphree, Burdeane Or

5th Edition

978-1259688867, 1259688860, 78020530, 978-0078020537

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App