Answered step by step

Verified Expert Solution

Question

1 Approved Answer

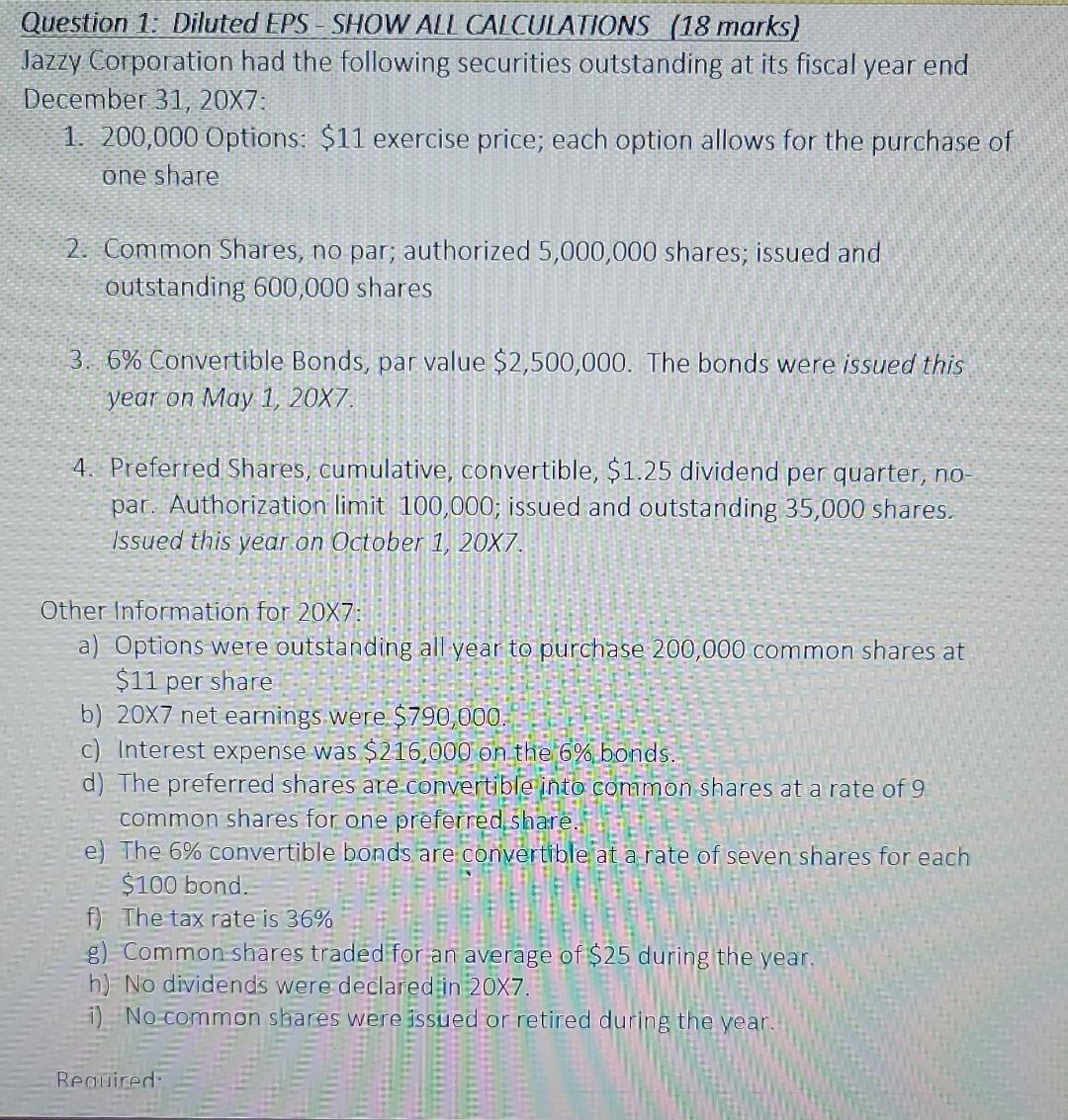

Right answer please Question 1: Diluted EPS - SHOW ALL CALCULATIONS (18 marks) Jazzy Corporation had the following securities outstanding at its fiscal year end

Right answer please

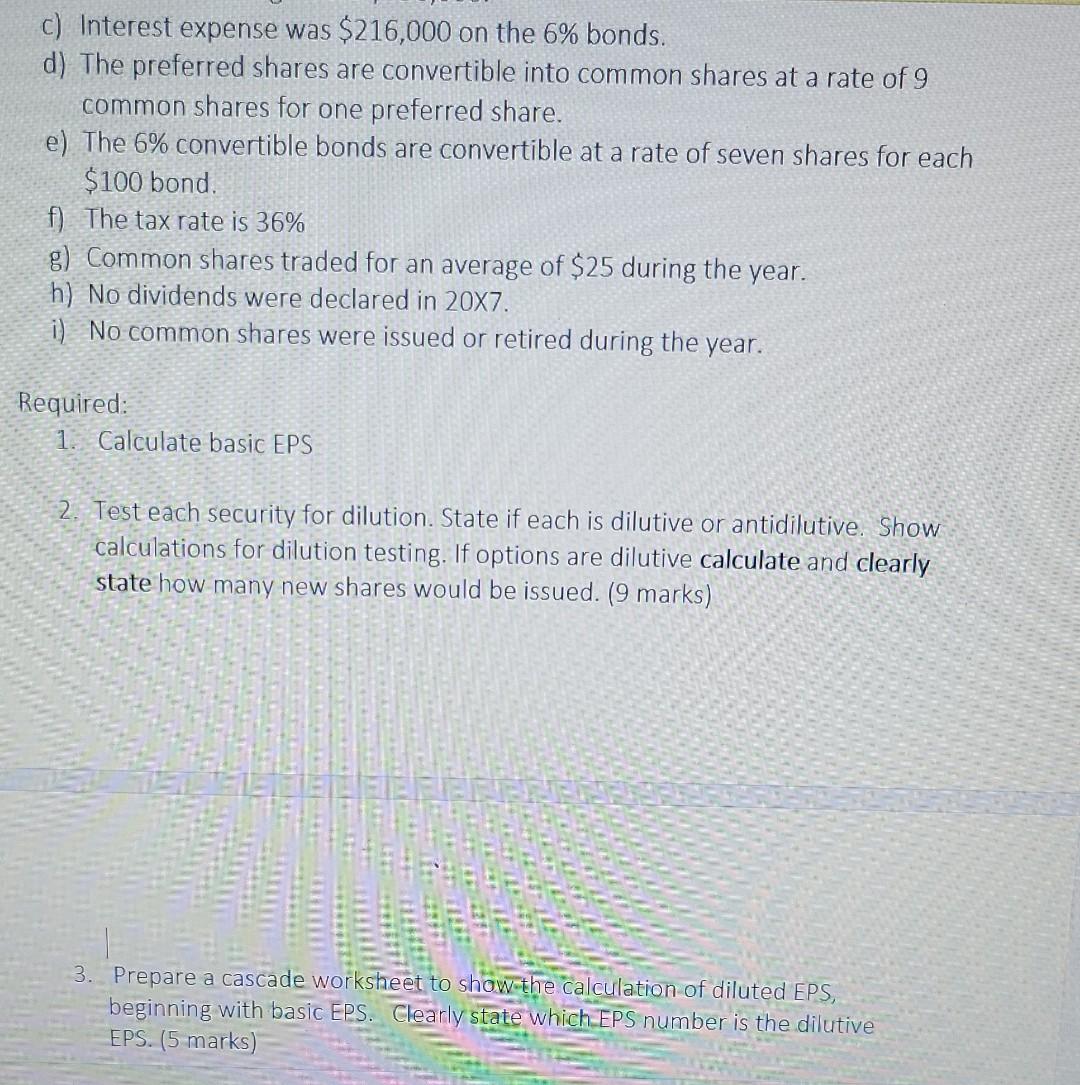

Question 1: Diluted EPS - SHOW ALL CALCULATIONS (18 marks) Jazzy Corporation had the following securities outstanding at its fiscal year end December 31, 20X7: 1. 200,000 Options: $11 exercise price; each option allows for the purchase of one share 2. Common Shares, no par; authorized 5,000,000 shares; issued and outstanding 600,000 shares 3. 6% Convertible Bonds, par value $2,500,000. The bonds were issued this year on May 1, 20X7. 4. Preferred Shares, cumulative, convertible, $1.25 dividend per quarter, no- par. Authorization limit 100,000; issued and outstanding 35,000 shares. Issued this year on October 1, 20X7. Other Information for 20X7: a) Options were outstanding all year to purchase 200,000 common shares at $11 per share b) 20X7 net earnings were $790,000. c) Interest expense was $216,000 on the 6% bonds. d) The preferred shares are convertible into common shares at a rate of 9 common shares for one preferred share. e) The 6% convertible bonds are convertible at a rate of seven shares for each $100 bond. f) The tax rate is 36% g) Common shares traded for an average of $25 during the year. h) No dividends were declared in 20x7. i) No common shares were issued or retired during the year. Required: c) Interest expense was $216,000 on the 6% bonds. d) The preferred shares are convertible into common shares at a rate of 9 common shares for one preferred share. e) The 6% convertible bonds are convertible at a rate of seven shares for each $100 bond. f) The tax rate is 36% g) Common shares traded for an average of $25 during the year. h) No dividends were declared in 20x7. i) No common shares were issued or retired during the year. Required: 1. Calculate basic EPS 2. Test each security for dilution. State if each is dilutive or antidilutive. Show calculations for dilution testing. If options are dilutive calculate and clearly state how many new shares would be issued. (9 marks) 3. Prepare a cascade worksheet to show the calculation of diluted EPS, beginning with basic EPS. Clearly state which EPS number is the dilutive EPSStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started