Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Right click and open images in new tab for better quality The following standard costing data, per unit, are for Black Ltd. for January: Direct

Right click and open images in new tab for better quality

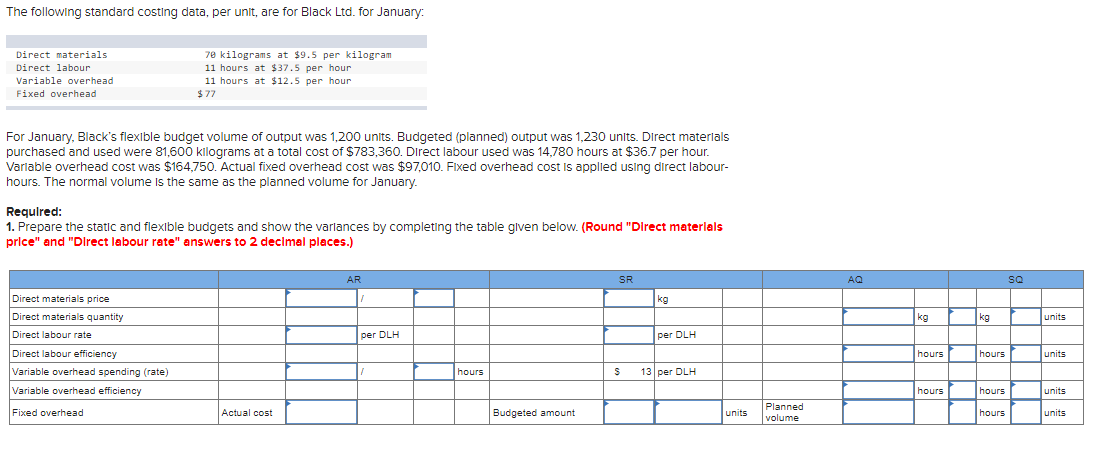

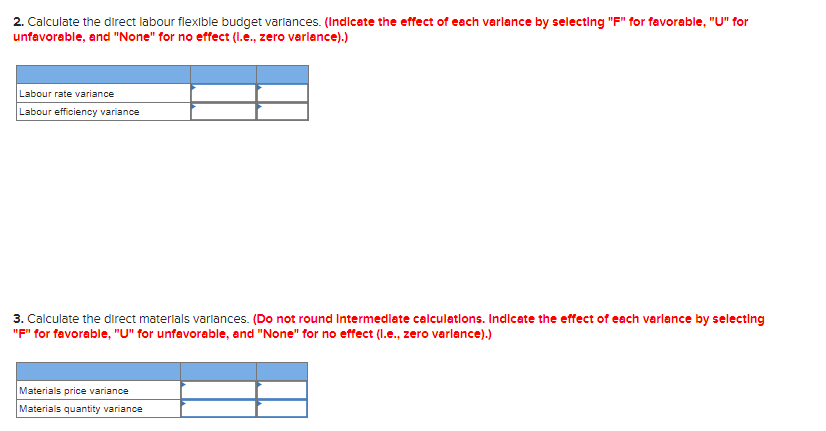

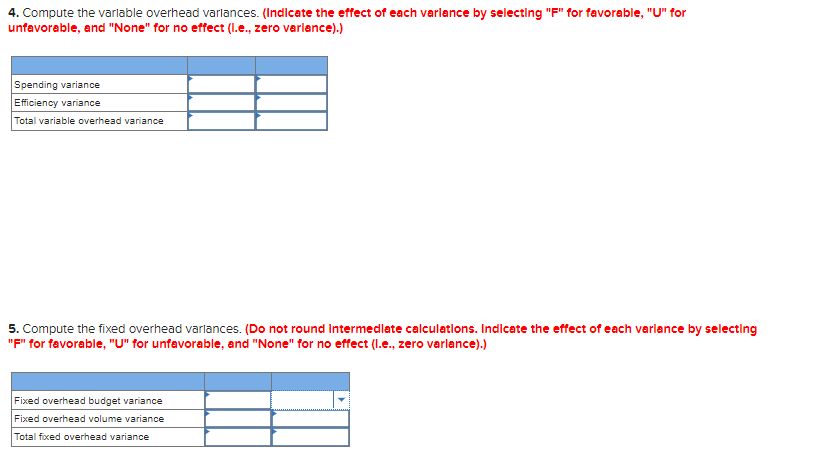

The following standard costing data, per unit, are for Black Ltd. for January: Direct materials Direct labour Variable overhead Fixed overhead 70 kilograms at $9.5 per kilogram 11 hours at $37.5 per hour 11 hours at $12.5 per hour $77 For January, Black's flexible budget volume of output was 1,200 units. Budgeted (planned) output was 1,230 units. Direct materials purchased and used were 81,600 kilograms at a total cost of $783,360. Direct labour used was 14,780 hours at $36.7 per hour. Variable overhead cost was $164,750. Actual fixed overhead cost was $97,010. Fixed overhead cost is applied using direct labour- hours. The normal volume is the same as the planned volume for January. Required: 1. Prepare the static and flexible budgets and show the variances by completing the table given below. (Round "Direct materials price" and "Direct labour rate" answers to 2 decimal places.) AR SR SQ 1 kg kg kg units per DLH per DLH Direct materials price Direct materials quantity Direct labour rate Direct labour efficiency Variable overhead spending (rate) Variable overhead efficiency Fixed overhead hours hours units hours S 13 per DLH hours hours units Actual cost Budgeted amount units Planned volume i hours units 2. Calculate the direct labour flexible budget varlances. (Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (l.e., zero varlance).) Labour rate variance Labour efficiency variance 3. Calculate the direct materials varlances. (Do not round Intermediate calculations. Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (I.e., zero varlance).) Materials price variance Materials quantity variance 4. Compute the variable overhead varlances. (Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (l.e., zero varlance).) Spending variance Efficiency variance Total variable overhead variance 5. Compute the fixed overhead varlances. (Do not round Intermediate calculations. Indicate the effect of each varlance by selecting "F" for favorable, "U" for unfavorable, and "None" for no effect (I.e., zero varlance).) Fixed overhead budget variance Fixed overhead volume variance Total fixed overhead varianceStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started