Answered step by step

Verified Expert Solution

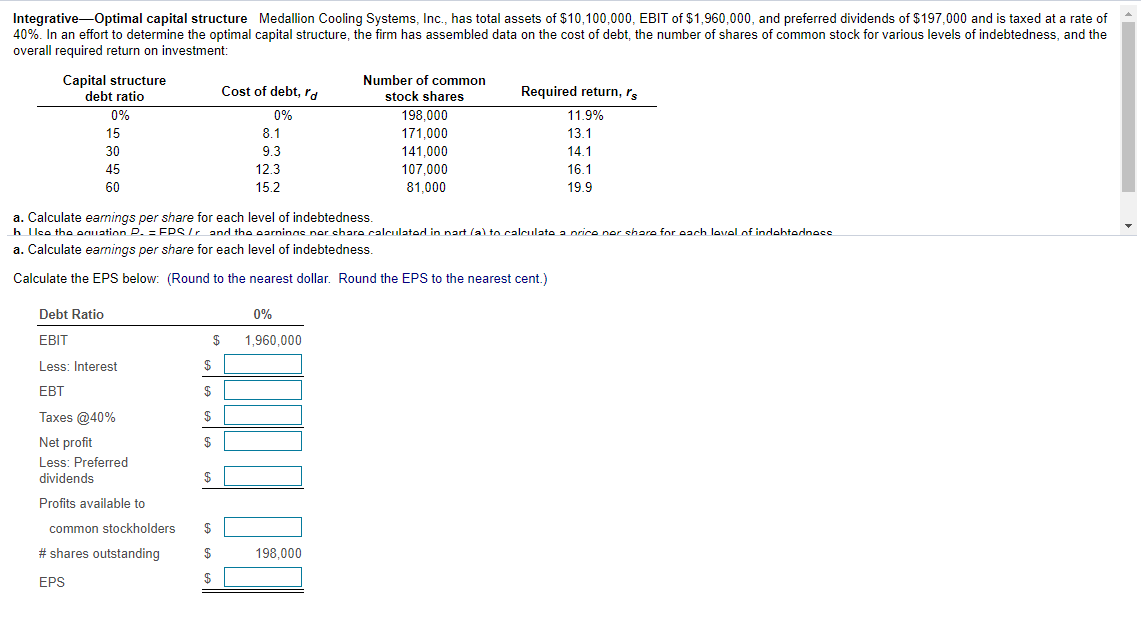

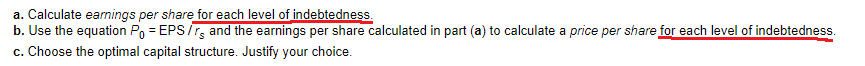

Question

1 Approved Answer

Right click on image and open image in new tab if text is too blurry. Please type out your answer or use Excel as it

Right click on image and open image in new tab if text is too blurry.

Please type out your answer or use Excel as it is easier to read than handwriting.

NOTE: Please consider that the question asks for EACH LEVEL, hence the multiple parts that I cannot view yet, but please answer the question completely.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started