Answered step by step

Verified Expert Solution

Question

1 Approved Answer

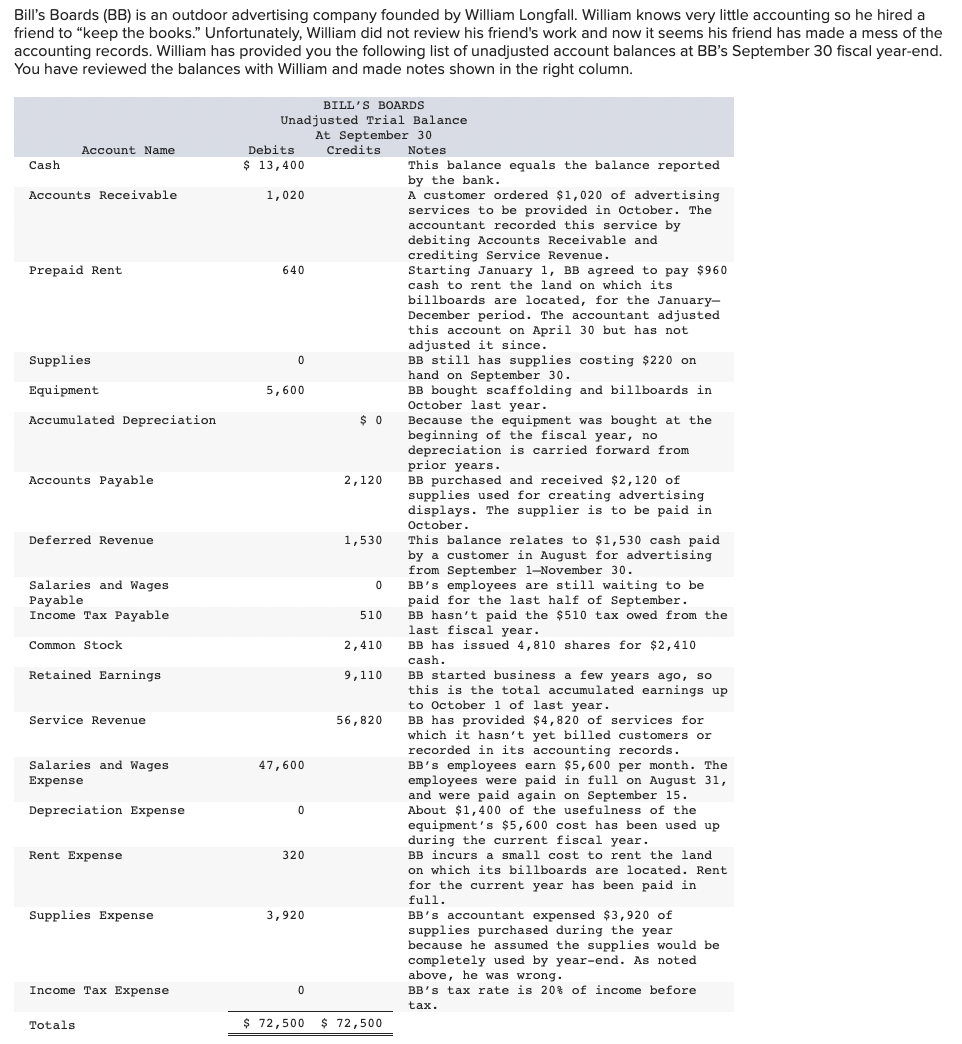

Rill'c Rnardc (RR) is an ntdnor adverticinn rnmnanv fn nded hv William I nncfall William knnwe verv little arcounting so he hired a 1 has

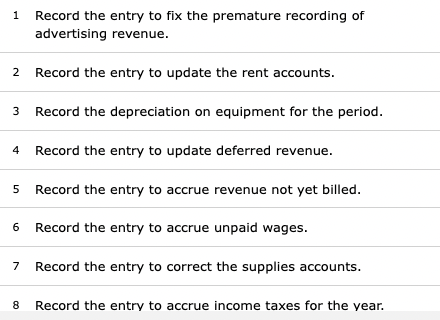

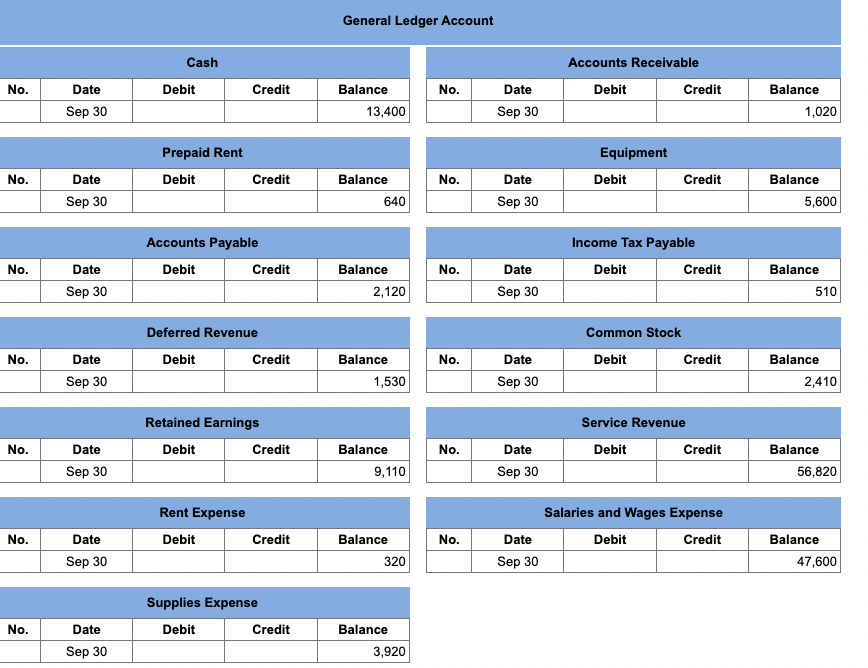

Rill'c Rnardc (RR) is an ntdnor adverticinn rnmnanv fn nded hv William I nncfall William knnwe verv little arcounting so he hired a 1 has made a mess of the mber 30 fiscal year-end. General Ledger Account \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Cash } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 13,400 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts Receivable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,020 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{5}{|c|}{ Prepaid Rent } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 640 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 5,600 \\ \hline \end{tabular} \begin{tabular}{l|c|c|c|c|} \multicolumn{5}{|c|}{ Accounts Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 2,120 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Income Tax Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 510 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{5}{|c|}{ Deferred Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,530 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Common Stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 2,410 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{5}{|c|}{ Retained Earnings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 9,110 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Service Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 56,820 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{7}{|c|}{ Rent Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 320 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Salaries and Wages Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 47,600 \\ \hline \end{tabular} Supplies Expense \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 3,920 \\ \hline \end{tabular} 1 Record the entry to fix the premature recording of advertising revenue. 2 Record the entry to update the rent accounts. 3 Record the depreciation on equipment for the period. 4 Record the entry to update deferred revenue. 5 Record the entry to accrue revenue not yet billed. 6 Record the entry to accrue unpaid wages. 7 Record the entry to correct the supplies accounts. 8 Record the entry to accrue income taxes for the year. Rill'c Rnardc (RR) is an ntdnor adverticinn rnmnanv fn nded hv William I nncfall William knnwe verv little arcounting so he hired a 1 has made a mess of the mber 30 fiscal year-end. General Ledger Account \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Cash } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 13,400 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts Receivable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,020 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{5}{|c|}{ Prepaid Rent } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 640 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 5,600 \\ \hline \end{tabular} \begin{tabular}{l|c|c|c|c|} \multicolumn{5}{|c|}{ Accounts Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 2,120 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Income Tax Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 510 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{5}{|c|}{ Deferred Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,530 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Common Stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 2,410 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{5}{|c|}{ Retained Earnings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 9,110 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Service Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 56,820 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{7}{|c|}{ Rent Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 320 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Salaries and Wages Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 47,600 \\ \hline \end{tabular} Supplies Expense \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 3,920 \\ \hline \end{tabular} 1 Record the entry to fix the premature recording of advertising revenue. 2 Record the entry to update the rent accounts. 3 Record the depreciation on equipment for the period. 4 Record the entry to update deferred revenue. 5 Record the entry to accrue revenue not yet billed. 6 Record the entry to accrue unpaid wages. 7 Record the entry to correct the supplies accounts. 8 Record the entry to accrue income taxes for the year

Rill'c Rnardc (RR) is an ntdnor adverticinn rnmnanv fn nded hv William I nncfall William knnwe verv little arcounting so he hired a 1 has made a mess of the mber 30 fiscal year-end. General Ledger Account \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Cash } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 13,400 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts Receivable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,020 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{5}{|c|}{ Prepaid Rent } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 640 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 5,600 \\ \hline \end{tabular} \begin{tabular}{l|c|c|c|c|} \multicolumn{5}{|c|}{ Accounts Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 2,120 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Income Tax Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 510 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{5}{|c|}{ Deferred Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,530 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Common Stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 2,410 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{5}{|c|}{ Retained Earnings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 9,110 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Service Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 56,820 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{7}{|c|}{ Rent Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 320 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Salaries and Wages Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 47,600 \\ \hline \end{tabular} Supplies Expense \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 3,920 \\ \hline \end{tabular} 1 Record the entry to fix the premature recording of advertising revenue. 2 Record the entry to update the rent accounts. 3 Record the depreciation on equipment for the period. 4 Record the entry to update deferred revenue. 5 Record the entry to accrue revenue not yet billed. 6 Record the entry to accrue unpaid wages. 7 Record the entry to correct the supplies accounts. 8 Record the entry to accrue income taxes for the year. Rill'c Rnardc (RR) is an ntdnor adverticinn rnmnanv fn nded hv William I nncfall William knnwe verv little arcounting so he hired a 1 has made a mess of the mber 30 fiscal year-end. General Ledger Account \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Cash } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 13,400 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Accounts Receivable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,020 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{5}{|c|}{ Prepaid Rent } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 640 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Equipment } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 5,600 \\ \hline \end{tabular} \begin{tabular}{l|c|c|c|c|} \multicolumn{5}{|c|}{ Accounts Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 2,120 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Income Tax Payable } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 510 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{5}{|c|}{ Deferred Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 1,530 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Common Stock } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 2,410 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{5}{|c|}{ Retained Earnings } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 9,110 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \multicolumn{5}{|c|}{ Service Revenue } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 56,820 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \multicolumn{7}{|c|}{ Rent Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 320 \\ \hline \end{tabular} \begin{tabular}{|l|c|c|c|c|} \hline \multicolumn{5}{|c|}{ Salaries and Wages Expense } \\ \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 47,600 \\ \hline \end{tabular} Supplies Expense \begin{tabular}{|c|c|c|c|c|} \hline No. & Date & Debit & Credit & Balance \\ \hline & Sep 30 & & & 3,920 \\ \hline \end{tabular} 1 Record the entry to fix the premature recording of advertising revenue. 2 Record the entry to update the rent accounts. 3 Record the depreciation on equipment for the period. 4 Record the entry to update deferred revenue. 5 Record the entry to accrue revenue not yet billed. 6 Record the entry to accrue unpaid wages. 7 Record the entry to correct the supplies accounts. 8 Record the entry to accrue income taxes for the year Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started