Answered step by step

Verified Expert Solution

Question

1 Approved Answer

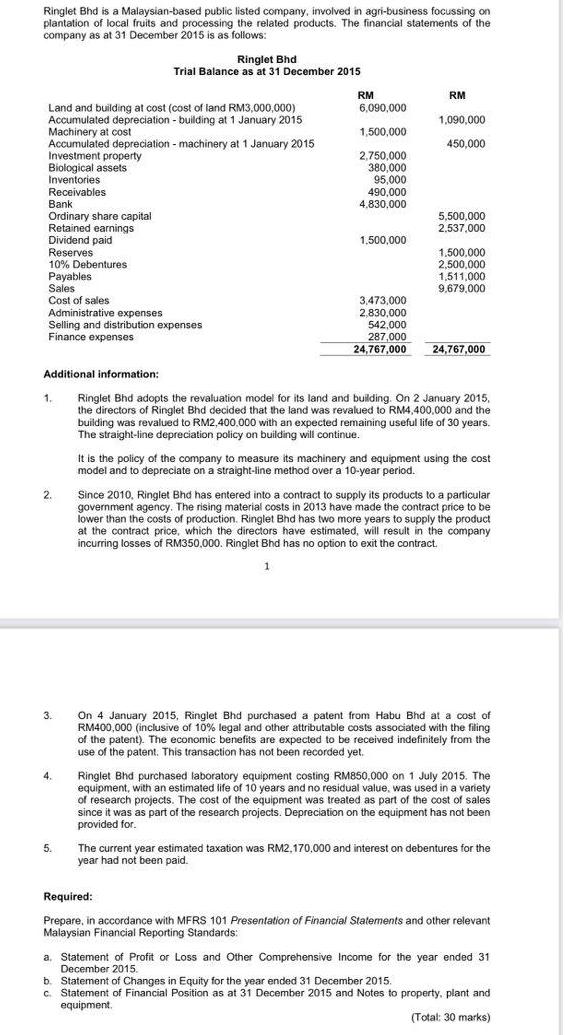

Ringlet Bhd is a Malaysian-based public listed company, involved in agri-business focussing on plantation of local fruits and processing the related products. The financial

Ringlet Bhd is a Malaysian-based public listed company, involved in agri-business focussing on plantation of local fruits and processing the related products. The financial statements of the company as at 31 December 2015 is as follows: Land and building at cost (cost of land RM3,000,000) Accumulated depreciation - building at 1 January 2015 Machinery at cost Accumulated depreciation - machinery at 1 January 2015 Investment property Biological assets Inventories Receivables Bank Ordinary share capital Retained earnings Dividend paid Reserves 10% Debentures Payables Sales Cost of sales: Administrative expenses Selling and distribution expenses Finance expenses 1. Ringlet Bhd Trial Balance as at 31 December 2015 2. 3. 4. 5. RM 6,090,000 1,500,000 2,750,000 380,000 95,000 490,000 4,830,000 1,500,000 3,473,000 2,830,000 542,000 287,000 24,767,000 RM Additional information: Ringlet Bhd adopts the revaluation model for its land and building. On 2 January 2015, the directors of Ringlet Bhd decided that the land was revalued to RM4,400,000 and the building was revalued to RM2,400.000 with an expected remaining useful life of 30 years. The straight-line depreciation policy on building will continue. 1,090,000 450,000 5.500,000 2.537,000 1,500,000 2,500,000 1,511,000 9,679,000 24,767,000 It is the policy of the company to measure its machinery and equipment using the cost model and to depreciate on a straight-line method over a 10-year period. Since 2010, Ringlet Bhd has entered into a contract to supply its products to a particular government agency. The rising material costs in 2013 have made the contract price to be lower than the costs of production. Ringlet Bhd has two more years to supply the product at the contract price, which the directors have estimated, will result in the company incurring losses of RM350,000. Ringlet Bhd has no option to exit the contract. 1 On 4 January 2015, Ringlet Bhd purchased a patent from Habu Bhd at a cost of RM400,000 (inclusive of 10% legal and other attributable costs associated with the filing of the patent). The economic benefits are expected to be received indefinitely from the use of the patent. This transaction has not been recorded yet. Ringlet Bhd purchased laboratory equipment costing RM850,000 on 1 July 2015. The equipment, with an estimated life of 10 years and no residual value, was used in a variety of research projects. The cost of the equipment was treated as part of the cost of sales since it was as part of the research projects. Depreciation on the equipment has not been provided for. The current year estimated taxation was RM2,170,000 and interest on debentures for the year had not been paid. Required: Prepare, in accordance with MFRS 101 Presentation of Financial Statements and other relevant Malaysian Financial Reporting Standards: a. Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2015. b. Statement of Changes in Equity for the year ended 31 December 2015. c. Statement of Financial Position as at 31 December 2015 and Notes to property, plant and equipment. (Total: 30 marks)

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a Statement of Profit or Loss and Other Comprehensive Income for the year ended 31 December 2015 Ringlet Bhd Statement of Profit or Loss and Other Comprehensive Income For the year ended 31 December 2...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started