Answered step by step

Verified Expert Solution

Question

1 Approved Answer

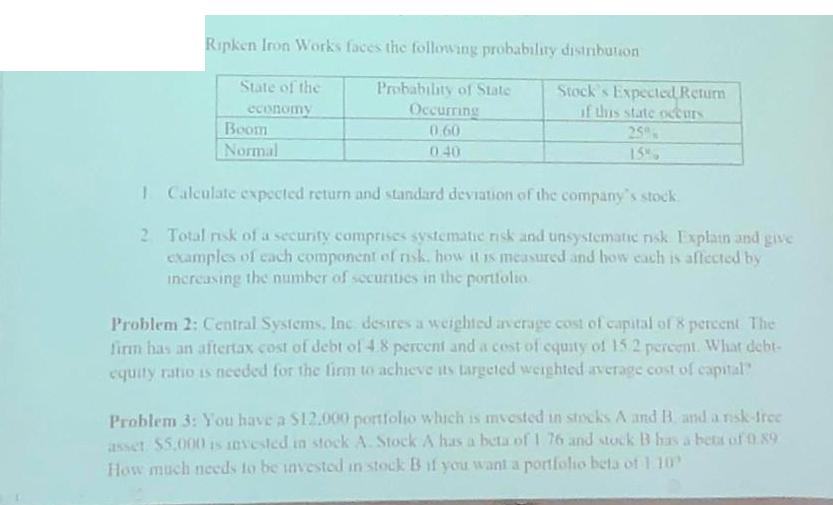

Ripken Iron Works faces the following probability distribution Probability of State Occurring 0.60 0.40 State of the economy Boom Normal Stock's Expected Return if

Ripken Iron Works faces the following probability distribution Probability of State Occurring 0.60 0.40 State of the economy Boom Normal Stock's Expected Return if this state occurs 25% 15% I Calculate expected return and standard deviation of the company's stock 2 Total risk of a security comprises systematic risk and unsystematic risk Explain and give examples of each component of risk. how it is measured and how each is affected by increasing the number of securities in the portfolio. Problem 2: Central Systems, Inc desires a weighted average cost of capital of 8 percent The firm has an aftertax cost of debt of 4.8 percent and a cost of equity of 15.2 percent. What debt- equity ratio is needed for the firm to achieve its targeted weighted average cost of capital" Problem 3: You have a $12.000 portfolio which is mvested in stocks A and B and a risk-free asset $5,000 is invested in stock A. Stock A has a beta of 1 76 and stock B has a beta of 0.89 How much needs to be invested in stock B if you want a portfolio beta of 110

Step by Step Solution

★★★★★

3.40 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started