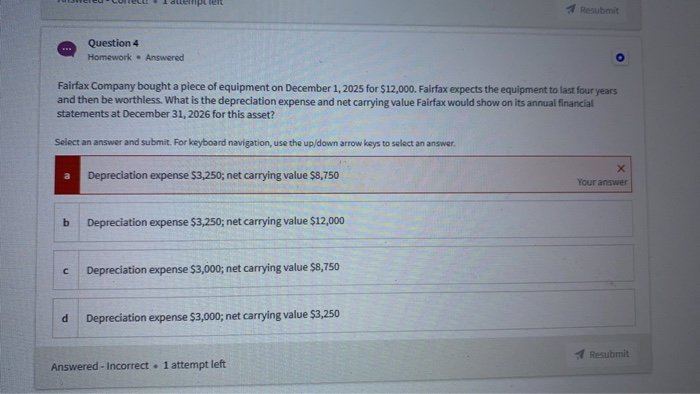

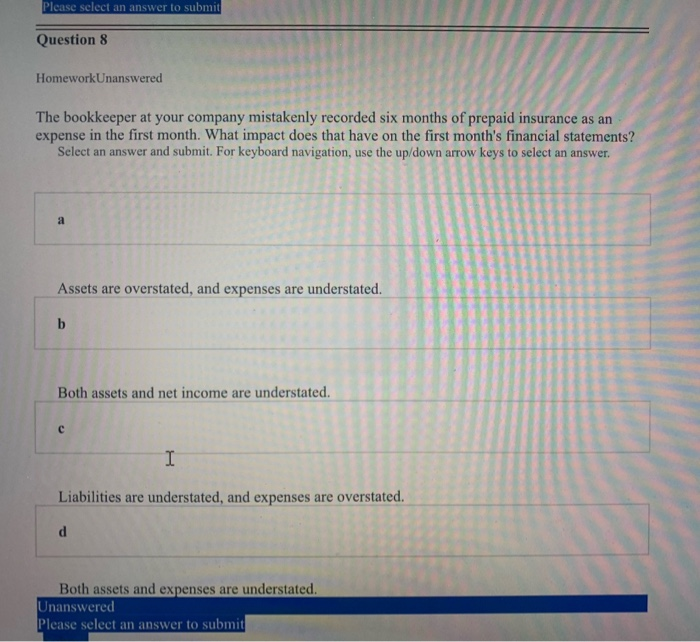

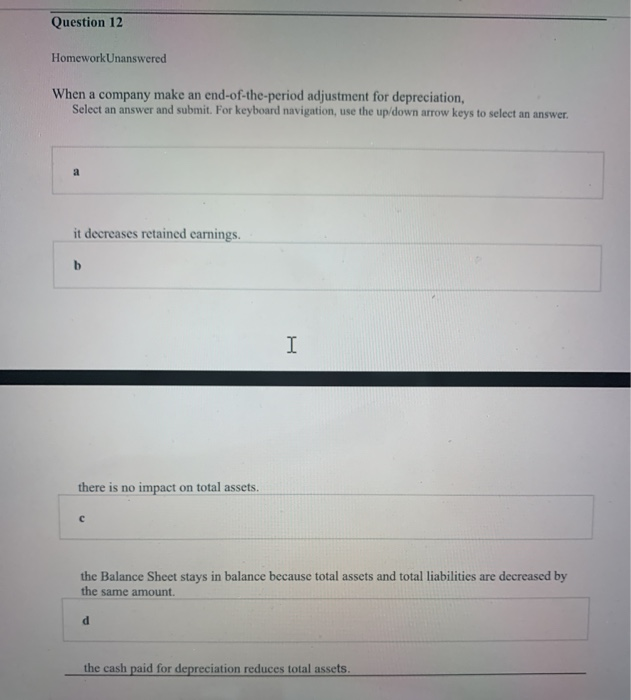

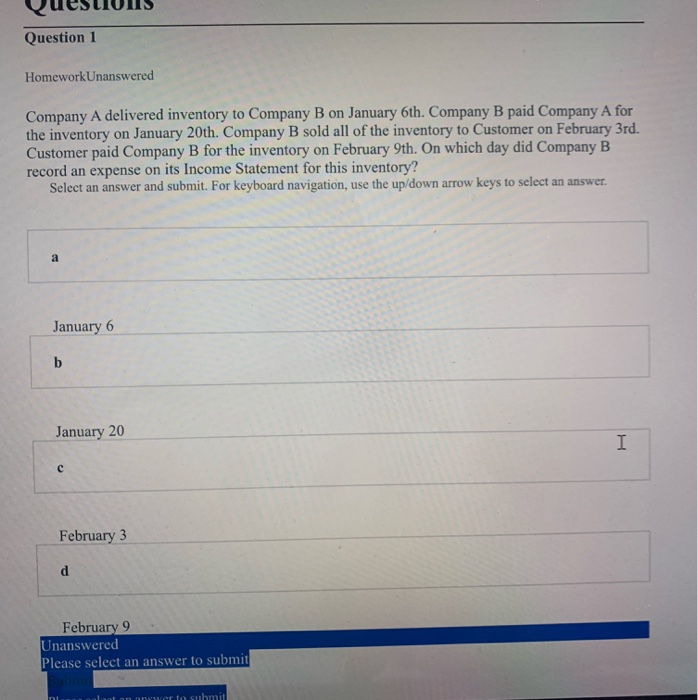

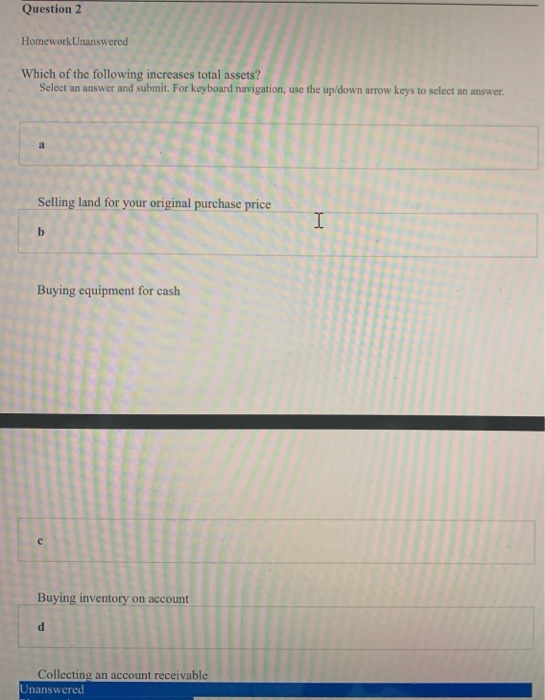

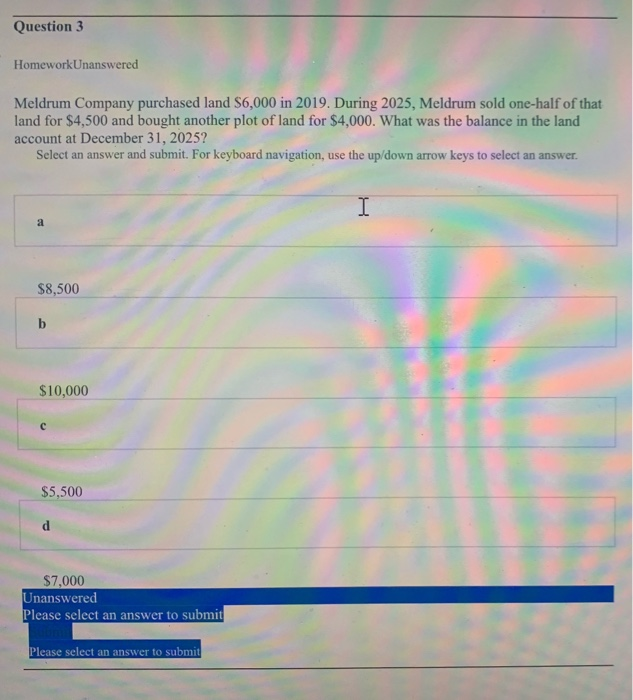

ripleft Resubmit Question 4 Homework Answered O Fairfax Company bought a piece of equipment on December 1, 2025 for $12,000. Fairfax expects the equipment to last four years and then be worthless. What is the depreciation expense and net carrying value Fairfax would show on its annual financial statements at December 31, 2026 for this asset? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. x Depreciation expense $3,250; net carrying value $8,750 Your answer b Depreciation expense $3,250; net carrying value $12,000 Depreciation expense $3,000; net carrying value $8,750 d Depreciation expense $3,000; net carrying value $3,250 Resubmit Answered - Incorrect. 1 attempt left Please select an answer to submit Question 8 HomeworkUnanswered The bookkeeper at your company mistakenly recorded six months of prepaid insurance as an expense in the first month. What impact does that have on the first month's financial statements? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Assets are overstated, and expenses are understated. b Both assets and net income are understated. I Liabilities are understated, and expenses are overstated. d Both assets and expenses are understated. Unanswered Please select an answer to submit Question 12 HomeworkUnanswered When a company make an end-of-the-period adjustment for depreciation, Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a it decreases retained earnings. b I there is no impact on total assets. the Balance Sheet stays in balance because total assets and total liabilities are decreased by the same amount d the cash paid for depreciation reduces total assets. Question 1 HomeworkUnanswered Company A delivered inventory to Company B on January 6th. Company B paid Company A for the inventory on January 20th. Company B sold all of the inventory to Customer on February 3rd. Customer paid Company B for the inventory on February 9th. On which day did Company B record an expense on its Income Statement for this inventory? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a January 6 b January 20 I February 3 d February 9 Unanswered Please select an answer to submit not an ner to submit Question 2 HomeworkUnanswered Which of the following increases total assets? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Selling land for your original purchase price I b Buying equipment for cash Buying inventory on account d Collecting an account receivable Unanswered Question 3 HomeworkUnanswered Meldrum Company purchased land $6,000 in 2019. During 2025, Meldrum sold one-half of that land for $4,500 and bought another plot of land for $4,000. What was the balance in the land account at December 31, 2025? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. I a $8,500 b $10,000 $5,500 d $7,000 Unanswered Please select an answer to submit Please select an answer to submit Question 2 HomeworkUnanswered Which of the following increases total assets? Select an answer and submit. For keyboard navigation, use the up/down arrow keys to select an answer. a Selling land for your original purchase price I b Buying equipment for cash Buying inventory on account d Collecting an account receivable Unanswered