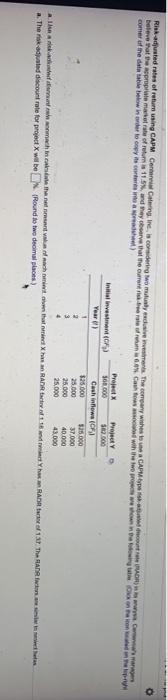

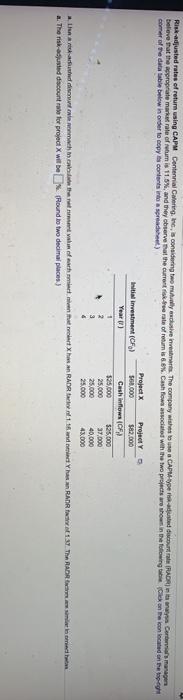

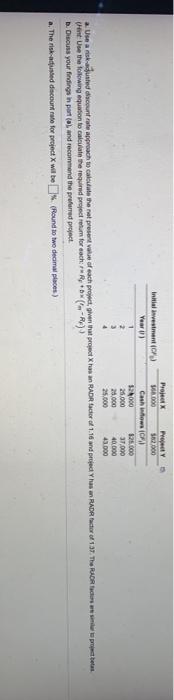

Risk adjusted rates of return using CAPM Centering, song only the chest CAPRI believe that propriate materiale of 1.5 dybe that the Crowd with the wood comer of the date in order to cortante Project Project Initial investment) 302.600 52.000 Cash inflows 325.000 525 000 25.000 37.000 25.000 25.000 43.000 the new machine that the achit that it has an RAD 18 anh.RAD Beof 13 The RARI a. The risk adjusted discount rate for project X wil be Round is two decimal places) Your 40.000 Risk adjusted rates of return using CAPM Centennial Catering, Inc. is considering to my closive investments. The company wishes to use a CAPM-type riseaduse PADRI Certes manager believe that the propriate market rate of retumis 11.5% and they observe that the current rate of retums 68% Cash flow acted with the two prostre shows in the following the contre conceden come of the data cable below in order to copy contents into gradient) ProjectX Project Initial investment (CF) 1.000 $82,000 Year) Cashindows (CF) 525.000 $25.000 25.000 37.000 25,000 40,000 25.000 43.000 hard dichthemen her fathmith RADIR.1 and YRAR 13. The RADR a. The risk-adjusted discount role for project will be found to two decimal places) 2.000 Projet PY Initial investment) OOO S2000 Year) Cash intown ICE S2000 125.000 31.000 28.000 40.000 25.000 43.000 Use a iskustunt rate approach to call the nel present of each project, given that project has an RADR factor of 1.16 andre has an RADA do 13. The RAOR probe into the following equation to calculate the required project team for each *** (-Rs) D. Discuss your findings in partial and recommend the preferred project The riskused diacount rule for project X will be I (Round to two decam places) Risk adjusted rates of return using CAPM Centering, song only the chest CAPRI believe that propriate materiale of 1.5 dybe that the Crowd with the wood comer of the date in order to cortante Project Project Initial investment) 302.600 52.000 Cash inflows 325.000 525 000 25.000 37.000 25.000 25.000 43.000 the new machine that the achit that it has an RAD 18 anh.RAD Beof 13 The RARI a. The risk adjusted discount rate for project X wil be Round is two decimal places) Your 40.000 Risk adjusted rates of return using CAPM Centennial Catering, Inc. is considering to my closive investments. The company wishes to use a CAPM-type riseaduse PADRI Certes manager believe that the propriate market rate of retumis 11.5% and they observe that the current rate of retums 68% Cash flow acted with the two prostre shows in the following the contre conceden come of the data cable below in order to copy contents into gradient) ProjectX Project Initial investment (CF) 1.000 $82,000 Year) Cashindows (CF) 525.000 $25.000 25.000 37.000 25,000 40,000 25.000 43.000 hard dichthemen her fathmith RADIR.1 and YRAR 13. The RADR a. The risk-adjusted discount role for project will be found to two decimal places) 2.000 Projet PY Initial investment) OOO S2000 Year) Cash intown ICE S2000 125.000 31.000 28.000 40.000 25.000 43.000 Use a iskustunt rate approach to call the nel present of each project, given that project has an RADR factor of 1.16 andre has an RADA do 13. The RAOR probe into the following equation to calculate the required project team for each *** (-Rs) D. Discuss your findings in partial and recommend the preferred project The riskused diacount rule for project X will be I (Round to two decam places)