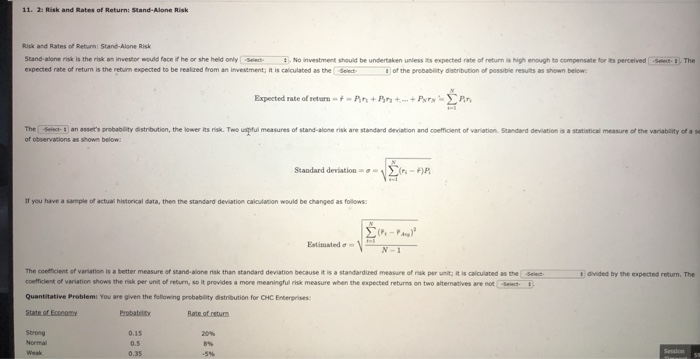

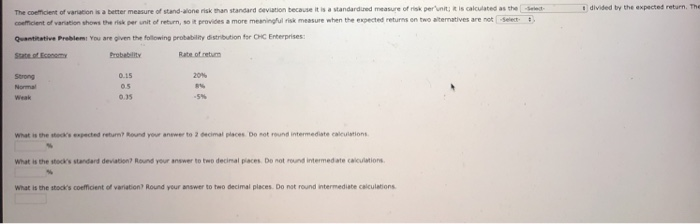

Risk and Rates of Return: Stand-Alone Risk Stand-alone risk is the risk an investor would face if he or she held onlySeec No investment shouid be undertaken unless its expected rate of return is high enough to compensate for its percelvedSelect:. The expected rate of return is the return expected to be realized from an investment; it is calculated as the Seed of the probablity distribution of possibie results as shown below Expected rate of return--PP+Pr The Sel '| an asser s prebeblity distrbution, the lower its Two u ul measures of stand aire risk are standard deviation and coemcient of veno on sadrd devaeonss statisteal measure de, aubry a Standard deviation-,- (n-nn If you have a sample of actual historical data, then the standard deviation calculacion would be changed as follows Estimated -V- N-1 The coefficient of variation is a better measure of stand-aione risk than standard deviation because it is a standardized measure of risk per unit; it is calculated as the coefficient of veriation shows the risk per unit of return, so it provides a more meaningful risk measure when the expected returns on two altermatives are noc Quantitative Problem You are given the fellowing probabiity distribution for CHC Enterprises: 1 divided by the expected return. The Probabliy Strong Normal 0.15 0.5 divided by the expected return. The The coefficient of varacion is a better measure of stand-sione risk than standard ceviation because it is a standarduned measure of risk per'unit, t is calculated as theSe coefficient of variation shows the risk per unit of return, so it provides a more meaningful risk measure when the expected returns on two aitermatives are not Selet Qvantinative Preblem You are given the following protability distribution for CHC Enterprises Rate of.retum Strong Normal 0.15 0.5 0.35 20% 5% -5% as re stea, expected return? Ro d you anewe to 2 decimal-ace. Do sot round intermediate altiation. What is the stock's standard deviation? Round your answer to twe decimal places Do not round intermedate caiculations What is the stock's coefficient of variation? Round your answer to two decimal places. Do nat round intermediate calculations