Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Solve the above case study according to the above conditions and questions given in it.Solve complete case study Case Study Analyse the following scenario in

Solve the above case study according to the above conditions and questions given in it.Solve complete case study

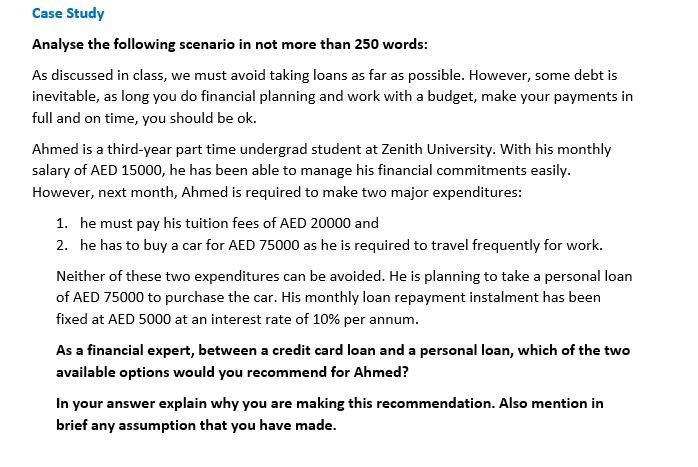

Case Study Analyse the following scenario in not more than 250 words: As discussed in class, we must avoid taking loans as far as possible. However, some debt is inevitable, as long you do financial planning and work with a budget, make your payments in full and on time, you should be ok. Ahmed is a third-year part time undergrad student at Zenith University. With his monthly salary of AED 15000, he has been able to manage his financial commitments easily. However, next month, Ahmed is required to make two major expenditures: 1. he must pay his tuition fees of AED 20000 and 2. he has to buy a car for AED 75000 as he is required to travel frequently for work. Neither of these two expenditures can be avoided. He is planning to take a personal loan of AED 75000 to purchase the car. His monthly loan repayment instalment has been fixed at AED 5000 at an interest rate of 10% per annum. As a financial expert, between a credit card loan and a personal loan, which of the two available options would you recommend for Ahmed? In your answer explain why you are making this recommendation. Also mention in brief any assumption that you have madeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started