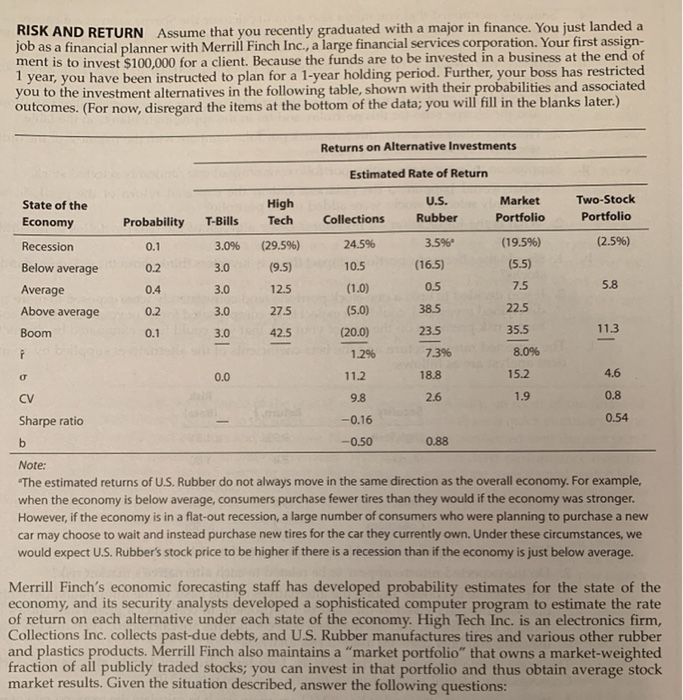

RISK AND RETURN Assume that you recently graduated with a major in finance. You just landed a job as a financial planner with Merrill Finch Inc., a large financial services corporation. Your first assign- ment is to invest $100,000 for a client. Because the funds are to be invested in a business at the end of 1 year, you have been instructed to plan for a 1-year holding period. Further, your boss has restricted you to the investment alternatives in the following table, shown with their probabilities and associated outcomes. (For now, disregard the items at the bottom of the data; you will fill in the blanks later.) Returns on Alternative Investments Estimated Rate of Return High Tech U.S. Rubber Market Portfolio Two-Stock Portfolio Probability T-Bills Collections 0.1 3.096 24.5% 3.5% (2.5%) State of the Economy Recession Below average Average Above average Boom (29.5%) (9.5) (19.5%) (5.5) 0.2 3.0 10.5 (16.5) 0.5 0.4 3.0 12.5 7.5 5.8 0.2 3.0 27.5 38.5 22.5 (1.0) (5.0) (20.0) 1.29 0.1 3.0 42.5 23.5 35.5 11.3 7.3% 8.096 o 0.0 11.2 18.8 15.2 4.6 CV 9.8 2.6 1.9 0.8 -0.16 0.54 1 Sharpe ratio b -0.50 0.88 Note: "The estimated returns of U.S. Rubber do not always move in the same direction as the overall economy. For example, when the economy is below average, consumers purchase fewer tires than they would if the economy was stronger. However, if the economy is in a flat-out recession, a large number of consumers who were planning to purchase a new car may choose to wait and instead purchase new tires for the car they currently own. Under these circumstances, we would expect U.S. Rubber's stock price to be higher if there is a recession than if the economy is just below average. Merrill Finch's economic forecasting staff has developed probability estimates for the state of the economy, and its security analysts developed a sophisticated computer program to estimate the rate of return on each alternative under each state of the economy. High Tech Inc. is an electronics firm, Collections Inc. collects past-due debts, and U.S. Rubber manufactures tires and various other rubber and plastics products. Merrill Finch also maintains a "market portfolio" that owns a market-weighted fraction of all publicly traded stocks; you can invest in that portfolio and thus obtain average stock market results. Given the situation described, answer the following questions: 1. Suppose investors raised their inflation expectations by 3 percentage points over current esti- mates as reflected in the 3.0% risk-free rate. What effect would higher inflation have on the SML and on the returns required on high- and low-risk securities? 2. Suppose instead that investors' risk aversion increased enough to cause the market risk pre- mium to increase by 3 percentage points. (Inflation remains constant.) What effect would this have on the SML and on returns of high- and low-risk securities