Answered step by step

Verified Expert Solution

Question

1 Approved Answer

RISK AND RETURN Assume that you recently graduated with a major in finance. You just landed a job as a financial planner with Merrill Finch

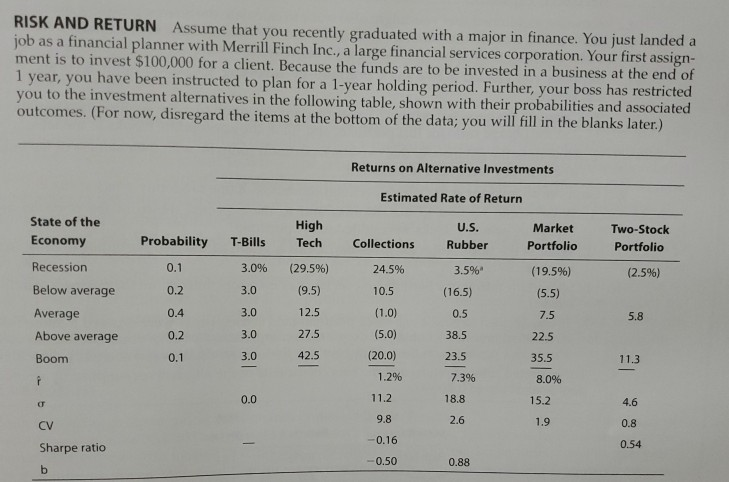

RISK AND RETURN Assume that you recently graduated with a major in finance. You just landed a job as a financial planner with Merrill Finch Inc., a large financial services corporation. Your first assign- ment is to invest $100,000 for a client. Because the funds are to be invested in a business at the end of 1 year, you have been instructed to plan for a 1-year holding period. Further, your boss has restricted you to the investment alternatives in the following table, shown with their probabilities and associated outcomes. (For now, disregard the items at the bottom of the data; you will fill in the blanks later.) Returns on Alternative Investments Estimated Rate of Return State of the Economy High Tech Probability T-Bills U.S. Rubber Collections Market Portfolio Two-Stock Portfolio 0.1 3.0% (29.5%) 24.5% (2.5%) 3.5% (16.5) (19.5%) (5.5) 0.2 3.0 (9.5) 10.5 Recession Below average Average Above average 0.4 3.0 12.5 (1.0) 0.5 7.5 5.8 0.2 3.0 27.5 38.5 22.5 (5.0) (20.0) Boom 0.1 3.0 42.5 23.5 35.5 11.3 1.2% 7.3% 8.0% 0.0 11.2 18.8 T 15.2 4.6 9.8 2.6 CV 1.9 0.8 -0.16 Sharpe ratio 0.54 -0.50 0.88 b a. market results. Given the situation described, answer the following questions: 1. Why is the T-bill's return independent of the state of the economy? Do T-bills promise a com- pletely risk-free return? Explain. 2. Why are High Tech's returns expected to move with the economy, whereas Collections's are expected to move counter to the economy? b. Calculate the expected rate of return on each alternative, and fill in the blanks on the row for f in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started