Risk and return estimates (4 marks): a. Use CAPM to estimate the expected return for the shares of: i) your case company (ADH); and ii) a hypothetical company with a beta of 1.60. To do this, use the yield to maturity of a 10-year Australian Government bond on 1 April 2020 as a proxy for the risk-free rate, assume the market risk premium is 5.50% and use your case companys most recent 5-year beta. b. Using the data from part 2a, estimate portfolio expected return and beta, assuming a portfolio with 70% invested in your case company and the remainder invested in the hypothetical company. Risk and return analysis (15 marks):

Drawing on expectations from theory and incorporating the overall context of your chosen company, interpret and discuss the risk and return measures from parts a and b above.

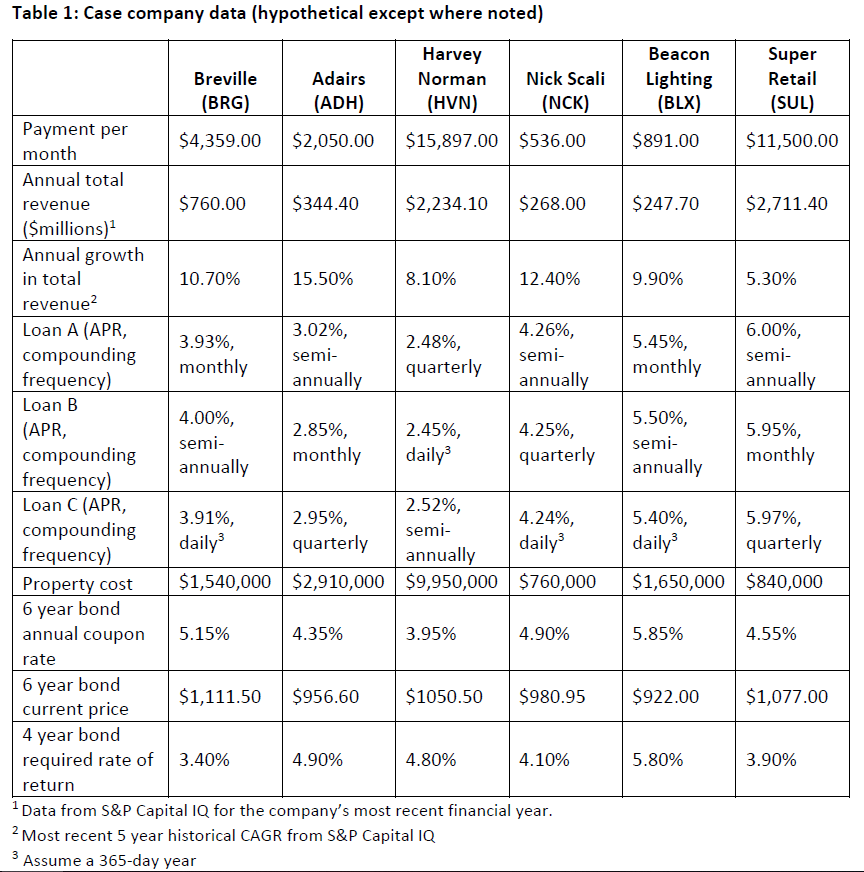

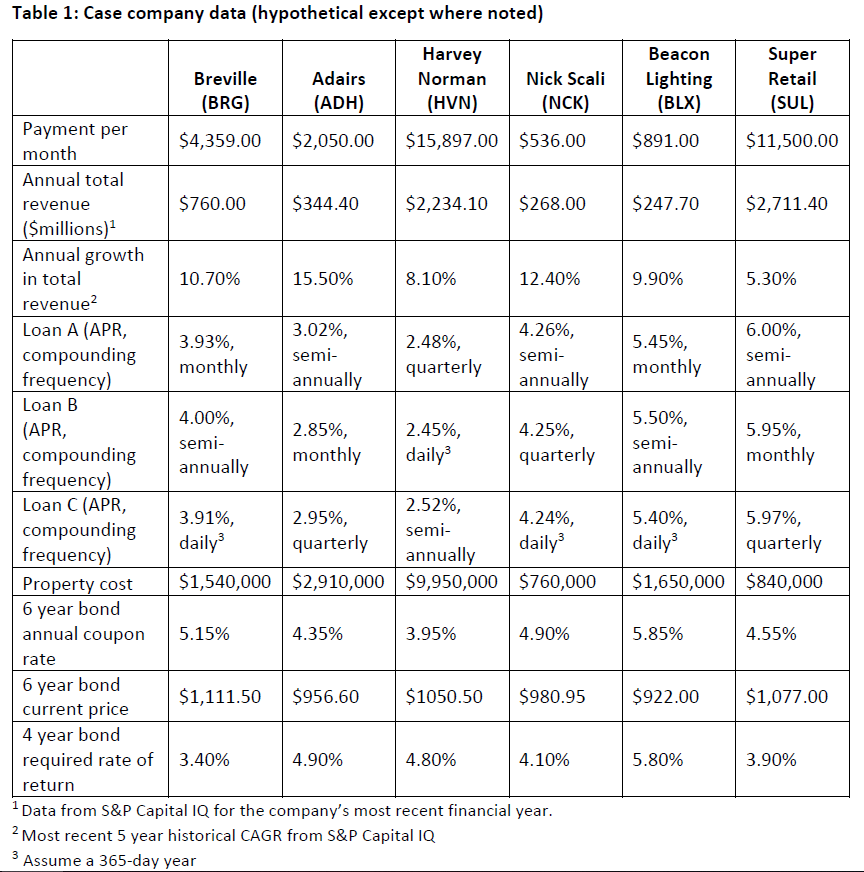

Table 1: Case company data (hypothetical except where noted) Beacon Lighting (BLX) Super Retail (SUL) $891.00 $11,500.00 $247.70 $2,711.40 9.90% 5.30% 5.45%, monthly 6.00%, semi- annually Harvey Breville Adairs Norman Nick Scali (BRG) (ADH) (HVN) (NCK) Payment per $4,359.00 $2,050.00 $15,897.00 $536.00 month Annual total revenue $760.00 $344.40 $2,234.10 $268.00 ($millions) Annual growth in total 10.70% 15.50% 8.10% 12.40% revenue Loan A (APR, 3.02%, 4.26%, 3.93%, 2.48%, compounding semi- semi- monthly quarterly frequency) annually annually Loan B 4.00%, (APR, 2.85%, 2.45%, 4.25%, semi- compounding monthly daily3 quarterly annually frequency) Loan C(APR, 2.52%, 3.91%, 2.95%, 4.24%, compounding semi- daily quarterly daily frequency) annually Property cost $1,540,000 $2,910,000 $9,950,000 $760,000 6 year bond annual coupon 5.15% 4.35% 3.95% 4.90% rate 6 year bond $1,111.50 $956.60 $1050.50 $980.95 current price 4 year bond required rate of 3.40% 4.90% 4.80% 4.10% return 1 Data from S&P Capital iQ for the company's most recent financial year. 2 Most recent 5 year historical CAGR from S&P Capital IQ 3 Assume a 365-day year 5.50%, semi- annually 5.95%, monthly 5.40%, daily 5.97% quarterly $840,000 $1,650,000 5.85% 4.55% $922.00 $1,077.00 5.80% 3.90% Table 1: Case company data (hypothetical except where noted) Beacon Lighting (BLX) Super Retail (SUL) $891.00 $11,500.00 $247.70 $2,711.40 9.90% 5.30% 5.45%, monthly 6.00%, semi- annually Harvey Breville Adairs Norman Nick Scali (BRG) (ADH) (HVN) (NCK) Payment per $4,359.00 $2,050.00 $15,897.00 $536.00 month Annual total revenue $760.00 $344.40 $2,234.10 $268.00 ($millions) Annual growth in total 10.70% 15.50% 8.10% 12.40% revenue Loan A (APR, 3.02%, 4.26%, 3.93%, 2.48%, compounding semi- semi- monthly quarterly frequency) annually annually Loan B 4.00%, (APR, 2.85%, 2.45%, 4.25%, semi- compounding monthly daily3 quarterly annually frequency) Loan C(APR, 2.52%, 3.91%, 2.95%, 4.24%, compounding semi- daily quarterly daily frequency) annually Property cost $1,540,000 $2,910,000 $9,950,000 $760,000 6 year bond annual coupon 5.15% 4.35% 3.95% 4.90% rate 6 year bond $1,111.50 $956.60 $1050.50 $980.95 current price 4 year bond required rate of 3.40% 4.90% 4.80% 4.10% return 1 Data from S&P Capital iQ for the company's most recent financial year. 2 Most recent 5 year historical CAGR from S&P Capital IQ 3 Assume a 365-day year 5.50%, semi- annually 5.95%, monthly 5.40%, daily 5.97% quarterly $840,000 $1,650,000 5.85% 4.55% $922.00 $1,077.00 5.80% 3.90%