Question

Risk Rating Systems Millennial Farms is applying for a loan with their local bank. The bank asked for balance sheet and income statement information. For

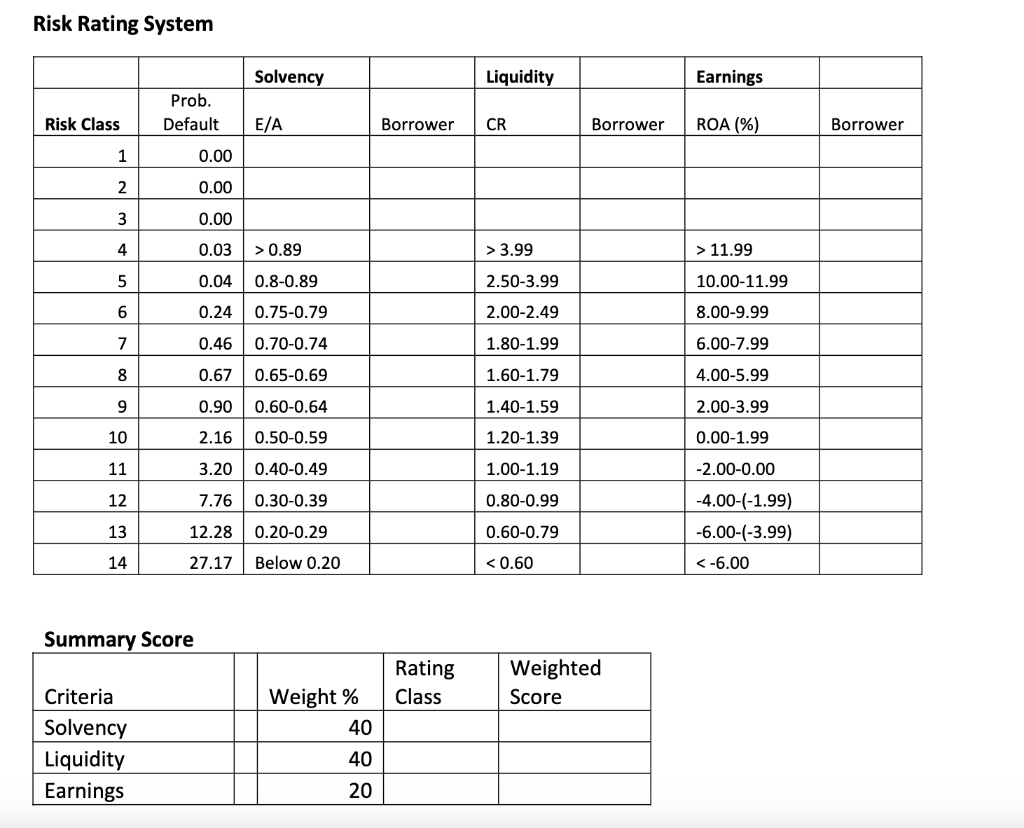

Risk Rating Systems Millennial Farms is applying for a loan with their local bank. The bank asked for balance sheet and income statement information. For 2021, Millennial Farms supplied the following information: Balance Sheet. December 31, 2021 Current Assets 181,677 Current Liabilities 200,685 Intermediate Assets 855,230 Intermediate Liabilities 548,982 Long-term Assets 2,560,800 Long-Term Liabilities 1,025,662 Total Assets 3,597,707 Total Liabilities 1,775,329 Net Worth 1,822,378 Income Statement Gross Cash Farm Income 2,560,874 Cash Farm Expenses -2,068,479 (interest expense = $107,596) Inventory change -25,680 Depreciation -178,563 Net Farm Income 288,152 Using the following rating system: (1) What classes are the farm solvency, liquidity and earnings measures in? (2) What is the weighted risk class rating (rounded to the nearest integer) for Millennial Farms? (3) Are they likely to be successful in getting a loan? And (4) What other factors may be considered by the lender?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started