Answered step by step

Verified Expert Solution

Question

1 Approved Answer

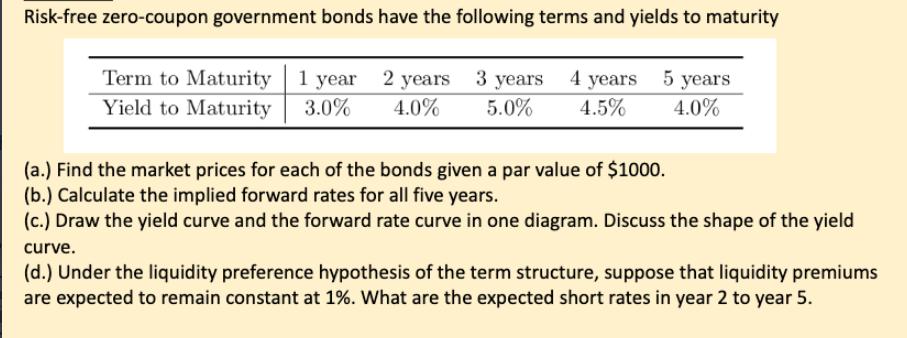

Risk-free zero-coupon government bonds have the following terms and yields to maturity Term to Maturity 1 year 2 years 3 years 4 years 5

Risk-free zero-coupon government bonds have the following terms and yields to maturity Term to Maturity 1 year 2 years 3 years 4 years 5 years Yield to Maturity 3.0% 4.0% 5.0% 4.5% 4.0% (a.) Find the market prices for each of the bonds given a par value of $1000. (b.) Calculate the implied forward rates for all five years. (c.) Draw the yield curve and the forward rate curve in one diagram. Discuss the shape of the yield curve. (d.) Under the liquidity preference hypothesis of the term structure, suppose that liquidity premiums are expected to remain constant at 1%. What are the expected short rates in year 2 to year 5.

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a To find the market prices for each bond we can use the formula for calculating the present value of a zerocoupon bond Market Price Par Value 1 Yield ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started