Answered step by step

Verified Expert Solution

Question

1 Approved Answer

solve the following questions below Q1 YZ company Balance sheet Balance Sheet Cash and equivalents Operating assets Property, plant, and equipment Other assets Total Assets

solve the following questions below

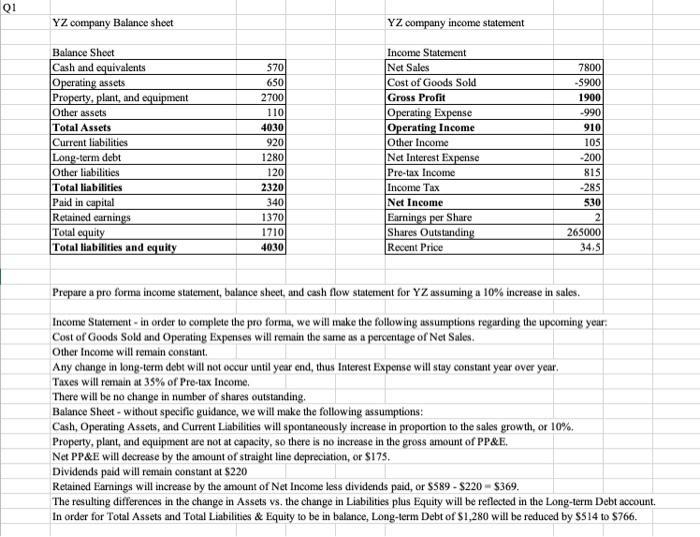

Q1 YZ company Balance sheet Balance Sheet Cash and equivalents Operating assets Property, plant, and equipment Other assets Total Assets Current liabilities Long-term debt Other liabilities Total liabilities Paid in capital Retained earnings Total equity Total liabilities and equity 570 650 2700 110 4030 920 1280 120 2320 340 1370 1710 4030 YZ company income statement Income Statement Net Sales Cost of Goods Sold Gross Profit Operating Expense Operating Income Other Income Net Interest Expense Pre-tax Income Income Tax Net Income Earnings per Share Shares Outstanding Recent Price Any change in long-term debt will not occur until year end, thus Interest Expense will stay constant year over year. Taxes will remain at 35% of Pre-tax Income. 7800 -5900 1900 -990 910 Property, plant, and equipment are not at capacity, so there is no increase in the gross amount of PP&E. Net PP&E will decrease by the amount of straight line depreciation, or $175. Dividends paid will remain constant at $220 Retained Earnings will increase by the amount of Net Income less dividends paid, or $589 - $220-$369. 105 -200 Prepare a pro forma income statement, balance sheet, and cash flow statement for YZ assuming a 10% increase in sales. Income Statement- in order to complete the pro forma, we will make the following assumptions regarding the upcoming year: Cost of Goods Sold and Operating Expenses will remain the same as a percentage of Net Sales. Other Income will remain constant. There will be no change in number of shares outstanding. Balance Sheet - without specific guidance, we will make the following assumptions: Cash, Operating Assets, and Current Liabilities will spontaneously increase in proportion to the sales growth, or 10%. 815 -285 530 2 265000 34.5 The resulting differences in the change in Assets vs. the change in Liabilities plus Equity will be reflected in the Long-term Debt account. In order for Total Assets and Total Liabilities & Equity to be in balance, Long-term Debt of $1,280 will be reduced by $514 to $766.

Step by Step Solution

★★★★★

3.53 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

The question asks to prepare a pro forma income statement balance sheet and cash flow statement for YZ company assuming a 10 increase in sales To do t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started