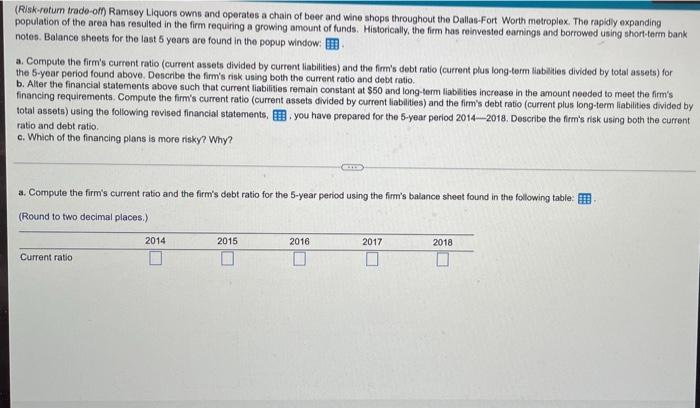

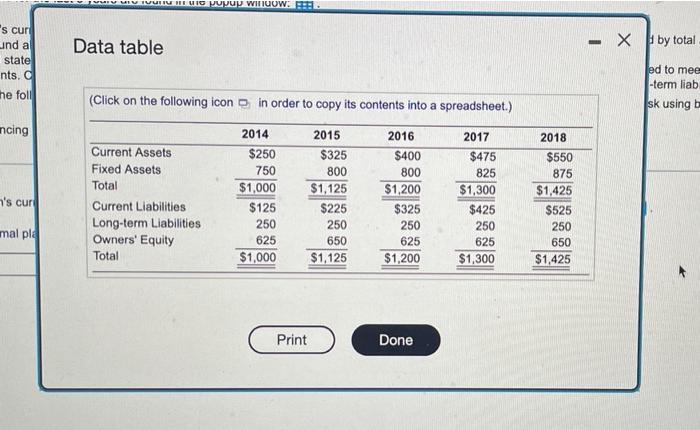

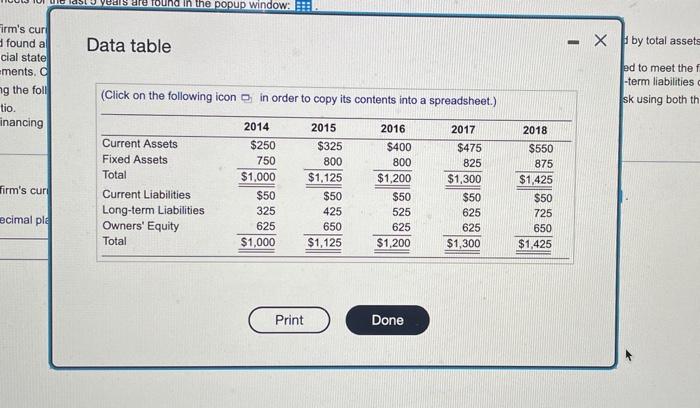

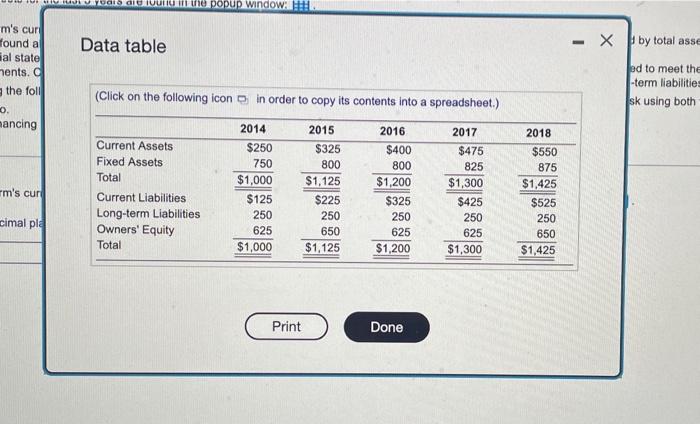

(Risk-rotum trade-off) Ramsey Liquors owns and operates a chain of beer and wine shops throughout the Dallas-Fort Worth metroplex. The rapidly expanding population of the area has resulted in the firm requiring a growing amount of funds. Historically, the firm has reinvested earnings and borrowed using short-term bank notes Balance sheets for the last 5 years are found in the popup window: m a. Compute the firm's current ratio (current assets divided by current liabilities) and the firm's debt ratio (current plus long-term liabilitles divided by total assets) for the 5-year period found above. Describe the firm's risk using both the current ratio and debt ratio. b. Alter the financial statements above such that current liabilities remain constant at $60 and long-term liabilities increase in the amount needed to meet the firm's financing requirements. Compute the firm's current ratio (current assets divided by current liabilities) and the firm's debt ratio (current plus long-term liabilities divided by total assets) using the following revised financial statements, you have prepared for the 5-year period 2014-2018. Describe the firm's risk using both the current ratio and debt ratio. c. Which of the financing plans is more risky? Why? a. Compute the firm's current ratio and the firm's debt ratio for the 5-year period using the firm's balance sheet found in the following table: (Round to two decimal places.) 2014 2015 2016 2017 2018 Current ratio VIVULI BUIC VUVU window. ::: 's cur and a Data table - X by total state nts. ed to mee -term liab sk using the foll (Click on the following icon in order to copy its contents into a spreadsheet.) ncing 2014 's cur Current Assets Fixed Assets Total Current Liabilities Long-term Liabilities Owners' Equity Total $250 750 $1,000 $125 250 625 $1,000 2015 $325 800 $1,125 $225 250 650 $1,125 2016 $400 800 $1,200 $325 250 625 $1,200 2017 $475 825 $1,300 $425 250 625 $1,300 2018 $550 875 $1,425 $525 250 650 $1,425 mal ple Print Done last vedls are found in the popup Window: 31: Data table - X by total assets Firm's cur found a cial state ments, ng the foll tio. inancing ed to meet the f -term liabilities sk using both th (Click on the following icon in order to copy its contents into a spreadsheet.) Current Assets Fixed Assets Total firm's curi 2014 $250 750 $1,000 $50 325 625 $1,000 2015 $325 800 $1,125 $50 425 650 $1,125 2016 $400 800 $1,200 $50 525 625 $1,200 2017 $475 825 $1,300 $50 625 625 $1,300 2018 $550 875 $1,425 $50 725 650 $1,425 ecimal pla Current Liabilities Long-term Liabilities Owners' Equity Total Print Done ab di lui e popup Window Data table - X by total asse m's cur found a sal state hents. the foll ed to meet the -term liabilities sk using both (Click on the following icon in order to copy its contents into a spreadsheet.) 0. mancing Current Assets Fixed Assets Total m's cur 2014 $250 750 $1,000 $125 250 625 $1,000 2015 $325 800 $1,125 $225 250 650 $1,125 2016 $400 800 $1,200 $325 250 625 $1,200 2017 $475 825 $1,300 $425 250 625 $1,300 Current Liabilities Long-term Liabilities Owners' Equity Total 2018 $550 875 $1,425 $525 250 650 $1,425 cimal ple Print Done