Answered step by step

Verified Expert Solution

Question

1 Approved Answer

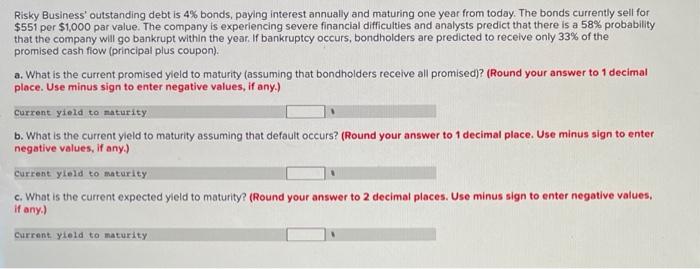

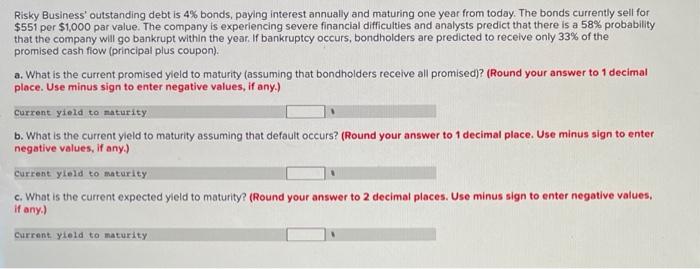

Risky Business' outstanding debt is 4% bonds, paying interest annually and maturing one year from today. The bonds currently sell for $551 per $1,000 par

Risky Business' outstanding debt is 4% bonds, paying interest annually and maturing one year from today. The bonds currently sell for $551 per $1,000 par value. The company is experiencing severe financial difficulties and analysts predict that there is a 58% probability that the company will go bankrupt within the year. If bankruptcy occurs, bondholders are predicted to recelve only 33% of the promised cash flow (principal plus coupon). a. What is the current promised yield to maturity (assuming that bondholders recelve all promised)? (Round your answer to 1 decimal place. Use minus sign to enter negative values, if any.) Current yield to naturity b. What is the current yleid to maturity assuming that default occurs? (Round your answer to 1 decimal place. Use minus sign to enter negative values, if any.)

Risky Business' outstanding debt is 4% bonds, paying interest annually and maturing one year from today. The bonds currently sell for $551 per $1,000 par value. The company is experiencing severe financial difficulties and analysts predict that there is a 58% probability that the company will go bankrupt within the year. If bankruptcy occurs, bondholders are predicted to recelve only 33% of the promised cash flow (principal plus coupon). a. What is the current promised yield to maturity (assuming that bondholders recelve all promised)? (Round your answer to 1 decimal place. Use minus sign to enter negative values, if any.) Current yield to naturity b. What is the current yleid to maturity assuming that default occurs? (Round your answer to 1 decimal place. Use minus sign to enter negative values, if any.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started