Answered step by step

Verified Expert Solution

Question

1 Approved Answer

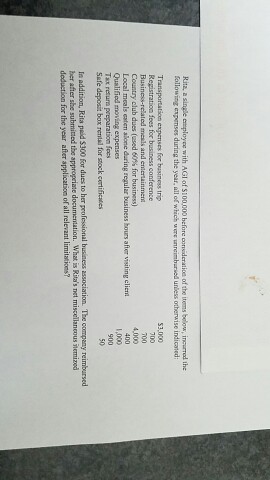

Rita, a single employee with AGI of $100,000 before consideration of the items below, incurred the following expenses during the year, all of which were

Rita, a single employee with AGI of $100,000 before consideration of the items below, incurred the following expenses during the year, all of which were unremembered unless otherwise indicated: In addition, Rita paid $300 for dues to her professional business associated. The company reimbursed her after she submitted the appropriate documentation. What is Rita's net miscellaneous itemized deduction for the year after application of all relevant limitations

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started