Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Financial Market Microstructure Question 2-OPTIONAL Page 3 of 51 January 2022 2. (a) Rita has recently come across news that could inform her trading

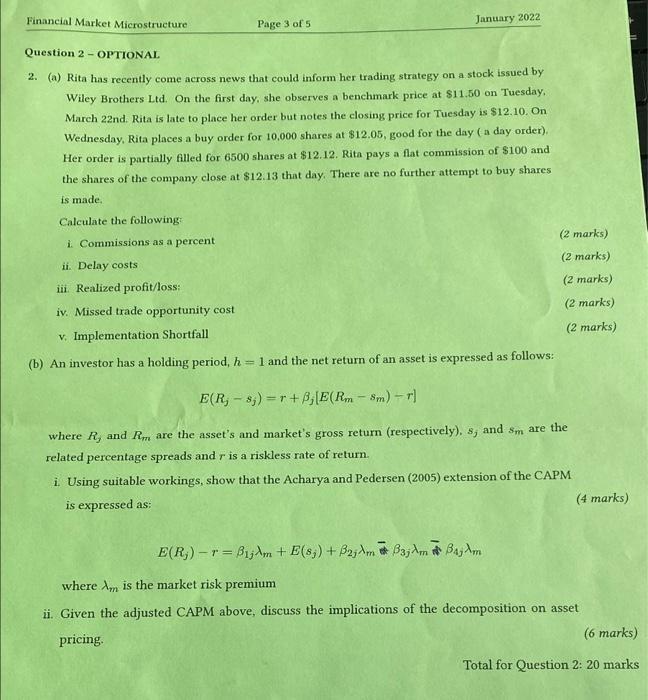

Financial Market Microstructure Question 2-OPTIONAL Page 3 of 51 January 2022 2. (a) Rita has recently come across news that could inform her trading strategy on a stock issued by Wiley Brothers Ltd. On the first day, she observes a benchmark price at $11.50 on Tuesday, March 22nd. Rita is late to place her order but notes the closing price for Tuesday is $12.10. On Wednesday, Rita places a buy order for 10,000 shares at $12.05, good for the day (a day order). Her order is partially filled for 6500 shares at $12.12. Rita pays a flat commission of $100 and the shares of the company close at $12.13 that day. There are no further attempt to buy shares is made. Calculate the following: i. Commissions as a percent ii. Delay costs iii. Realized profit/loss: iv. Missed trade opportunity cost v. Implementation Shortfall (b) An investor has a holding period, h = 1 and the net return of an asset is expressed as follows: E(R, 8;) r+B,[E(Rm-8m)-r] (2 marks) (2 marks) (2 marks) (2 marks) (2 marks) where R, and R, are the asset's and market's gross return (respectively). 8, and 8m are the related percentage spreads and r is a riskless rate of return. i. Using suitable workings, show that the Acharya and Pedersen (2005) extension of the CAPM is expressed as: E(R)-r Bijm + E(8) + Bajm Bajm Bajm where A is the market risk premium ii. Given the adjusted CAPM above, discuss the implications of the decomposition on asset (4 marks) pricing. (6 marks) Total for Question 2: 20 marks

Step by Step Solution

★★★★★

3.43 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Lets calculate the requested values step by step 1 Commissions as a percent Total commission paid 100 Total value of shares bought 6500 shares 1212sha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started