Answered step by step

Verified Expert Solution

Question

1 Approved Answer

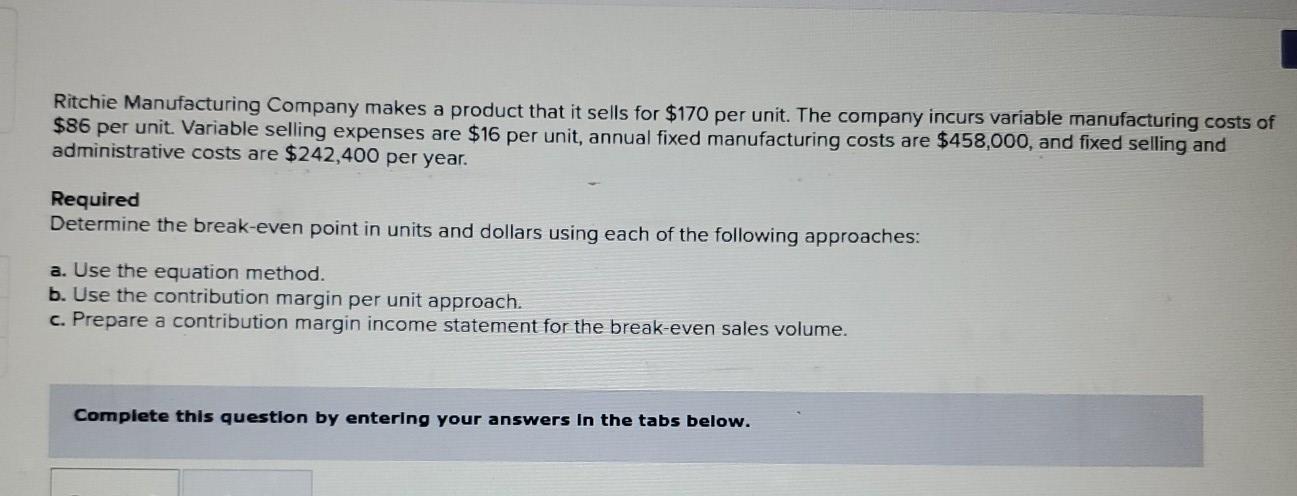

Ritchie Manufacturing Company makes a product that it sells for $170 per unit. The company incurs variable manufacturing costs of $86 per unit. Variable selling

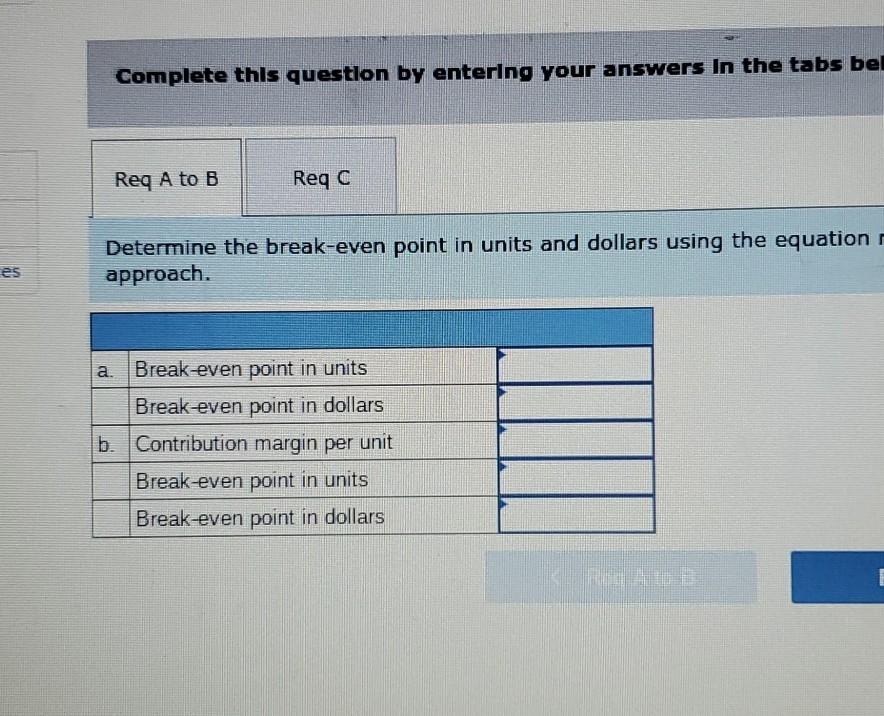

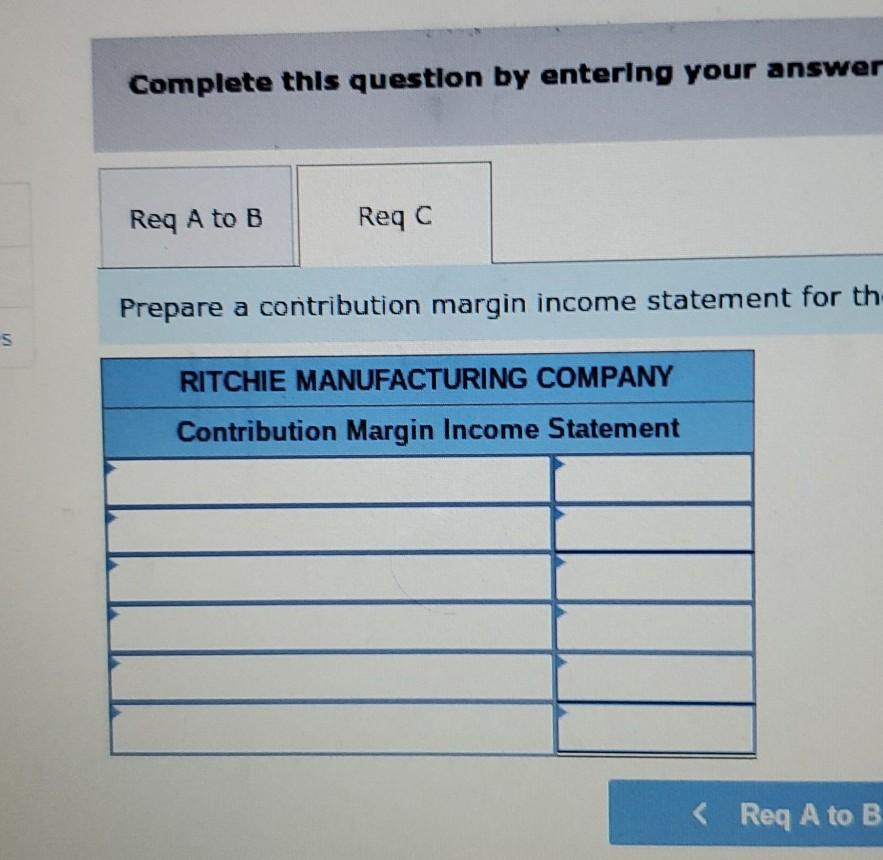

Ritchie Manufacturing Company makes a product that it sells for $170 per unit. The company incurs variable manufacturing costs of $86 per unit. Variable selling expenses are $16 per unit, annual fixed manufacturing costs are $458,000, and fixed selling and administrative costs are $242,400 per year. Required Determine the break-even point in units and dollars using each of the following approaches: a. Use the equation method. b. Use the contribution margin per unit approach. c. Prepare a contribution margin income statement for the break-even sales volume. Complete this question by entering your answers in the tabs below. Complete this question by entering your answers In the tabs bel Req A to B Reqc Determine the break-even point in units and dollars using the equation approach. es a. Break-even point in units Break-even point in dollars b. Contribution margin per unit Break-even point in units Break-even point in dollars Complete this question by entering your answer Req A to B Reqc Prepare a contribution margin income statement for th s RITCHIE MANUFACTURING COMPANY Contribution Margin Income Statement

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started