Answered step by step

Verified Expert Solution

Question

1 Approved Answer

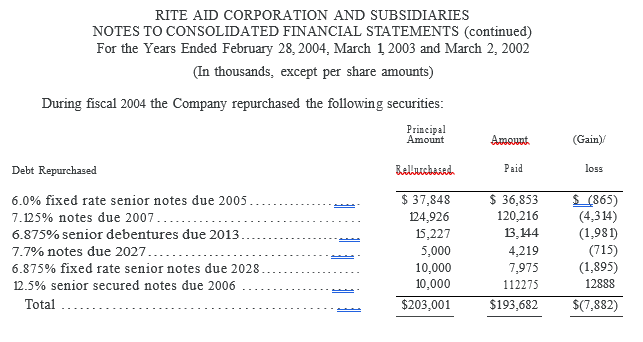

Rite Aid Long Term Debt Case: f. Note IO reports that Rite Aid engaged in some open-market debt transactions during year ended February 28, 2004

Rite Aid Long Term Debt Case: f. Note IO reports that Rite Aid engaged in some open-market debt transactions during year ended February 28, 2004 (see the part of note 10 marked "Debt Repurchased"). i. Prepare the journal entry required to record the repurchase of these notes. ii. Why did Rite Aid not have to pay the face value to repurchase these notes on the open market? 111. Explain why Rite Aid recorded a gain on all of the repurchased notes except on the 12.5% note on which it recorded a loss?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started