Answered step by step

Verified Expert Solution

Question

1 Approved Answer

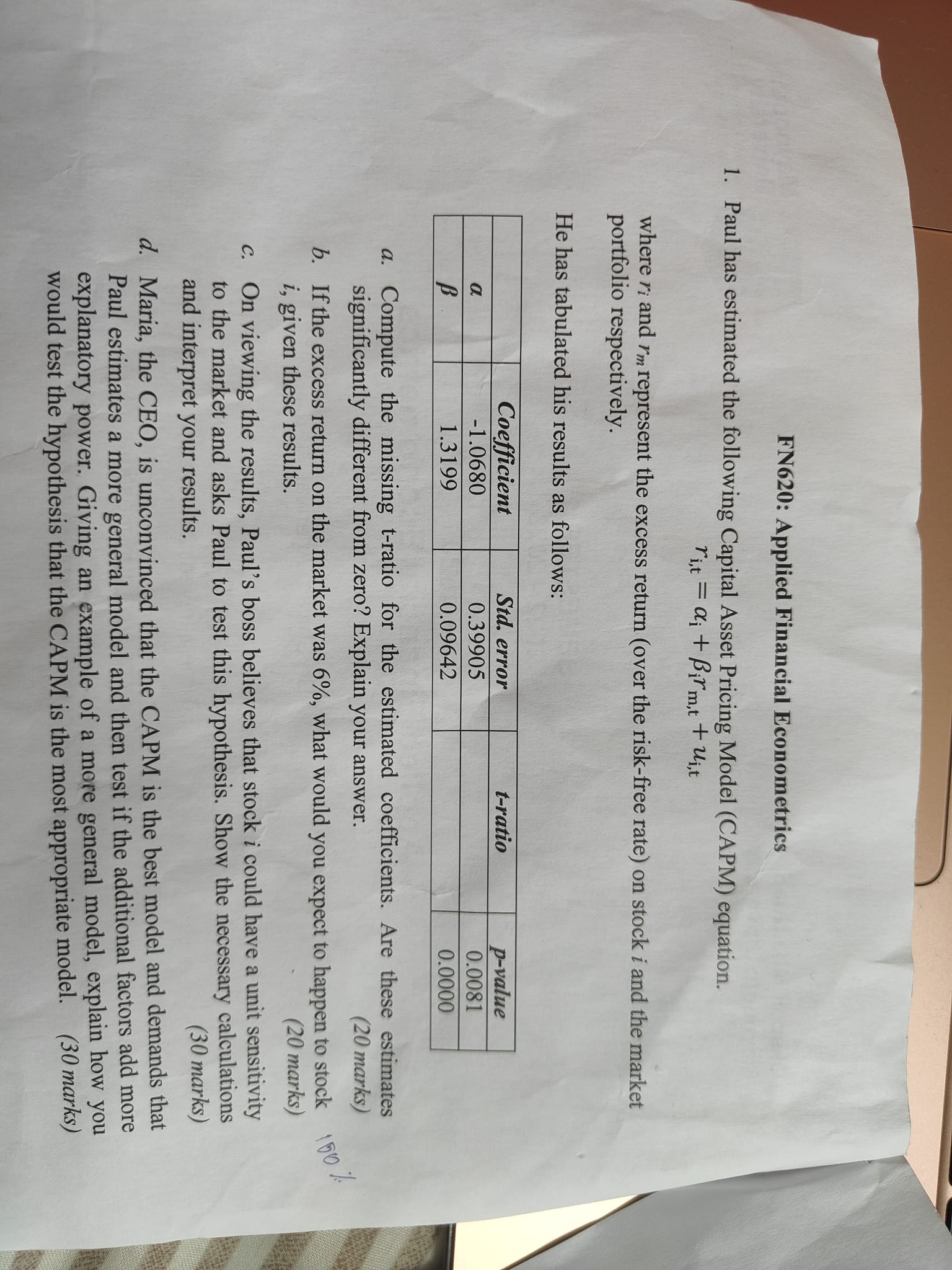

ri,t=i+irm,t+ui,t where ri and rm represent the excess return (over the risk-free rate) on stock i and the market portfolio respectively. He has tabulated his

ri,t=i+irm,t+ui,t where ri and rm represent the excess return (over the risk-free rate) on stock i and the market portfolio respectively. He has tabulated his results as follows: a. Compute the missing t-ratio for the estimated coefficients. Are these estimates significantly different from zero? Explain your answer. (20 marks) b. If the excess return on the market was 6%, what would you expect to happen to stock i, given these results. (20 marks) c. On viewing the results, Paul's boss believes that stock i could have a unit sensitivity to the market and asks Paul to test this hypothesis. Show the necessary calculations and interpret your results. (30 marks) d. Maria, the CEO, is unconvinced that the CAPM is the best model and demands that Paul estimates a more general model and then test if the additional factors add more explanatory power. Giving an example of a more general model, explain how you would test the hypothesis that the CAPM is the most appropriate model. (30 marks)

ri,t=i+irm,t+ui,t where ri and rm represent the excess return (over the risk-free rate) on stock i and the market portfolio respectively. He has tabulated his results as follows: a. Compute the missing t-ratio for the estimated coefficients. Are these estimates significantly different from zero? Explain your answer. (20 marks) b. If the excess return on the market was 6%, what would you expect to happen to stock i, given these results. (20 marks) c. On viewing the results, Paul's boss believes that stock i could have a unit sensitivity to the market and asks Paul to test this hypothesis. Show the necessary calculations and interpret your results. (30 marks) d. Maria, the CEO, is unconvinced that the CAPM is the best model and demands that Paul estimates a more general model and then test if the additional factors add more explanatory power. Giving an example of a more general model, explain how you would test the hypothesis that the CAPM is the most appropriate model. (30 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started