Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ritika is concerned that her GIS benefit may be reduced this year due to the amount of income she is receiving. In 2020, she had

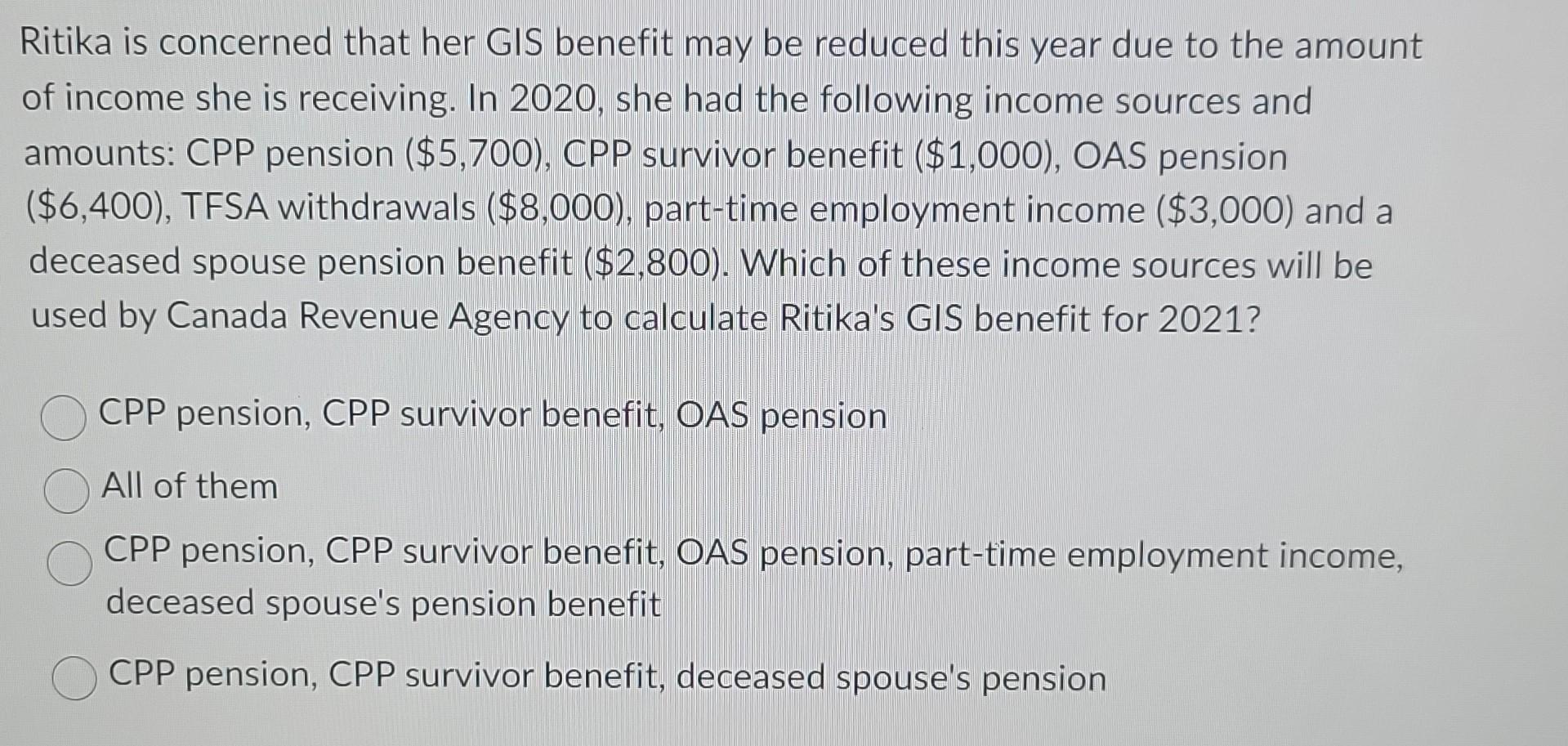

Ritika is concerned that her GIS benefit may be reduced this year due to the amount of income she is receiving. In 2020, she had the following income sources and amounts: CPP pension ( $5,700), CPP survivor benefit ($1,000), OAS pension ($6,400), TFSA withdrawals ($8,000), part-time employment income ($3,000) and a deceased spouse pension benefit ($2,800). Which of these income sources will be used by Canada Revenue Agency to calculate Ritika's GIS benefit for 2021? CPP pension, CPP survivor benefit, OAS pension All of them CPP pension, CPP survivor benefit, OAS pension, part-time employment income, deceased spouse's pension benefit CPP pension, CPP survivor benefit, deceased spouse's pension

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started