Answered step by step

Verified Expert Solution

Question

1 Approved Answer

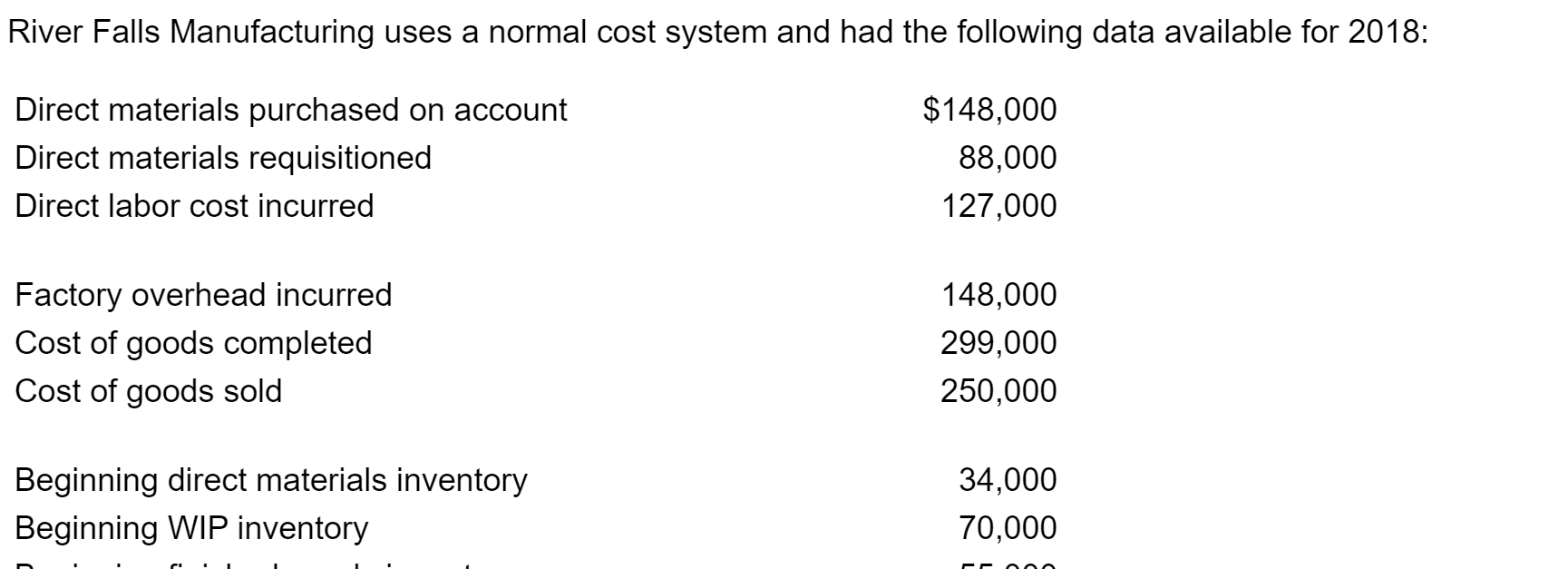

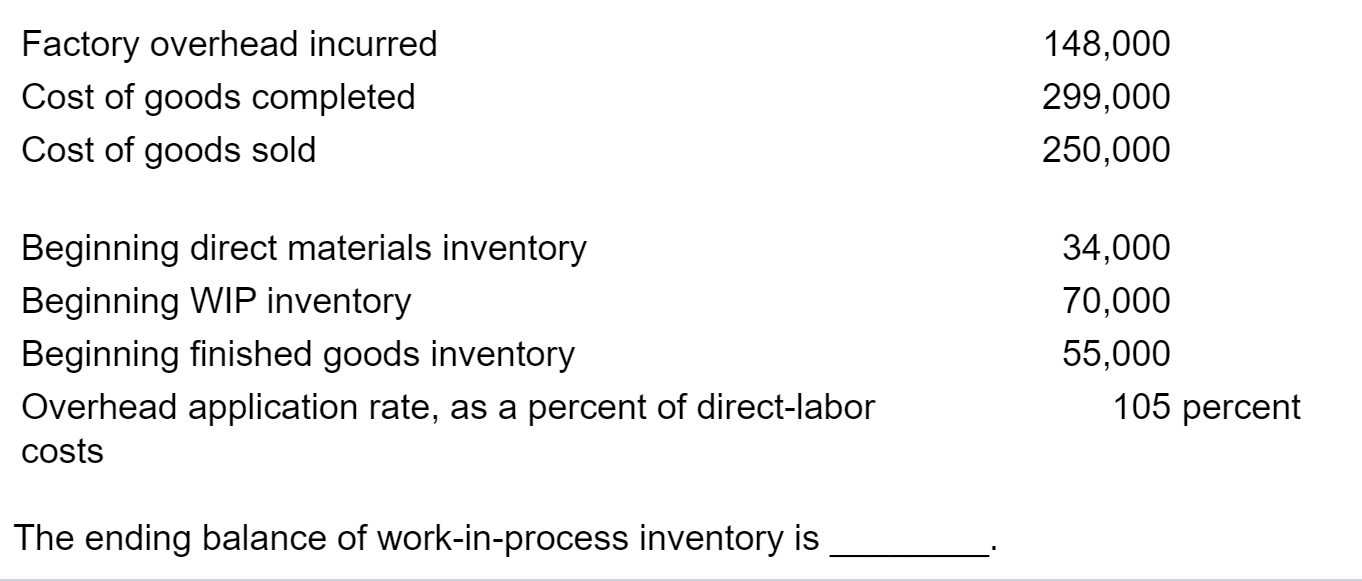

River Falls Manufacturing uses a normal cost system and had the following data available for 2018: Direct materials purchased on account $148,000 Direct materials requisitioned

River Falls Manufacturing uses a normal cost system and had the following data available for 2018:

| Direct materials purchased on account | $148,000 | ||

| Direct materials requisitioned | 88,000 | ||

| Direct labor cost incurred | 127,000 |

|

| Factory overhead incurred | 148,000 | ||

| Cost of goods completed | 299,000 | ||

| Cost of goods sold | 250,000 | ||

| Beginning direct materials inventory | 34,000 | ||

| Beginning WIP inventory | 70,000 | ||

| Beginning finished goods inventory | 55,000 | ||

| Overhead application rate, as a percent of direct-labor costs | 105 | percent |

The ending balance of work-in-process inventory is ________.

River Falls Manufacturing uses a normal cost system and had the following data available for 2018: Direct materials purchased on account Direct materials requisitioned Direct labor cost incurred $148,000 88,000 127,000 Factory overhead incurred Cost of goods completed Cost of goods sold 148,000 299,000 250,000 Beginning direct materials inventory Beginning WIP inventory 34,000 70,000 nnn Factory overhead incurred Cost of goods completed Cost of goods sold 148,000 299,000 250,000 Beginning direct materials inventory Beginning WIP inventory Beginning finished goods inventory Overhead application rate, as a percent of direct-labor costs 34,000 70,000 55,000 105 percent The ending balance of work-in-process inventory isStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started