Question

River WildRiver Wild is considering purchasing a water park in Newark, New JerseyNewark, New Jersey, for $ 2,300,000. The new facility will generate annual net

River WildRiver Wild is considering purchasing a water park in Newark, New JerseyNewark, New Jersey, for $ 2,300,000. The new facility will generate annual net cash inflows of $ 515,000 for ten years. Engineers estimate that the facility will remain useful for

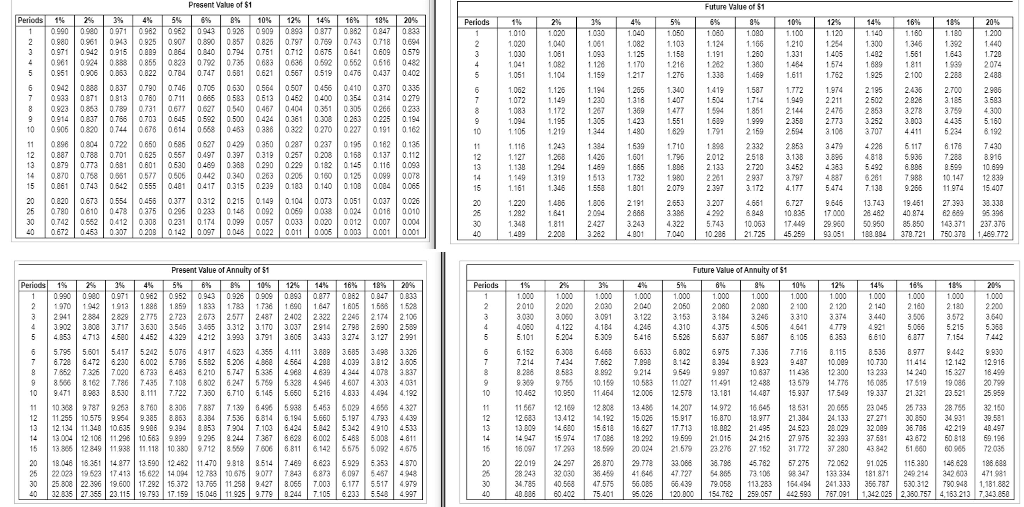

ten years and have no residual value. The company uses straight-line depreciation. Its owners want payback in less than five years and an ARR of 10% or more. Management uses a 14% hurdle rate on investments of this nature.

The payback period is ______ years. (Round the percentage to the nearest tenth percent.)

The ARR (accounting rate of return) is ______%. (Round your answer to the nearest whole dollar.)

Net present value is ______ The IRR (internal rate of return) is between_____:

Recommend whether the company should invest in this project.

Jania OOOO 5452 ala 474 | 3646 6.72 0885 3.743 | 18.551 2462 192 92 370.721 | = 70 57 | | 1996 | 1.4E.72 0.31 | 15 | 6.003 | 40 Present Value of Annulty of 5 bare vase of Annuity of Periods 15 | 56% 1% | 0 | ages | 262 | 16 | 1| 20% | 005 1:17 CN 4791 : | 41 11 ||| 7.62 | 7.03 | 3.142 | 2394 | 223 201215 195-9 1987) 146 | 12005 | 125 | 13.1 288 | 13.4] 430 | 14.92 | 10 1 + t 3 1.23 ( 28 TFS || C45 Jame Cai namE | 41 84 | 7| 85 | 31 | 34 | 193 34 | 181837 | 26 27 | 342 43 4718 2011 3

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started