Answered step by step

Verified Expert Solution

Question

1 Approved Answer

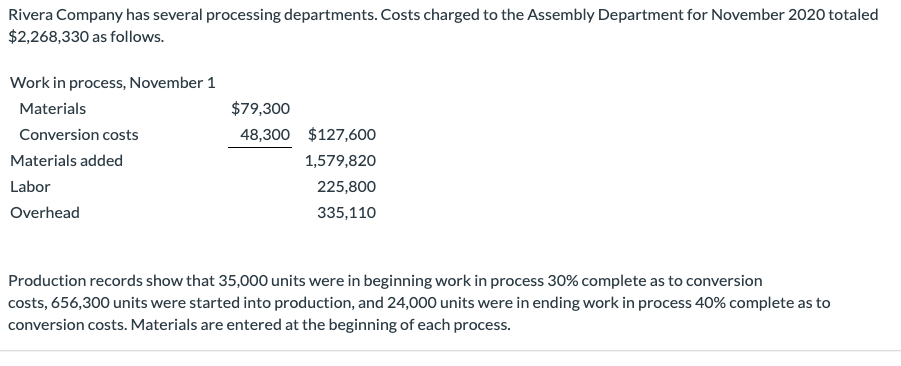

Rivera Company has several processing departments. Costs charged to the Assembly Department for November 2020 totaled $2,268,330 as follows. Work in process, November 1 Materials

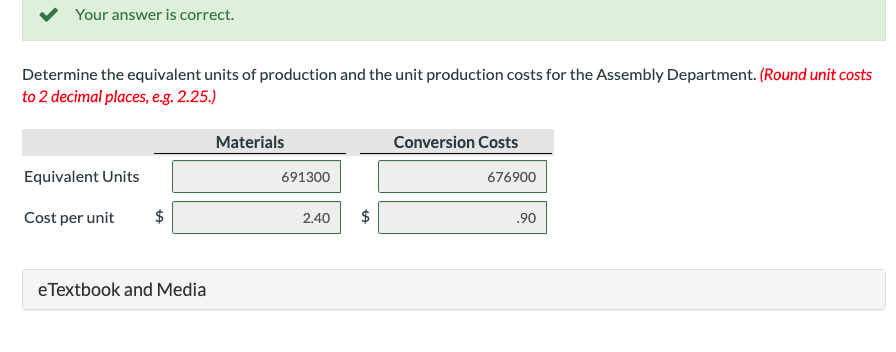

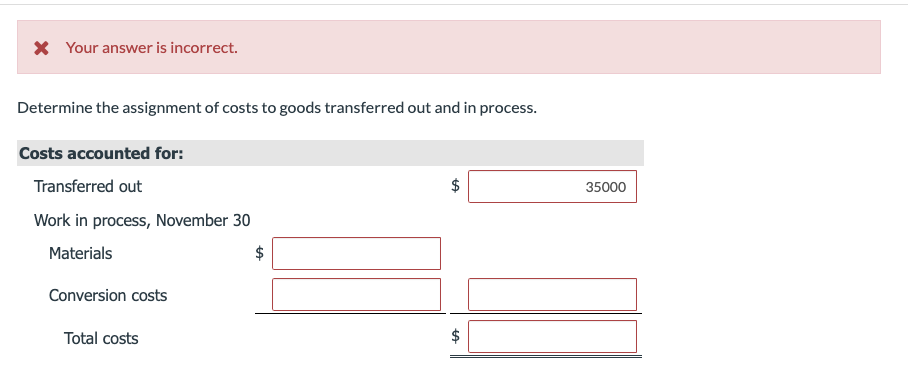

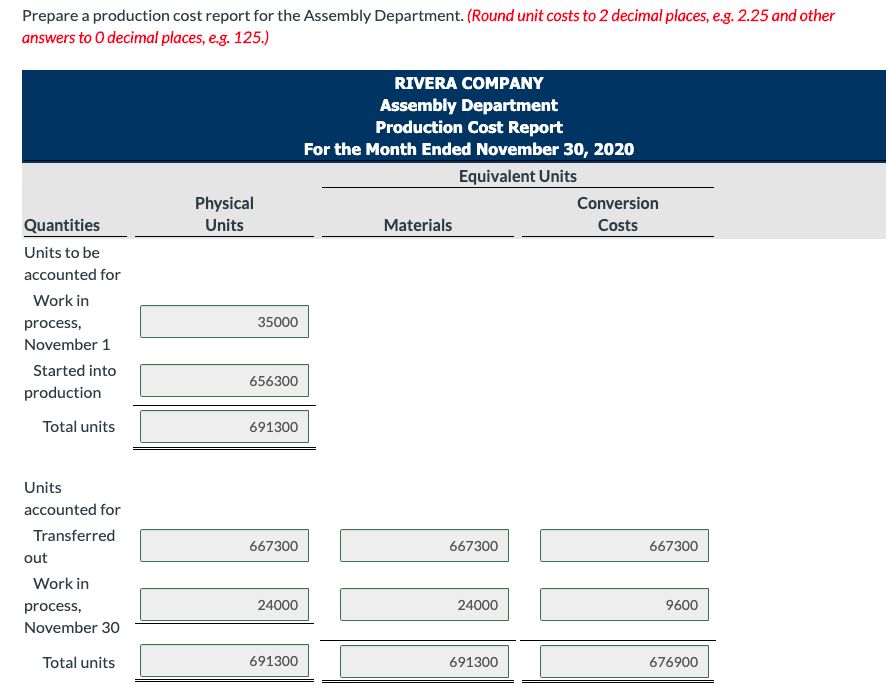

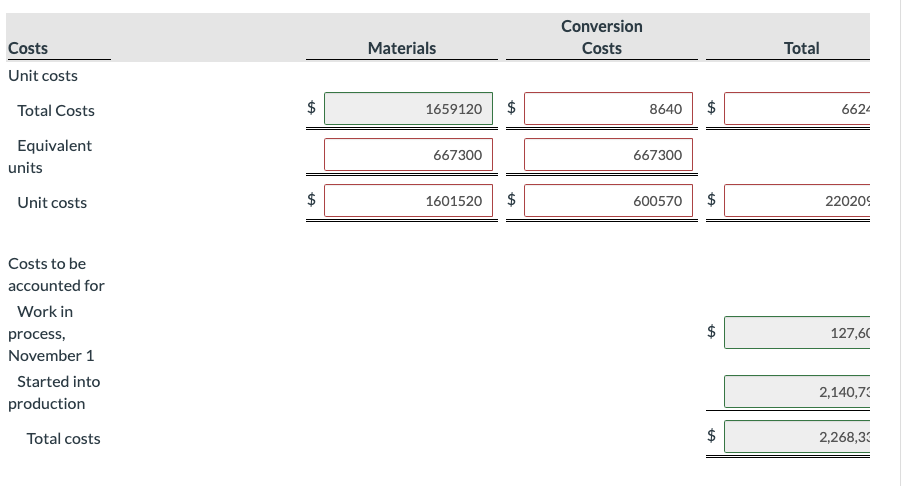

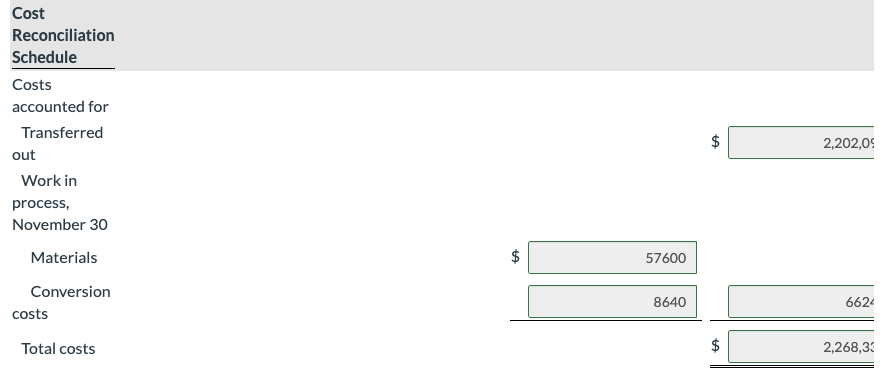

Rivera Company has several processing departments. Costs charged to the Assembly Department for November 2020 totaled $2,268,330 as follows. Work in process, November 1 Materials Conversion costs Materials added Labor Overhead $79,300 48,300 $127,600 1,579,820 225,800 335,110 Production records show that 35,000 units were in beginning work in process 30% complete as to conversion costs, 656,300 units were started into production, and 24,000 units were in ending work in process 40% complete as to conversion costs. Materials are entered at the beginning of each process. Your answer is correct. Determine the equivalent units of production and the unit production costs for the Assembly Department. (Round unit costs to 2 decimal places, e.g. 2.25.) Materials Conversion Costs Equivalent Units 691300 676900 Cost per unit $ 2.40 $ .90 e Textbook and Media * Your answer is incorrect. Determine the assignment of costs to goods transferred out and in process. $ 35000 Costs accounted for: Transferred out Work in process, November 30 Materials Conversion costs Total costs $ Prepare a production cost report for the Assembly Department. (Round unit costs to 2 decimal places, e.g. 2.25 and other answers to 0 decimal places, e.g. 125.) RIVERA COMPANY Assembly Department Production Cost Report For the Month Ended November 30, 2020 Equivalent Units Conversion Materials Costs Physical Units Quantities Units to be accounted for Work in process, November 1 Started into production Total units 35000 656300 691300 667300 667300 667300 Units accounted for Transferred out Work in process, November 30 24000 24000 9600 Total units 691300 691300 676900 Materials Conversion Costs Total Costs Unit costs Total Costs $ 1659120 $ 8640 $ 6624 Equivalent units 667300 667300 Unit costs $ 1601520 $ 600570 $ 22020 Costs to be accounted for Work in process, November 1 Started into production $ 127,66 2,140,73 Total costs $ 2,268,33 Cost Reconciliation Schedule Costs accounted for Transferred out Work in process, November 30 Materials $ 2,202,0 $ 57600 Conversion costs 8640 6624 Total costs $ 2,268,33

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started