Question

Riverbend Incorporated received a $222,500 dividend from stock it held in Hobble Corporation. Riverbend's taxable income is $2,800,000 before deducting the dividends-received deduction (DRD), a

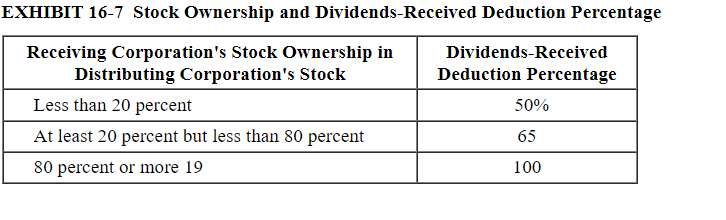

Riverbend Incorporated received a $222,500 dividend from stock it held in Hobble Corporation. Riverbend's taxable income is $2,800,000 before deducting the dividends-received deduction (DRD), a $80,000 NOL carryover, and a $147,000 charitable contribution. Use Exhibit 16-7.

Note: Round your tax rates to 2 decimal places. Leave no answer blank. Enter zero if applicable.

a. What is Riverbend's deductible DRD assuming it owns 10 percent of Hobble Corporation?

b. Assming that it owns 10 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividend after taking the DRD into account?

c. What is Riverbend's DRD assuming it owns 79 percent of Hobble Corporation?

d. Assuming that it owns 79 percent of Hobble Corporation, what is Riverbend's marginal tax rate on the dividend?

e. What is Riverbend's DRD assuming it owns 95 percent of Hobble Corporation (and is part of the same affiliated group)?

EXHIBIT 16-7 Stock Ownership and Dividends-Received Deduction Percentage \\begin{tabular}{|l|c|} \\hline \\( \\begin{array}{c}\\text { Receiving Corporation's Stock Ownership in } \\\\ \\text { Distributing Corporation's Stock }\\end{array} \\) & \\( \\begin{array}{c}\\text { Dividends-Received } \\\\ \\text { Deduction Percentage }\\end{array} \\) \\\\ \\hline Less than 20 percent & \50 \\\\ \\hline At least 20 percent but less than 80 percent & 65 \\\\ \\hline 80 percent or more 19 & 100 \\\\ \\hline \\end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started