Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Riveredge Manufacturing Company realized too late that it had made a mistake locating its controller's office and its electronic data processing system in the basement.

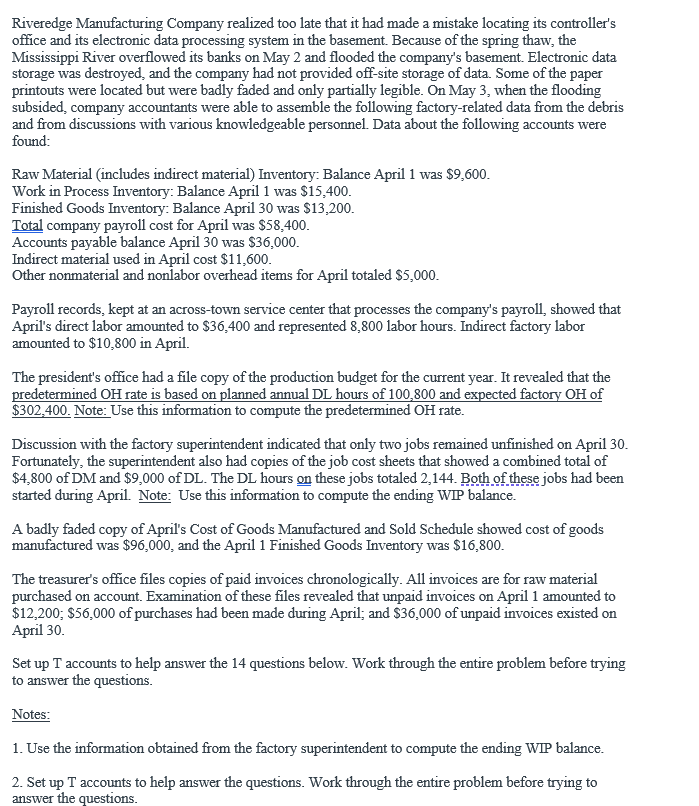

Riveredge Manufacturing Company realized too late that it had made a mistake locating its controller's office and its electronic data processing system in the basement. Because of the spring thaw, the Mississippi River overflowed its banks on May 2 and flooded the company's basement. Electronic data storage was destroyed, and the company had not provided off-site storage of data. Some of the paper printouts were located but were badly faded and only partially legible. On May 3 , when the flooding subsided, company accountants were able to assemble the following factory-related data from the debris and from discussions with various knowledgeable personnel. Data about the following accounts were found: Raw Material (includes indirect material) Inventory: Balance April 1 was $9,600. Work in Process Inventory: Balance April 1 was $15,400. Finished Goods Inventory: Balance April 30 was $13,200. Total company payroll cost for April was $58,400. Accounts payable balance April 30 was $36,000. Indirect material used in April cost $11,600. Other nonmaterial and nonlabor overhead items for April totaled \$5,000. Payroll records, kept at an across-town service center that processes the company's payroll, showed that April's direct labor amounted to $36,400 and represented 8,800 labor hours. Indirect factory labor amounted to $10,800 in April. The president's office had a file copy of the production budget for the current year. It revealed that the predetermined OH rate is based on planned annual DL hours of 100,800 and expected factory OH of $302,400. Note: Use this information to compute the predetermined OH rate. Discussion with the factory superintendent indicated that only two jobs remained unfinished on April 30. Fortunately, the superintendent also had copies of the job cost sheets that showed a combined total of $4,800 of DM and $9,000 of DL. The DL hours on these jobs totaled 2,144. Both of these jobs had been started during April. Note: Use this information to compute the ending WIP balance. A badly faded copy of April's Cost of Goods Manufactured and Sold Schedule showed cost of goods manufactured was $96,000, and the April 1 Finished Goods Inventory was $16,800. The treasurer's office files copies of paid invoices chronologically. All invoices are for raw material purchased on account. Examination of these files revealed that unpaid invoices on April 1 amounted to $12,200;$56,000 of purchases had been made during April; and $36,000 of unpaid invoices existed on April 30. Set up T accounts to help answer the 14 questions below. Work through the entire problem before trying to answer the questions. Notes: 1. Use the information obtained from the factory superintendent to compute the ending WIP balance. 2. Set up T accounts to help answer the questions. Work through the entire problem before trying to answer the questions. 1. COGS is $99,600 plus or minus the clearing of the OH account balance (see \#3 below). 12. EB of WPI is $20,232. You must compute the Predetermined OH rate so that you can figure out the cost of the two open jobs which constitute the ending balance of the WIP inventory. The "Discussion with the Factory Superintendent" in the third paragraph above can help you understand how to obtain the ending balance of WIP. These are information items only, not data for journal entries to WIP. The Predetermined OH rate can be obtained from the second paragraph on page 206. 3. OH balance is $1000 and it is "immaterial" (you decide if it is Under- or Over-applied and how to clear it to COGS). 4. DM used (issued to production and debited to WIP is $38,032 ). Note that there also indirect materials used and the amount is given for you to make an entry. The only way to derive DM is to obtain every other piece of information that goes into WIP (COGM, Ending WIP, Beginning WIP, DL, OH) and solve for DM using our "inventory identity" formula. 5. Question 5 refers to the total (DM and IM) raw materials used. This is the credit side of RM Inventory account. 6. Ending balance of Raw Materials Inventory (direct plus indirect materials) is $15,968 (derived last). 7. Company payroll of 58,400 includes S, G + A salaries (Misc. Expenses in our T-account system). 8. Purchases of 56,000 raw materials include both IM and DM, Separation is needed only on the credit side of the RM inventory account (IM used goes to OH, while DM used goes to WIP). 9. Do not forget to adjust any underapplied/overapplied amounts from overhead (assume underapplied/overapplied amount is immaterial). Assignment Questions: 1. Determine the predetermined overhead rate for the period. 2. How much overhead was applied to WIP during the period? 3. What is the ending balance in WIP? 4. Calculate the cost of direct materials used in April. 5. What was the cost of raw materials used (both direct and indirect) in production in April? 6. Calculate the April 30 balance of Raw Material Inventory. 7. Was manufacturing overhead underapplied or overapplied for April? 8. Determine the amount of underapplied or overapplied overhead for April (amount only, do not include words or negative signs). 9. What is the Cost of Goods Sold for April before manufacturing overhead is closed out? 10. Manufacturing overhead will be closed out to cost of goods sold. To close manufacturing overhead it must be: Debited; Credited - (circle one). 11. What is cost of goods sold after manufacturing overhead is closed out? 12. How much did the company pay for raw materials purchased in April? 13. How much did the company incur for non-manufacturing wages for April? 14. Determine the hourly rate paid to the direct labor workers (round to the nearest cent). Note: the amount is not realistic

Riveredge Manufacturing Company realized too late that it had made a mistake locating its controller's office and its electronic data processing system in the basement. Because of the spring thaw, the Mississippi River overflowed its banks on May 2 and flooded the company's basement. Electronic data storage was destroyed, and the company had not provided off-site storage of data. Some of the paper printouts were located but were badly faded and only partially legible. On May 3 , when the flooding subsided, company accountants were able to assemble the following factory-related data from the debris and from discussions with various knowledgeable personnel. Data about the following accounts were found: Raw Material (includes indirect material) Inventory: Balance April 1 was $9,600. Work in Process Inventory: Balance April 1 was $15,400. Finished Goods Inventory: Balance April 30 was $13,200. Total company payroll cost for April was $58,400. Accounts payable balance April 30 was $36,000. Indirect material used in April cost $11,600. Other nonmaterial and nonlabor overhead items for April totaled \$5,000. Payroll records, kept at an across-town service center that processes the company's payroll, showed that April's direct labor amounted to $36,400 and represented 8,800 labor hours. Indirect factory labor amounted to $10,800 in April. The president's office had a file copy of the production budget for the current year. It revealed that the predetermined OH rate is based on planned annual DL hours of 100,800 and expected factory OH of $302,400. Note: Use this information to compute the predetermined OH rate. Discussion with the factory superintendent indicated that only two jobs remained unfinished on April 30. Fortunately, the superintendent also had copies of the job cost sheets that showed a combined total of $4,800 of DM and $9,000 of DL. The DL hours on these jobs totaled 2,144. Both of these jobs had been started during April. Note: Use this information to compute the ending WIP balance. A badly faded copy of April's Cost of Goods Manufactured and Sold Schedule showed cost of goods manufactured was $96,000, and the April 1 Finished Goods Inventory was $16,800. The treasurer's office files copies of paid invoices chronologically. All invoices are for raw material purchased on account. Examination of these files revealed that unpaid invoices on April 1 amounted to $12,200;$56,000 of purchases had been made during April; and $36,000 of unpaid invoices existed on April 30. Set up T accounts to help answer the 14 questions below. Work through the entire problem before trying to answer the questions. Notes: 1. Use the information obtained from the factory superintendent to compute the ending WIP balance. 2. Set up T accounts to help answer the questions. Work through the entire problem before trying to answer the questions. 1. COGS is $99,600 plus or minus the clearing of the OH account balance (see \#3 below). 12. EB of WPI is $20,232. You must compute the Predetermined OH rate so that you can figure out the cost of the two open jobs which constitute the ending balance of the WIP inventory. The "Discussion with the Factory Superintendent" in the third paragraph above can help you understand how to obtain the ending balance of WIP. These are information items only, not data for journal entries to WIP. The Predetermined OH rate can be obtained from the second paragraph on page 206. 3. OH balance is $1000 and it is "immaterial" (you decide if it is Under- or Over-applied and how to clear it to COGS). 4. DM used (issued to production and debited to WIP is $38,032 ). Note that there also indirect materials used and the amount is given for you to make an entry. The only way to derive DM is to obtain every other piece of information that goes into WIP (COGM, Ending WIP, Beginning WIP, DL, OH) and solve for DM using our "inventory identity" formula. 5. Question 5 refers to the total (DM and IM) raw materials used. This is the credit side of RM Inventory account. 6. Ending balance of Raw Materials Inventory (direct plus indirect materials) is $15,968 (derived last). 7. Company payroll of 58,400 includes S, G + A salaries (Misc. Expenses in our T-account system). 8. Purchases of 56,000 raw materials include both IM and DM, Separation is needed only on the credit side of the RM inventory account (IM used goes to OH, while DM used goes to WIP). 9. Do not forget to adjust any underapplied/overapplied amounts from overhead (assume underapplied/overapplied amount is immaterial). Assignment Questions: 1. Determine the predetermined overhead rate for the period. 2. How much overhead was applied to WIP during the period? 3. What is the ending balance in WIP? 4. Calculate the cost of direct materials used in April. 5. What was the cost of raw materials used (both direct and indirect) in production in April? 6. Calculate the April 30 balance of Raw Material Inventory. 7. Was manufacturing overhead underapplied or overapplied for April? 8. Determine the amount of underapplied or overapplied overhead for April (amount only, do not include words or negative signs). 9. What is the Cost of Goods Sold for April before manufacturing overhead is closed out? 10. Manufacturing overhead will be closed out to cost of goods sold. To close manufacturing overhead it must be: Debited; Credited - (circle one). 11. What is cost of goods sold after manufacturing overhead is closed out? 12. How much did the company pay for raw materials purchased in April? 13. How much did the company incur for non-manufacturing wages for April? 14. Determine the hourly rate paid to the direct labor workers (round to the nearest cent). Note: the amount is not realistic Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started