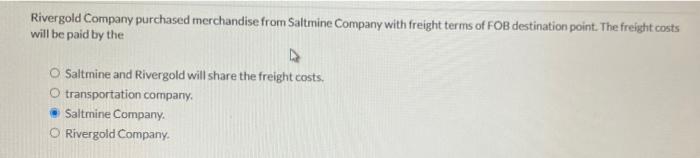

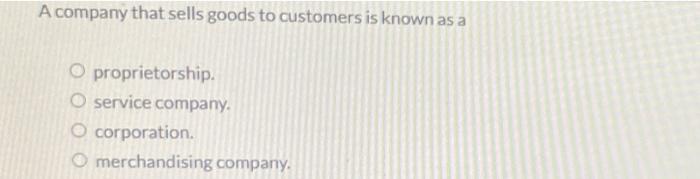

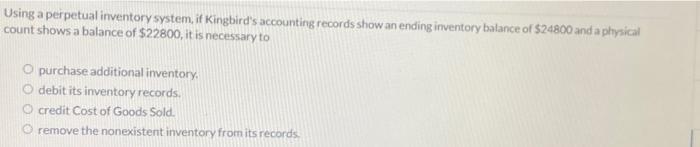

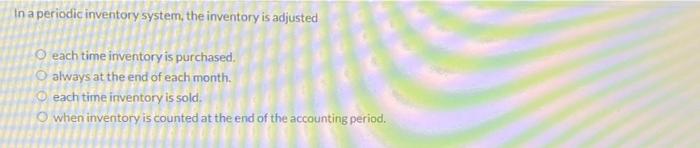

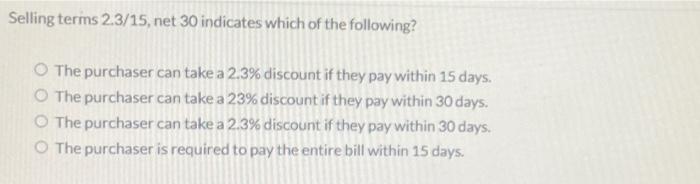

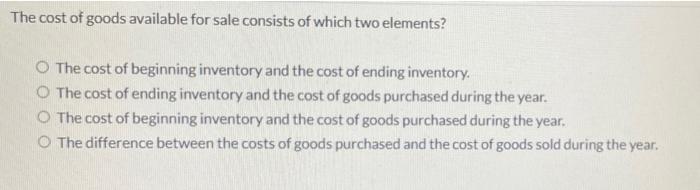

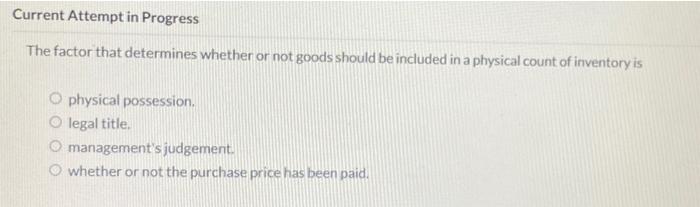

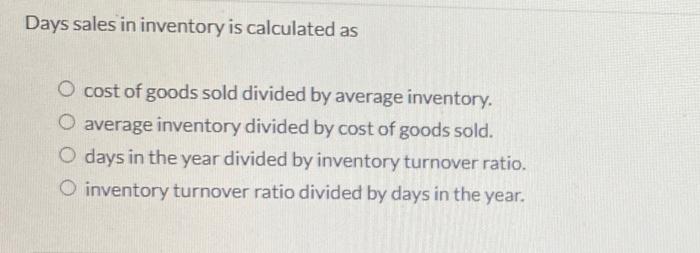

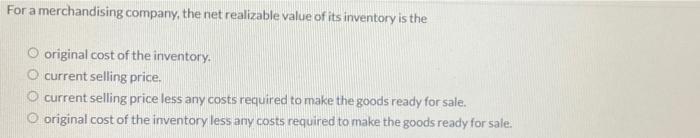

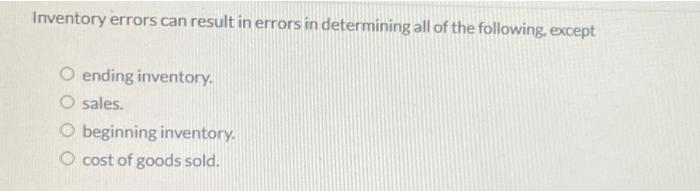

Rivergold Company purchased merchandise from Saltmine Company with freight terms of FOB destination point. The freight costs will be paid by the Saltmine and Rivergold will share the freight costs O transportation company, Saltmine Company O Rivergold Company A company that sells goods to customers is known as a O proprietorship. O service company. O corporation. O merchandising company. Using a perpetual inventory system, it Kingbird's accounting records show an ending inventory balance of $24800 and a physical count shows a balance of $22800, it is necessary to O purchase additional inventory, Odebit its inventory records, O credit Cost of Goods Sold. O remove the nonexistent inventory from its records In a periodic inventory system, the inventory is adjusted each time inventory is purchased. always at the end of each month. each time inventory is sold. when inventory is counted at the end of the accounting period. Selling terms 2.3/15, net 30 indicates which of the following? The purchaser can take a 2.3% discount if they pay within 15 days. The purchaser can take a 23% discount if they pay within 30 days. The purchaser can take a 2.3% discount if they pay within 30 days. The purchaser is required to pay the entire bill within 15 days. The cost of goods available for sale consists of which two elements? O The cost of beginning inventory and the cost of ending inventory. O The cost of ending inventory and the cost of goods purchased during the year. The cost of beginning inventory and the cost of goods purchased during the year. O The difference between the costs of goods purchased and the cost of goods sold during the year. Current Attempt in Progress The factor that determines whether or not goods should be included in a physical count of inventory is o physical possession. legal title, management's judgement. whether or not the purchase price has been paid. Days sales in inventory is calculated as O cost of goods sold divided by average inventory. O average inventory divided by cost of goods sold. O days in the year divided by inventory turnover ratio. O inventory turnover ratio divided by days in the year. For a merchandising company, the net realizable value of its inventory is the O original cost of the inventory. O current selling price. current selling price less any costs required to make the goods ready for sale. original cost of the inventory less any costs required to make the goods ready for sale. Inventory errors can result in errors in determining all of the following, except O ending inventory. O sales. beginning inventory. O cost of goods sold