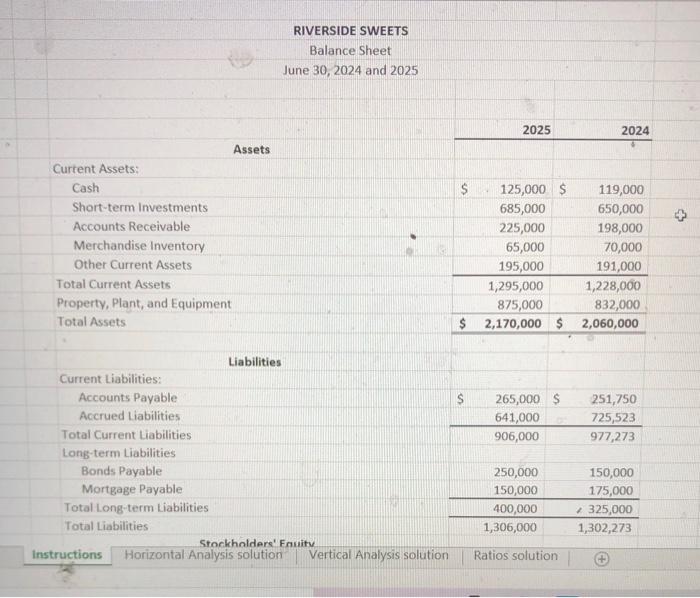

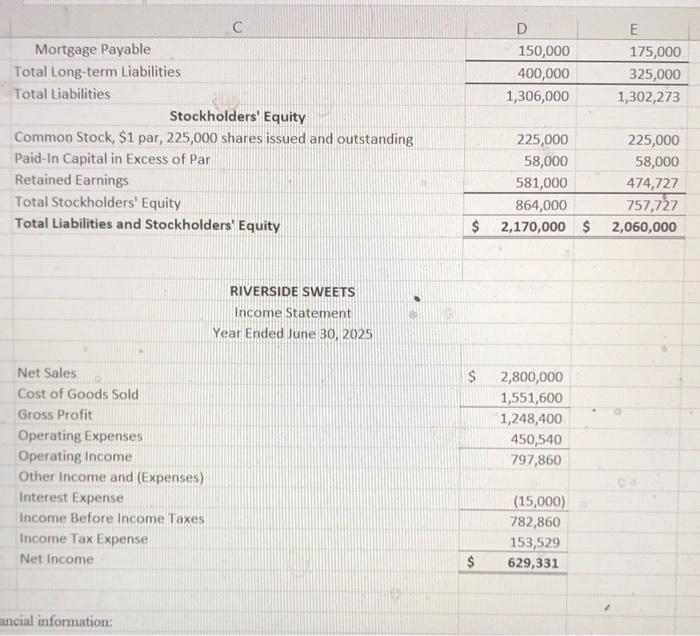

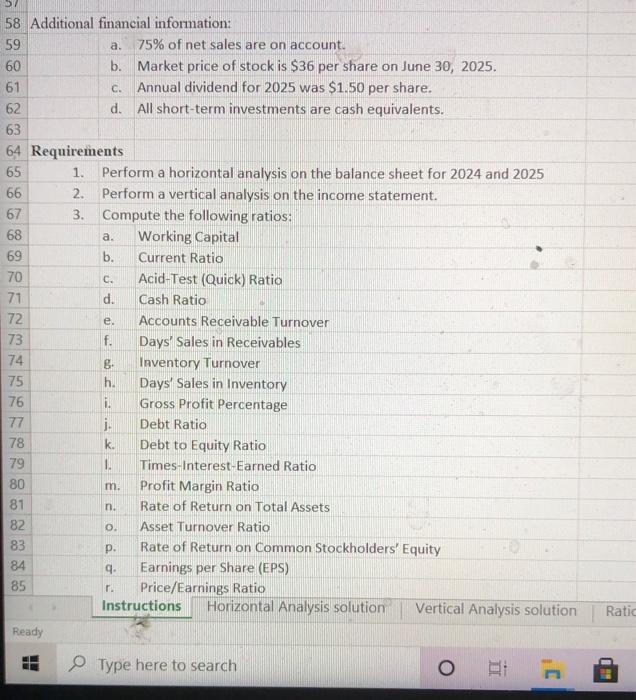

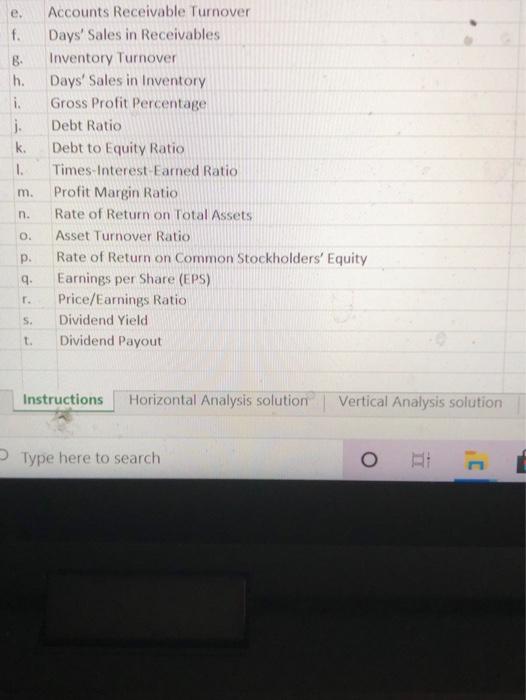

RIVERSIDE SWEETS Balance Sheet June 30, 2024 and 2025 2025 2024 Assets Current Assets: Cash Short-term Investments Accounts Receivable Merchandise Inventory Other Current Assets Total Current Assets Property, Plant, and Equipment Total Assets $ 125,000 $ 119,000 685,000 650,000 225,000 198,000 65,000 70,000 195,000 191,000 1,295,000 1,228,000 875,000 832,000 $ 2,170,000 $2,060,000 $ 265,000 $ 641,000 906,000 251,750 725,523 977,273 Liabilities Current Liabilities: Accounts Payable Accrued Liabilities Total Current Liabilities Long-term Liabilities Bonds Payable Mortgage Payable Total Long term Liabilities Total Liabilities Stockholders' Fruity Instructions Horizontal Analysis solution Vertical Analysis solution 250,000 150,000 400,000 1,306,000 150,000 175,000 325,000 1,302,273 Ratios solution D 150,000 400,000 1,306,000 E 175,000 325,000 1,302,273 Mortgage Payable Total Long-term Liabilities Total Liabilities Stockholders' Equity Common Stock, $1 par, 225,000 shares issued and outstanding Paid-In Capital in Excess of Par Retained Earnings Total Stockholders' Equity Total Liabilities and Stockholders' Equity 225,000 58,000 581,000 864,000 2,170,000 $ 225,000 58,000 474,727 757,727 2,060,000 $ RIVERSIDE SWEETS Income Statement Year Ended June 30, 2025 $ Net Sales Cost of Goods Sold Gross Profit Operating Expenses Operating Income Other Income and (Expenses) Interest Expense Income Before Income Taxes Income Tax Expense Net Income 2,800,000 1,551,600 1,248,400 450,540 797,860 (15,000) 782,860 153,529 629,331 $ ancial information: C. e. 58 Additional financial information: 59 a. 75% of net sales are on account. 60 b. Market price of stock is $36 per share on June 30, 2025. 61 c. Annual dividend for 2025 was $1.50 per share. 62 d. All short-term investments are cash equivalents. 63 64 Requirements 65 1. Perform a horizontal analysis on the balance sheet for 2024 and 2025 66 2. Perform a vertical analysis on the income statement. 67 3. Compute the following ratios: 68 a. Working Capital 69 b. Current Ratio 70 Acid-Test (Quick) Ratio 71 d. Cash Ratio 72 Accounts Receivable Turnover 73 f. Days' Sales in Receivables 74 B Inventory Turnover 75 h. Days' Sales in Inventory 76 1. Gross Profit Percentage 77 j. Debt Ratio 78 k. Debt to Equity Ratio 79 1. Times-Interest-Earned Ratio 80 m. Profit Margin Ratio 81 n. Rate of Return on Total Assets 82 Asset Turnover Ratio 83 p. Rate of Return on Common Stockholders' Equity 84 9. Earnings per Share (EPS) 85 Price/Earnings Ratio Instructions Horizontal Analysis solution Vertical Analysis solution Ready Type here to search o 0. Ratic C e. f. B h. i. k. I. Accounts Receivable Turnover Days' Sales in Receivables Inventory Turnover Days' Sales in Inventory Gross Profit Percentage Debt Ratio Debt to Equity Ratio Times Interest-Earned Ratio Profit Margin Ratio Rate of Return on Total Assets Asset Turnover Ratio Rate of Return on Common Stockholders' Equity Earnings per Share (EPS) Price/Earnings Ratio Dividend Yield Dividend Payout m. n. 0. p. 9. . S. t. Instructions Horizontal Analysis solution Vertical Analysis solution Type here to search O n