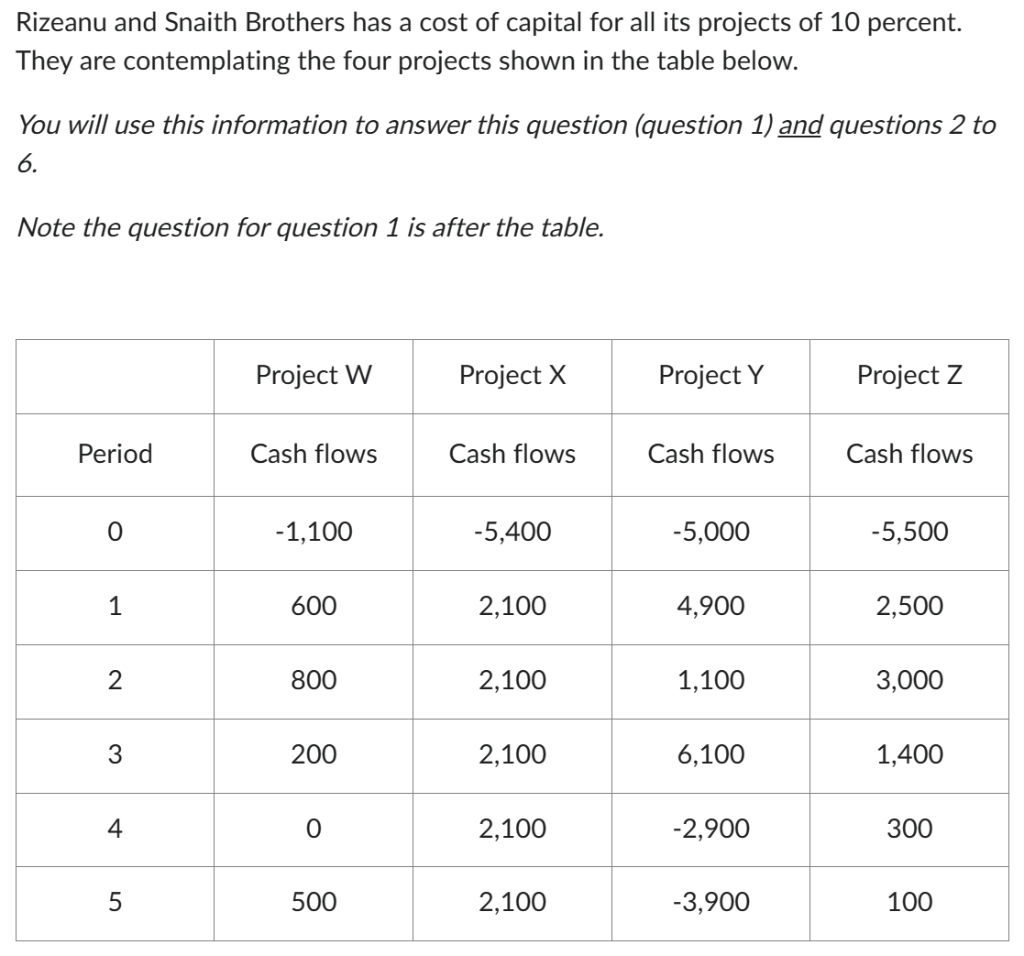

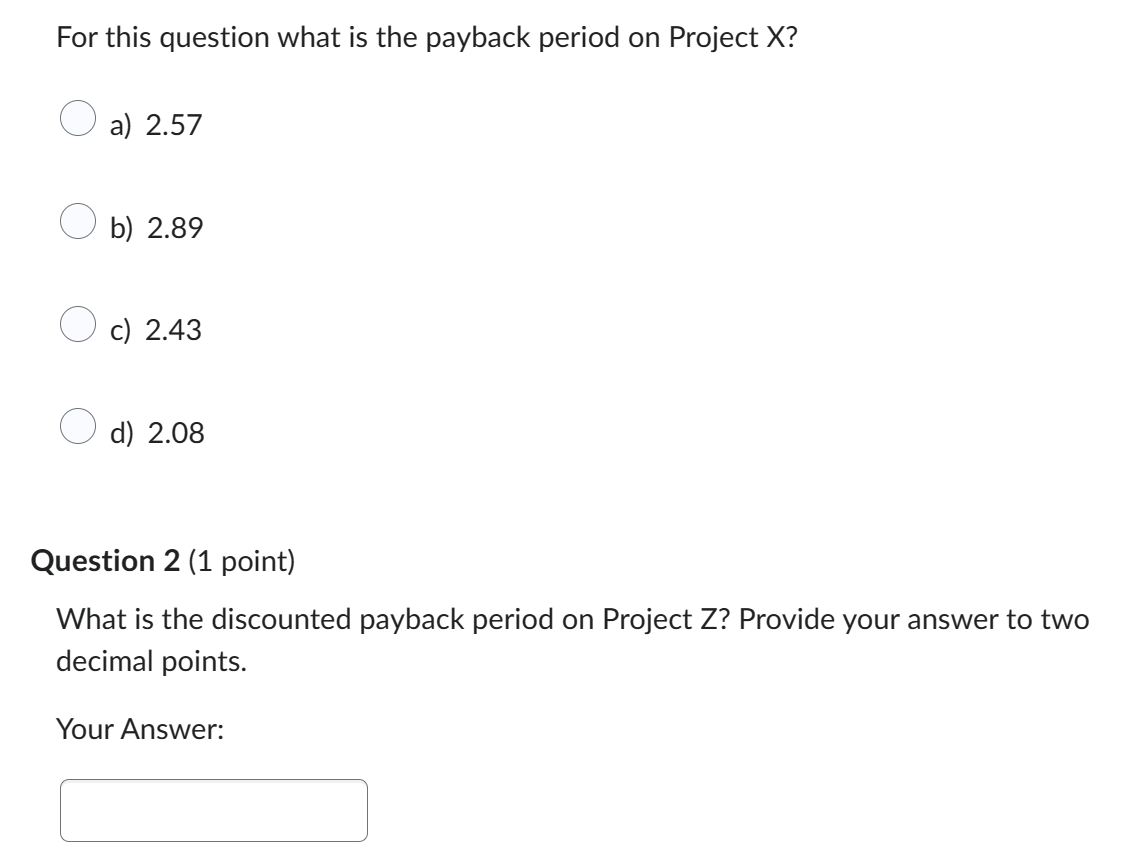

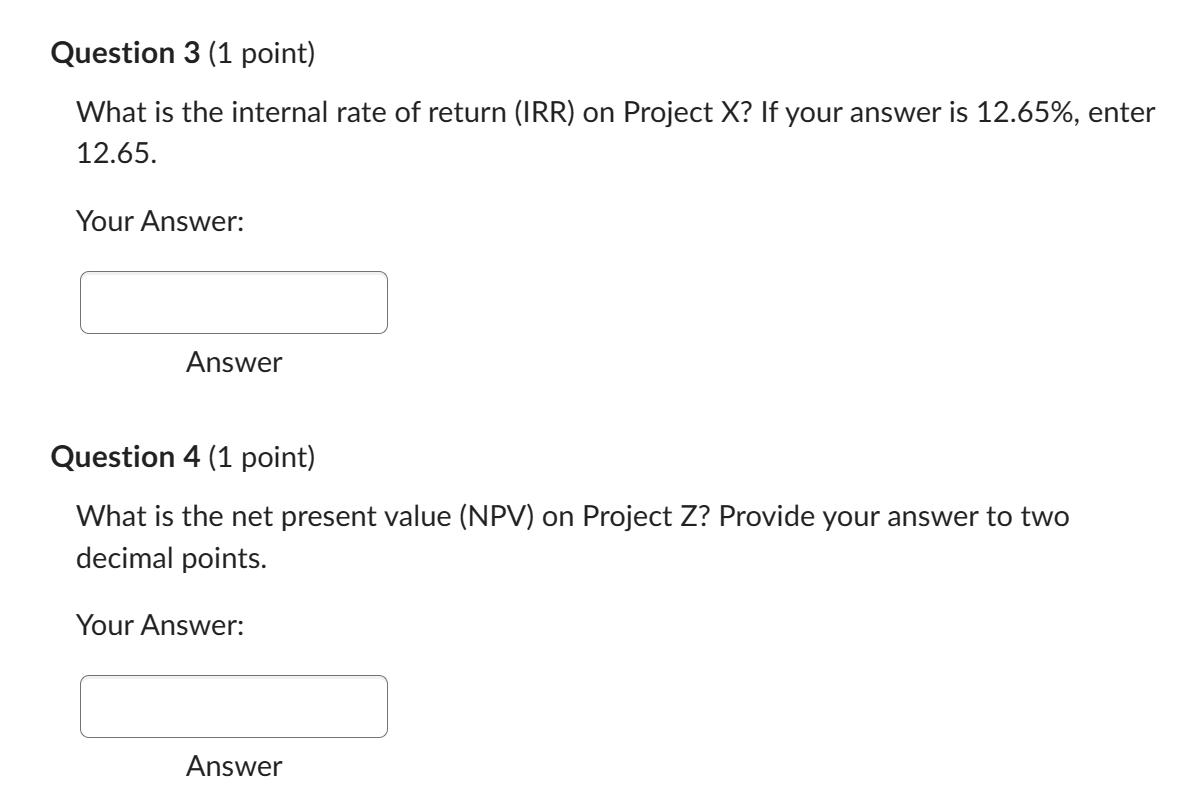

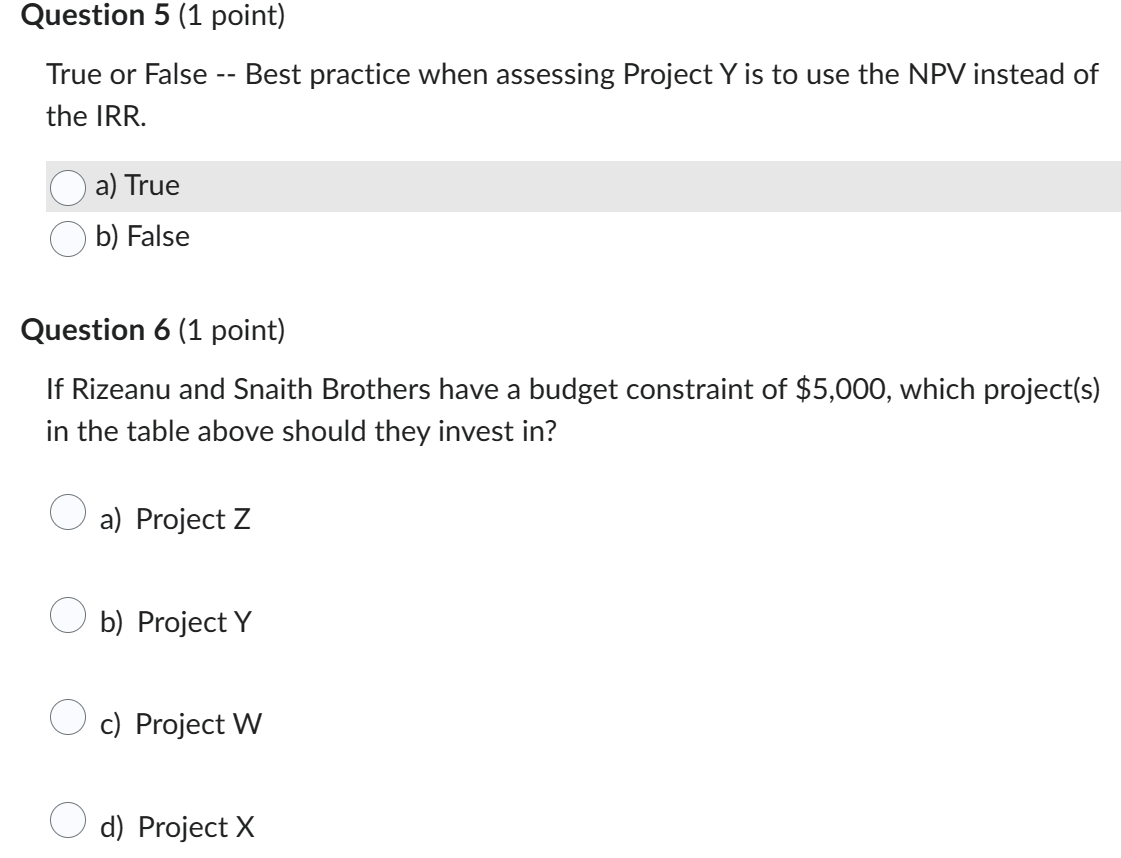

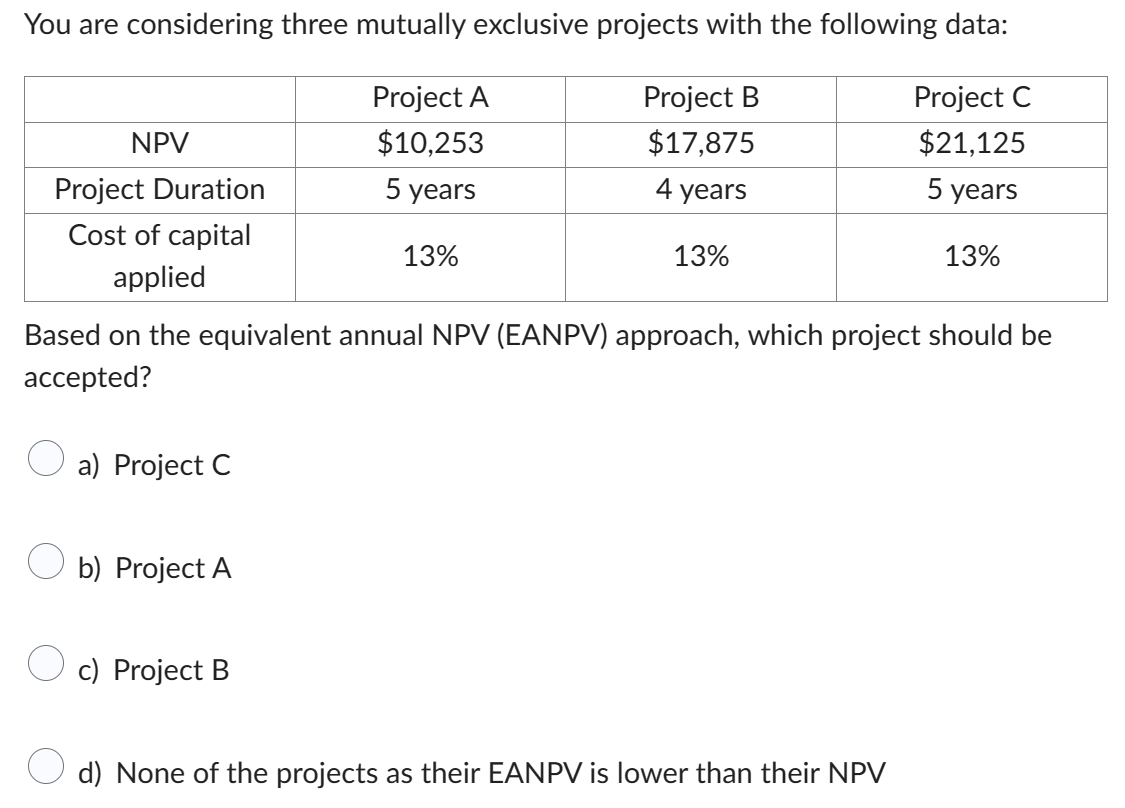

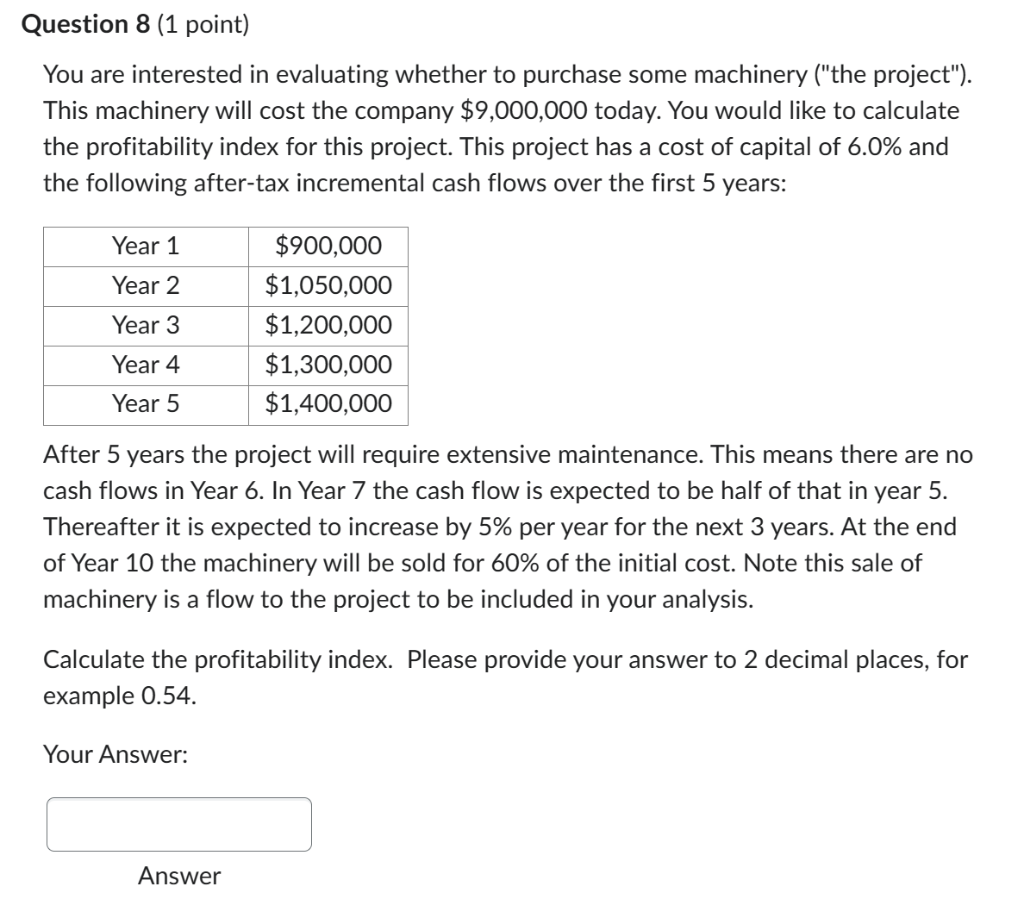

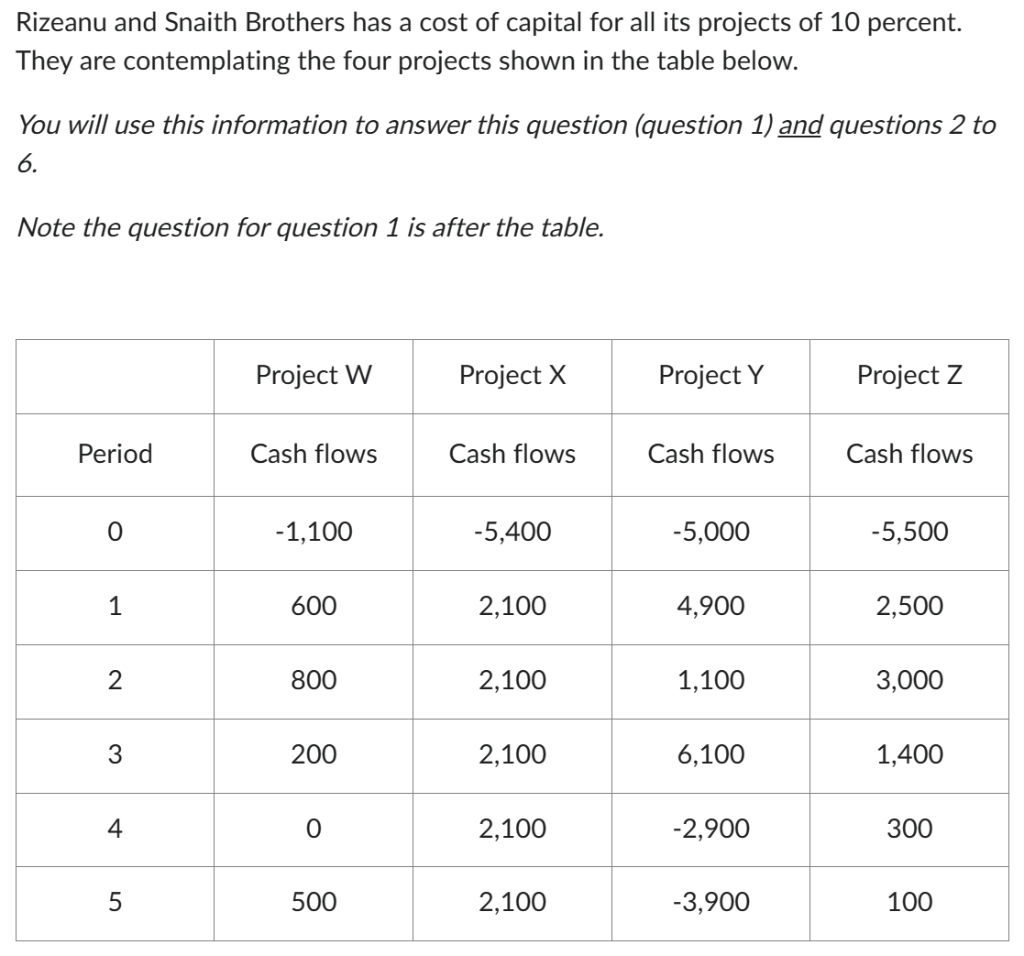

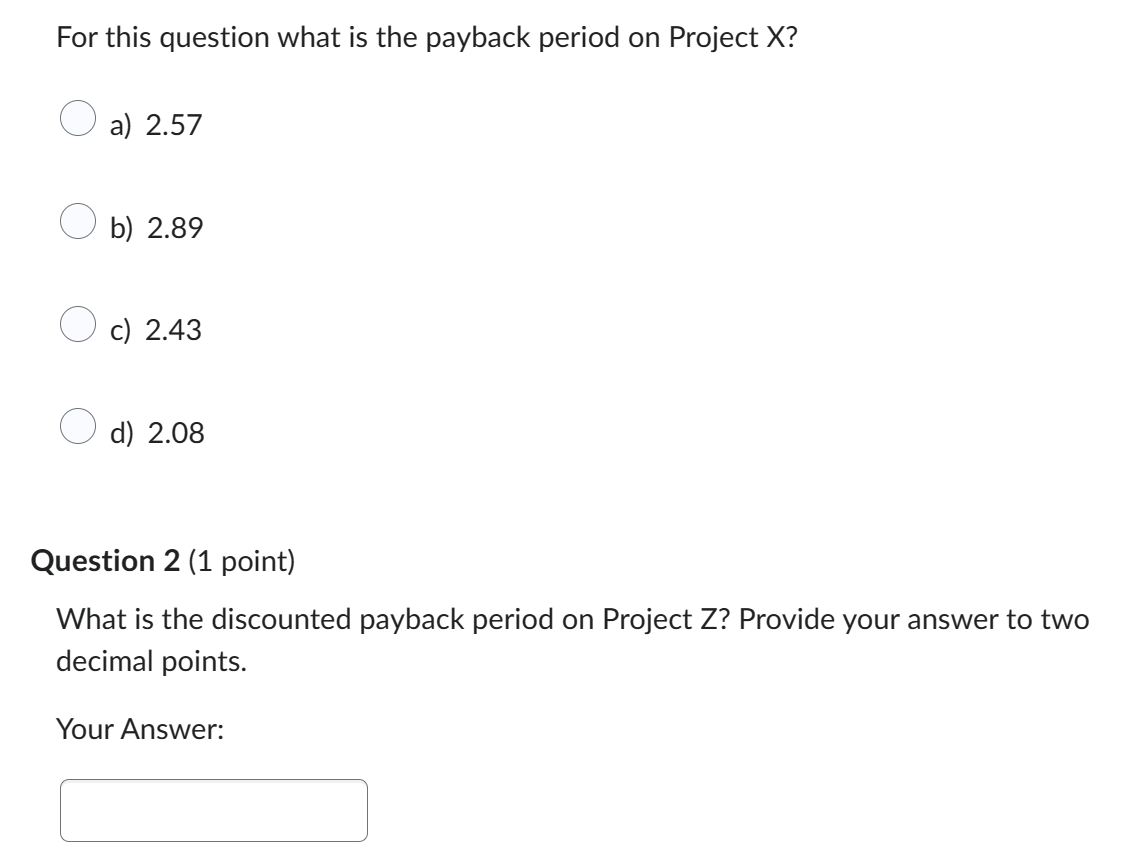

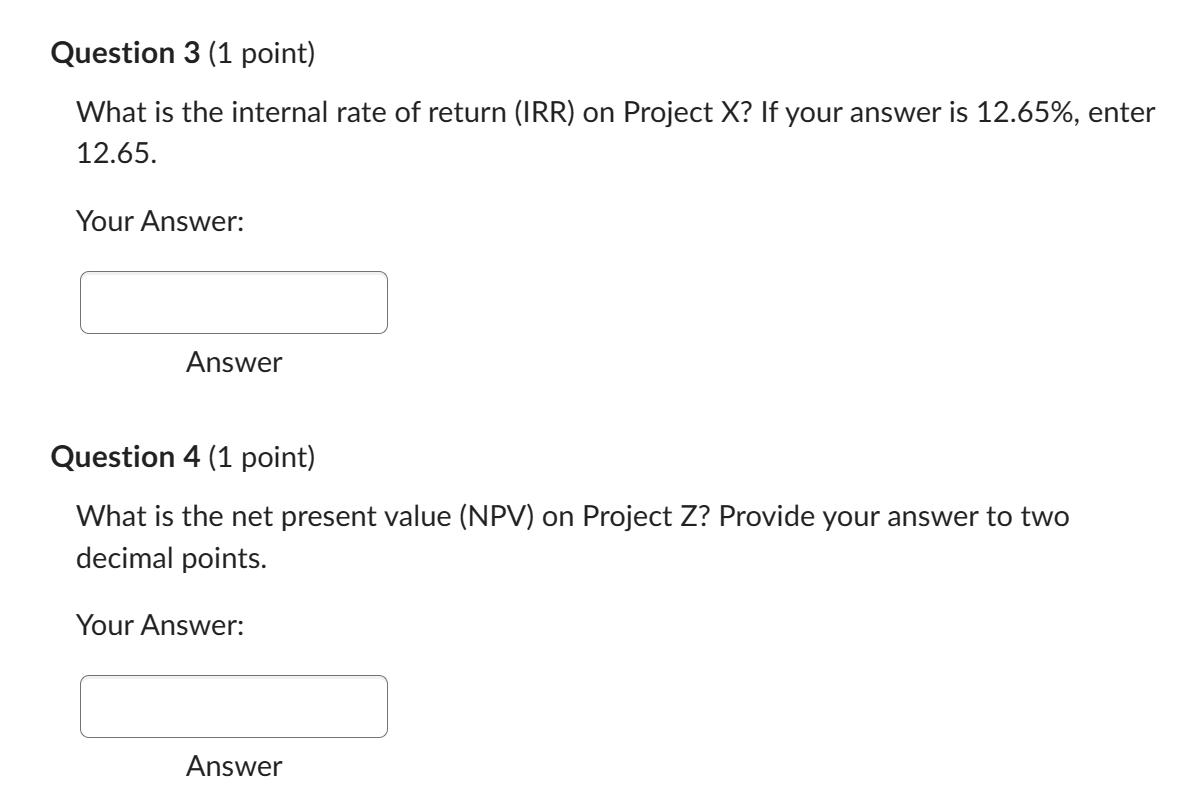

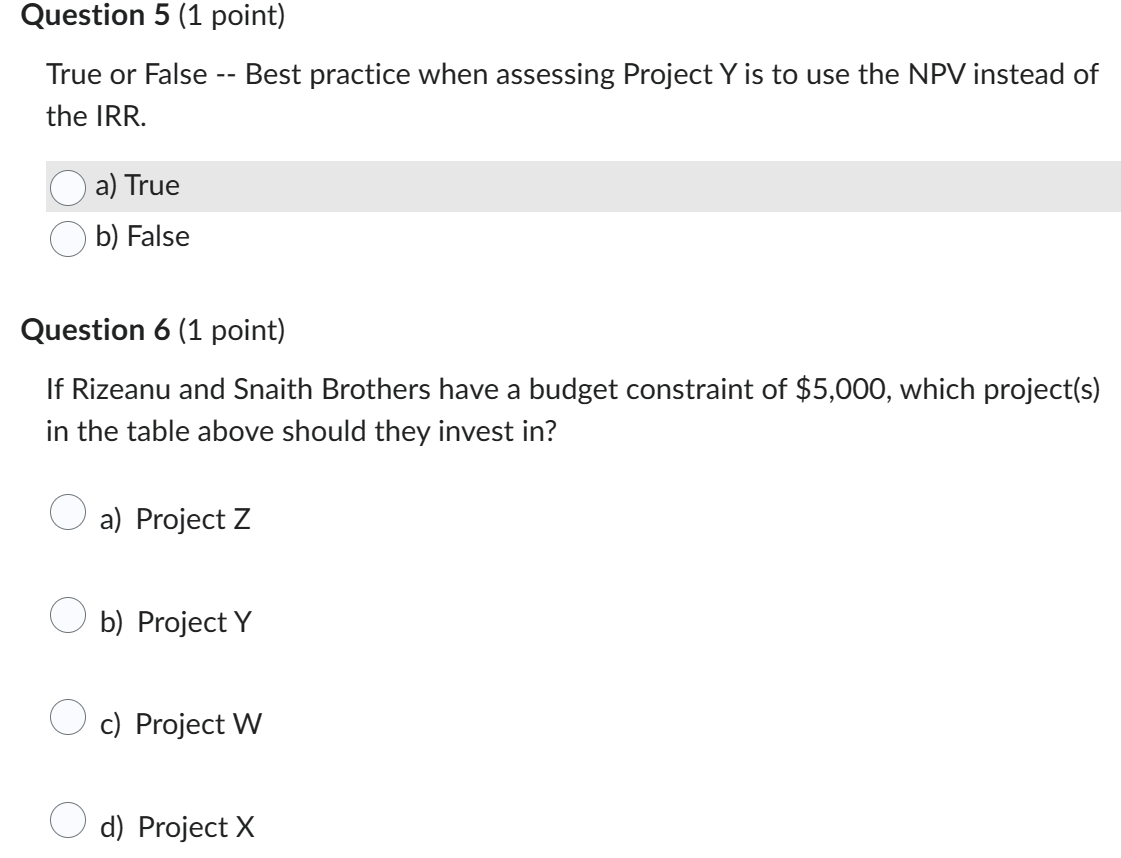

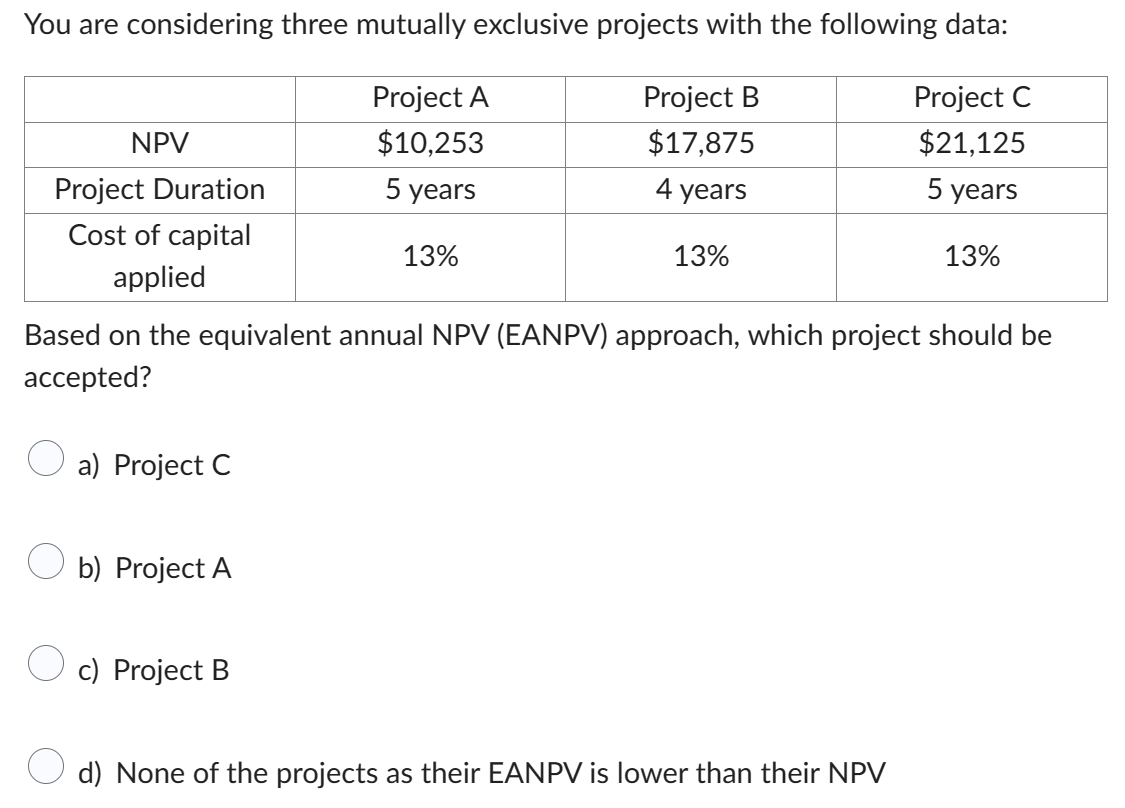

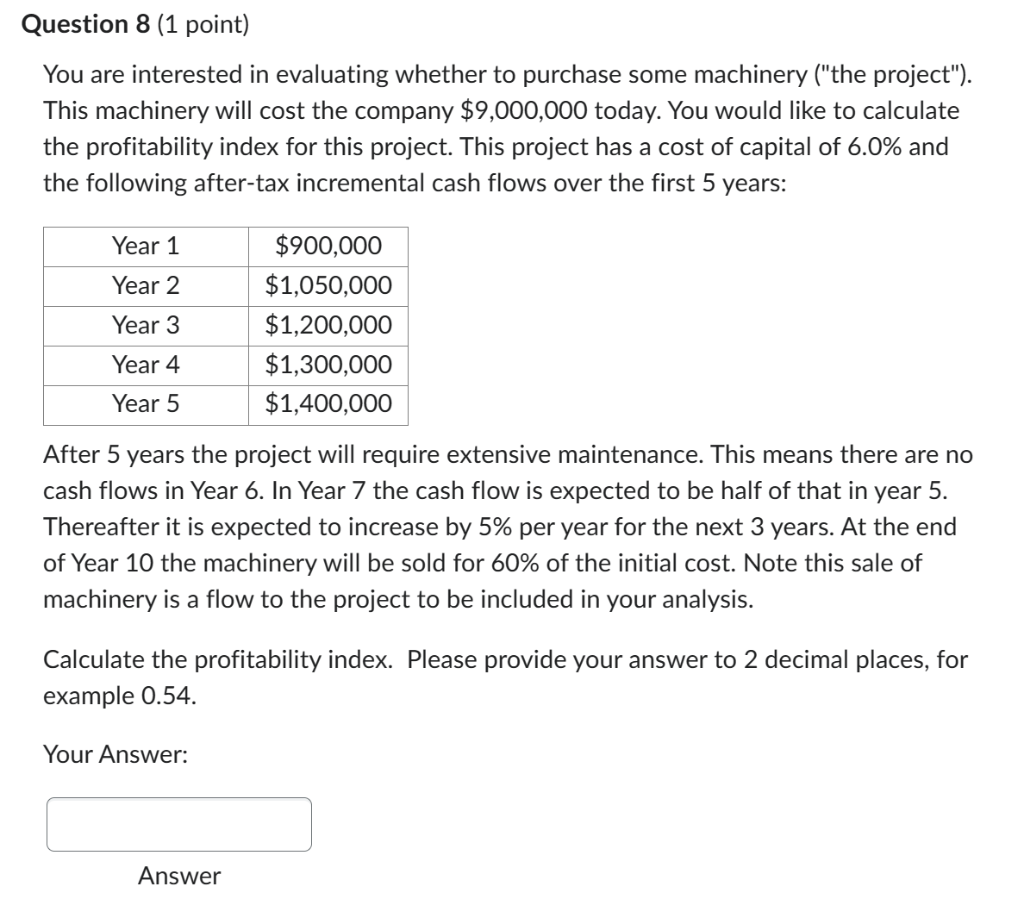

Rizeanu and Snaith Brothers has a cost of capital for all its projects of 10 percent. They are contemplating the four projects shown in the table below. You will use this information to answer this question (question 1) and questions 2 to 6. Note the question for question 1 is after the table. For this question what is the payback period on Project X ? a) 2.57 b) 2.89 c) 2.43 d) 2.08 Question 2 (1 point) What is the discounted payback period on Project Z ? Provide your answer to two decimal points. Your Answer: What is the internal rate of return (IRR) on Project X ? If your answer is 12.65%, enter 12.65. Your Answer: Answer Question 4 (1 point) What is the net present value (NPV) on Project Z? Provide your answer to two decimal points. Your Answer: Answer True or False -- Best practice when assessing Project Y is to use the NPV instead of the IRR. a) True b) False Question 6 (1 point) If Rizeanu and Snaith Brothers have a budget constraint of $5,000, which project(s) in the table above should they invest in? a) Project Z b) Project Y c) Project W d) Project X You are considering three mutually exclusive projects with the following data: Based on the equivalent annual NPV (EANPV) approach, which project should be accepted? a) Project C b) Project A c) Project B d) None of the projects as their EANPV is lower than their NPV You are interested in evaluating whether to purchase some machinery ("the project"). This machinery will cost the company $9,000,000 today. You would like to calculate the profitability index for this project. This project has a cost of capital of 6.0% and the following after-tax incremental cash flows over the first 5 years: After 5 years the project will require extensive maintenance. This means there are no cash flows in Year 6. In Year 7 the cash flow is expected to be half of that in year 5. Thereafter it is expected to increase by 5% per year for the next 3 years. At the end of Year 10 the machinery will be sold for 60% of the initial cost. Note this sale of machinery is a flow to the project to be included in your analysis. Calculate the profitability index. Please provide your answer to 2 decimal places, for example 0.54. Your Answer: Answer Rizeanu and Snaith Brothers has a cost of capital for all its projects of 10 percent. They are contemplating the four projects shown in the table below. You will use this information to answer this question (question 1) and questions 2 to 6. Note the question for question 1 is after the table. For this question what is the payback period on Project X ? a) 2.57 b) 2.89 c) 2.43 d) 2.08 Question 2 (1 point) What is the discounted payback period on Project Z ? Provide your answer to two decimal points. Your Answer: What is the internal rate of return (IRR) on Project X ? If your answer is 12.65%, enter 12.65. Your Answer: Answer Question 4 (1 point) What is the net present value (NPV) on Project Z? Provide your answer to two decimal points. Your Answer: Answer True or False -- Best practice when assessing Project Y is to use the NPV instead of the IRR. a) True b) False Question 6 (1 point) If Rizeanu and Snaith Brothers have a budget constraint of $5,000, which project(s) in the table above should they invest in? a) Project Z b) Project Y c) Project W d) Project X You are considering three mutually exclusive projects with the following data: Based on the equivalent annual NPV (EANPV) approach, which project should be accepted? a) Project C b) Project A c) Project B d) None of the projects as their EANPV is lower than their NPV You are interested in evaluating whether to purchase some machinery ("the project"). This machinery will cost the company $9,000,000 today. You would like to calculate the profitability index for this project. This project has a cost of capital of 6.0% and the following after-tax incremental cash flows over the first 5 years: After 5 years the project will require extensive maintenance. This means there are no cash flows in Year 6. In Year 7 the cash flow is expected to be half of that in year 5. Thereafter it is expected to increase by 5% per year for the next 3 years. At the end of Year 10 the machinery will be sold for 60% of the initial cost. Note this sale of machinery is a flow to the project to be included in your analysis. Calculate the profitability index. Please provide your answer to 2 decimal places, for example 0.54. Your