RJR is a conglomerate that produces a broad range of food and tobacco products. Currently, 50% of its business is in the food industry

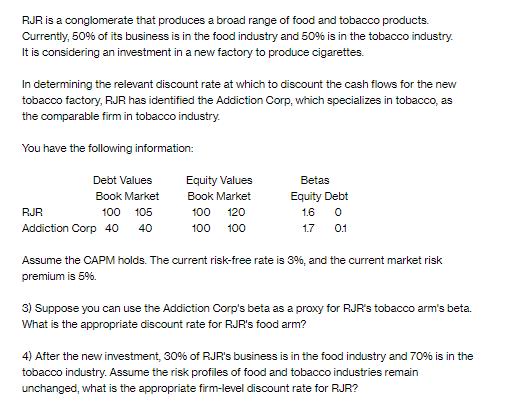

RJR is a conglomerate that produces a broad range of food and tobacco products. Currently, 50% of its business is in the food industry and 50% is in the tobacco industry. It is considering an investment in a new factory to produce cigarettes. In determining the relevant discount rate at which to discount the cash flows for the new tobacco factory, RJR has identified the Addiction Corp, which specializes in tobacco, as the comparable firm in tobacco industry. You have the following information: Debt Values Book Market RJR 100 105 Addiction Corp 40 40 Equity Values Book Market 100 120 100 100 Betas Equity Debt 1.6 0 0.1 17 Assume the CAPM holds. The current risk-free rate is 3%, and the current market risk premium is 5%. 3) Suppose you can use the Addiction Corp's beta as a proxy for RJR's tobacco arm's beta. What is the appropriate discount rate for RJR's food arm? 4) After the new investment, 30% of RJR's business is in the food industry and 70% is in the tobacco industry. Assume the risk profiles of food and tobacco industries remain unchanged, what is the appropriate firm-level discount rate for RJR?

Step by Step Solution

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

3 To find the appropriate discount rate for RJRs food arm we need to first calculate RJRs unlevered beta which can be calculated using the Hamada equa...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started