Answered step by step

Verified Expert Solution

Question

1 Approved Answer

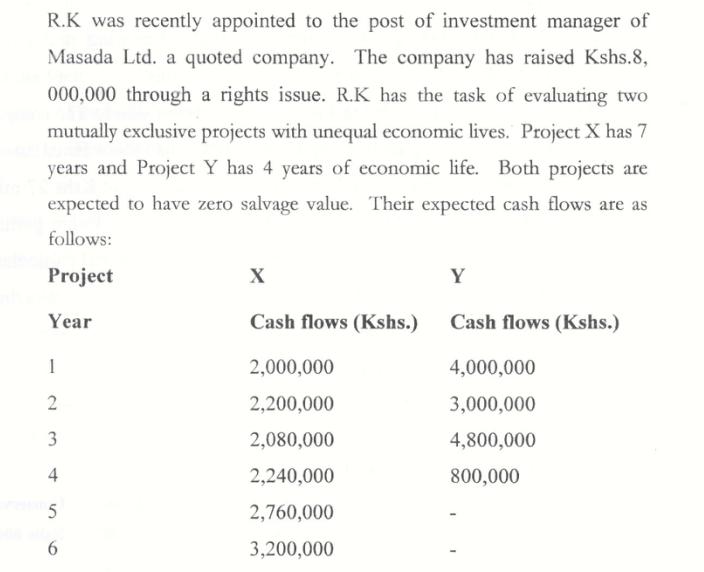

R.K was recently appointed to the post of investment manager of Masada Ltd. a quoted company. The company has raised Kshs.8, 000,000 through a

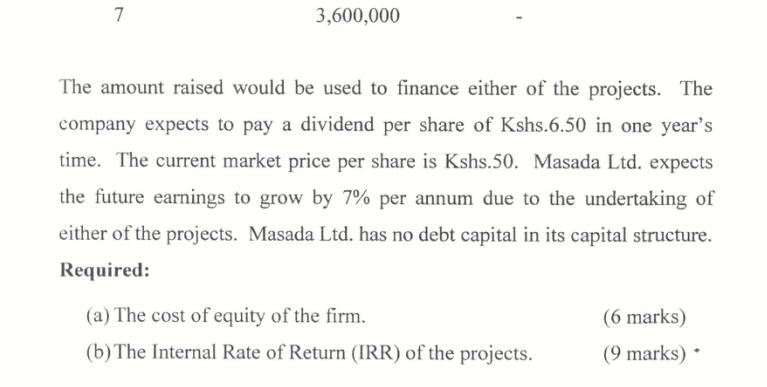

R.K was recently appointed to the post of investment manager of Masada Ltd. a quoted company. The company has raised Kshs.8, 000,000 through a rights issue. R.K has the task of evaluating two mutually exclusive projects with unequal economic lives. Project X has 7 years and Project Y has 4 years of economic life. Both projects are expected to have zero salvage value. Their expected cash flows are as follows: Project Year 1 2 3 4 5 6 X Cash flows (Kshs.) 2,000,000 2,200,000 2,080,000 2,240,000 2,760,000 3,200,000 Y Cash flows (Kshs.) 4,000,000 3,000,000 4,800,000 800,000 7 3,600,000 The amount raised would be used to finance either of the projects. The company expects to pay a dividend per share of Kshs.6.50 in one year's time. The current market price per share is Kshs.50. Masada Ltd. expects the future earnings to grow by 7% per annum due to the undertaking of either of the projects. Masada Ltd. has no debt capital in its capital structure. Required: (a) The cost of equity of the firm. (b) The Internal Rate of Return (IRR) of the projects. (6 marks) (9 marks).

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

The detailed answer for the above question is provided below a The cost of equit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started