Answered step by step

Verified Expert Solution

Question

1 Approved Answer

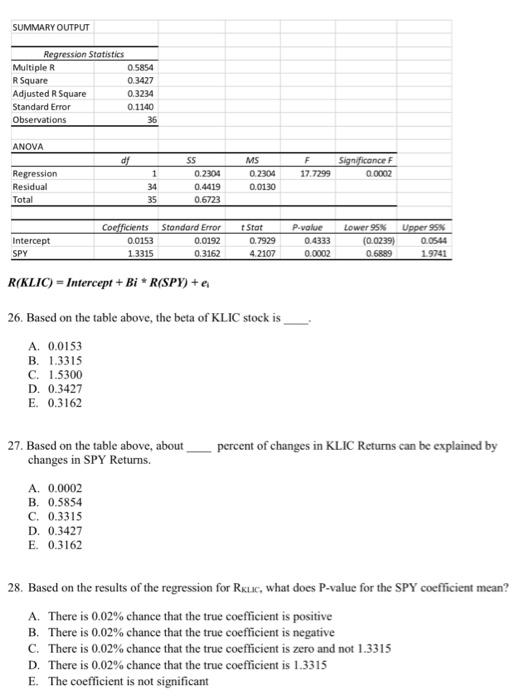

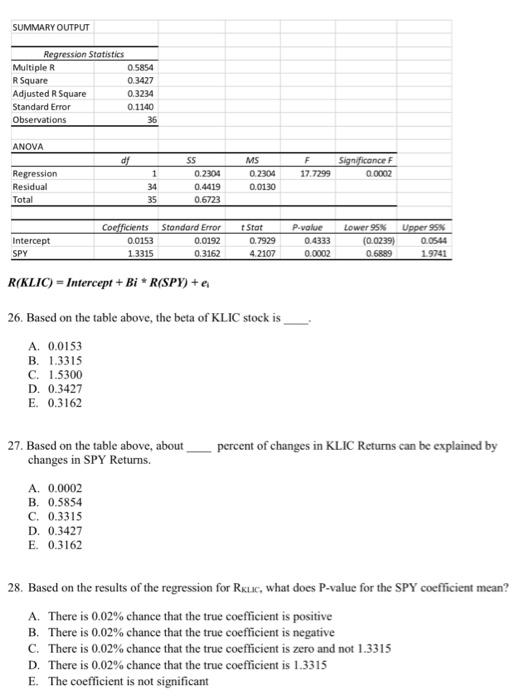

R(KLIC)=Intercept+BiR(SPY)+ei 26. Based on the table above, the beta of KLIC stock is A. 0.0153 B. 1.3315 C. 1.5300 D. 0.3427 E. 0.3162 27. Based

R(KLIC)=Intercept+BiR(SPY)+ei 26. Based on the table above, the beta of KLIC stock is A. 0.0153 B. 1.3315 C. 1.5300 D. 0.3427 E. 0.3162 27. Based on the table above, about percent of changes in KLIC Returns can be explained by changes in SPY Returns. A. 0.0002 B. 0.5854 C. 0.3315 D. 0.3427 E. 0.3162 28. Based on the results of the regression for R, what does P-value for the SPY coefficient mean? A. There is 0.02% chance that the true coefficient is positive B. There is 0.02% chance that the true coefficient is negative C. There is 0.02% chance that the true coefficient is zero and not 1.3315 D. There is 0.02% chance that the true coefficient is 1.3315 E. The coefficient is not significant 26. Baved en the tahle ahove, the beta of Kt. IC saok is A. 0.0153 B. 1.3315 C. 15300 D. 0.3427 E. 0.3162 27, Based on the table above, aboen percent of changes in KI.1C Returns can be cyplaised by changes in SPY Returns. A. 0.0002 B. 0.5854 C. 0.3515 D. 0.427 E. 0.3162 28. Based oe the resalts of the regression for RKLIX, what does P-value for the SPY coefficient meas? A. There is 0.024 chance that the true cocfficient is positive B. There is 0.02% ehanee that the true eecficices is negative C. There is 0.02% chance that the true coefficiet is aere and not 1.3315 D. There is 0.02% ehance that the true cocflicited is 1.3315 E. The coefficied is not significant 29. Based en the results of the regression for Rkix, if you ewoept Rion to be 62% act muethe what return weruld you expect to have for KLIC stock? A. 0.09% B. 6.23% C. 6.26% D. 9,79% 30. Based ee the Regression revuly for KL.tC, if Varianee of the Residuals is aipal 0.0126 and Varunet of SPY equals to 0.0037, what must be the amoent total risk for KILC7 A. 0.0163 B. 0.0417 C. 0.0362 D. 0.0192 E. 0.0704

R(KLIC)=Intercept+BiR(SPY)+ei 26. Based on the table above, the beta of KLIC stock is A. 0.0153 B. 1.3315 C. 1.5300 D. 0.3427 E. 0.3162 27. Based on the table above, about percent of changes in KLIC Returns can be explained by changes in SPY Returns. A. 0.0002 B. 0.5854 C. 0.3315 D. 0.3427 E. 0.3162 28. Based on the results of the regression for R, what does P-value for the SPY coefficient mean? A. There is 0.02% chance that the true coefficient is positive B. There is 0.02% chance that the true coefficient is negative C. There is 0.02% chance that the true coefficient is zero and not 1.3315 D. There is 0.02% chance that the true coefficient is 1.3315 E. The coefficient is not significant 26. Baved en the tahle ahove, the beta of Kt. IC saok is A. 0.0153 B. 1.3315 C. 15300 D. 0.3427 E. 0.3162 27, Based on the table above, aboen percent of changes in KI.1C Returns can be cyplaised by changes in SPY Returns. A. 0.0002 B. 0.5854 C. 0.3515 D. 0.427 E. 0.3162 28. Based oe the resalts of the regression for RKLIX, what does P-value for the SPY coefficient meas? A. There is 0.024 chance that the true cocfficient is positive B. There is 0.02% ehanee that the true eecficices is negative C. There is 0.02% chance that the true coefficiet is aere and not 1.3315 D. There is 0.02% ehance that the true cocflicited is 1.3315 E. The coefficied is not significant 29. Based en the results of the regression for Rkix, if you ewoept Rion to be 62% act muethe what return weruld you expect to have for KLIC stock? A. 0.09% B. 6.23% C. 6.26% D. 9,79% 30. Based ee the Regression revuly for KL.tC, if Varianee of the Residuals is aipal 0.0126 and Varunet of SPY equals to 0.0037, what must be the amoent total risk for KILC7 A. 0.0163 B. 0.0417 C. 0.0362 D. 0.0192 E. 0.0704

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started