Answered step by step

Verified Expert Solution

Question

1 Approved Answer

You are the quality control manager in N.Club & Co, a firm of Chartered Certified Accountants. You are carrying out a random quality control

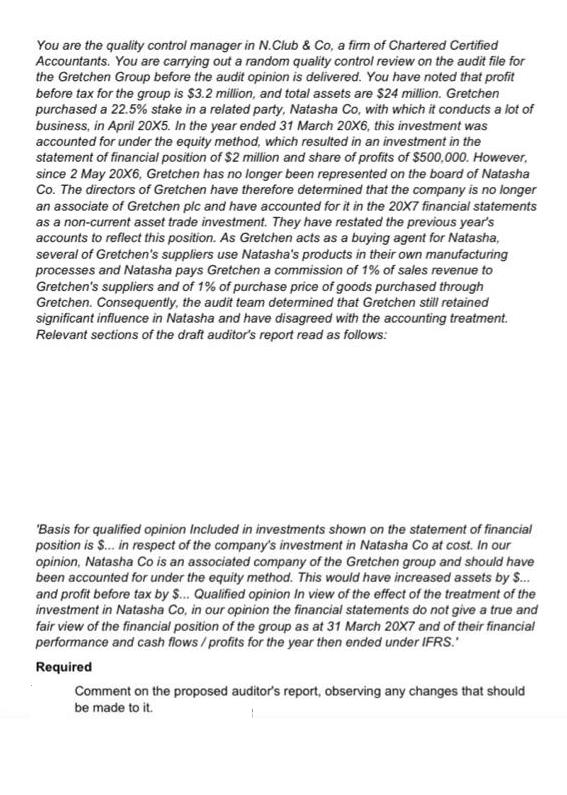

You are the quality control manager in N.Club & Co, a firm of Chartered Certified Accountants. You are carrying out a random quality control review on the audit file for the Gretchen Group before the audit opinion is delivered. You have noted that profit before tax for the group is $3.2 million, and total assets are $24 million. Gretchen purchased a 22.5% stake in a related party, Natasha Co, with which it conducts a lot of business, in April 20X5. In the year ended 31 March 20X6, this investment was accounted for under the equity method, which resulted in an investment in the statement of financial position of $2 million and share of profits of $500,000. However, since 2 May 20X6, Gretchen has no longer been represented on the board of Natasha Co. The directors of Gretchen have therefore determined that the company is no longer an associate of Gretchen plc and have accounted for it in the 20X7 financial statements as a non-current asset trade investment. They have restated the previous year's accounts to reflect this position. As Gretchen acts as a buying agent for Natasha, several of Gretchen's suppliers use Natasha's products in their own manufacturing processes and Natasha pays Gretchen a commission of 1% of sales revenue to Gretchen's suppliers and of 1% of purchase price of goods purchased through Gretchen. Consequently, the audit team determined that Gretchen still retained significant influence in Natasha and have disagreed with the accounting treatment. Relevant sections of the draft auditor's report read as follows: 'Basis for qualified opinion Included in investments shown on the statement of financial position is $... in respect of the company's investment in Natasha Co at cost. In our opinion, Natasha Co is an associated company of the Gretchen group and should have been accounted for under the equity method. This would have increased assets by S... and profit before tax by S... Qualified opinion In view of the effect of the treatment of the investment in Natasha Co, in our opinion the financial statements do not give a true and fair view of the financial position of the group as at 31 March 20X7 and of their financial performance and cash flows / profits for the year then ended under IFRS." Required Comment on the proposed auditor's report, observing any changes that should be made to it. 1

Step by Step Solution

★★★★★

3.53 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

The proposed auditors report is qualified due to the incorrect accounting treatment of the investmen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started