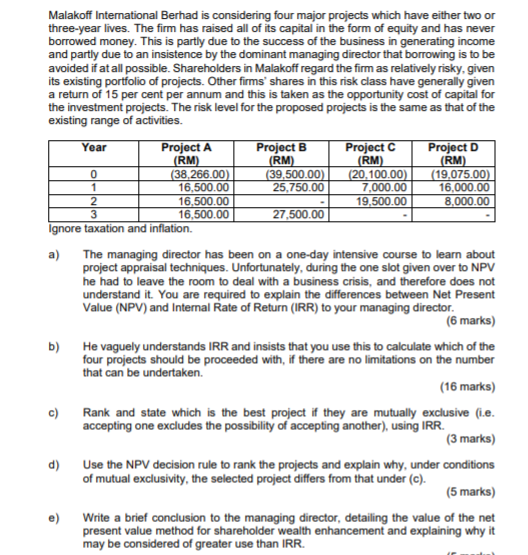

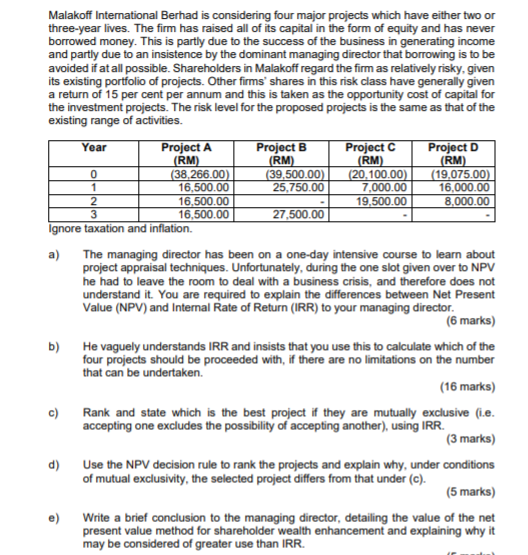

(RM) 0 1 2 3 Malakoff International Berhad is considering four major projects which have either two or three-year lives. The firm has raised all of its capital in the form of equity and has never borrowed money. This is partly due to the success of the business in generating income and partly due to an insistence by the dominant managing director that borrowing is to be avoided if at all possible. Shareholders in Malakoff regard the firm as relatively risky, given its existing portfolio of projects. Other firms' shares in this risk class have generally given a return of 15 per cent per annum and this is taken as the opportunity cost of capital for the investment projects. The risk level for the proposed projects is the same as that of the existing range of activities. Year Project A Project B Project C Project D (RM) (RM) (RM) (38,266.00) (39.500.00) (20,100.00) (19.075.00) 16,500.00 25,750.00 7,000.00 16,000.00 16,500.00 19,500.00 8,000.00 16,500.00 27,500.00 Ignore taxation and inflation. a) The managing director has been on a one-day intensive course to learn about project appraisal techniques. Unfortunately, during the one slot given over to NPV he had to leave the room to deal with a business crisis, and therefore does not understand it. You are required to explain the differences between Net Present Value (NPV) and Internal Rate of Return (IRR) to your managing director. (6 marks) b) He vaguely understands IRR and insists that you use this to calculate which of the four projects should be proceeded with, if there are no limitations on the number that can be undertaken. (16 marks) c) Rank and state which is the best project if they are mutually exclusive (i.e. accepting one excludes the possibility of accepting another), using IRR. (3 marks) d) Use the NPV decision rule to rank the projects and explain why, under conditions of mutual exclusivity, the selected project differs from that under (C). (5 marks) Write a brief conclusion to the managing director, detailing the value of the net present value method for shareholder wealth enhancement and explaining why it may be considered of greater use than IRR. (RM) 0 1 2 3 Malakoff International Berhad is considering four major projects which have either two or three-year lives. The firm has raised all of its capital in the form of equity and has never borrowed money. This is partly due to the success of the business in generating income and partly due to an insistence by the dominant managing director that borrowing is to be avoided if at all possible. Shareholders in Malakoff regard the firm as relatively risky, given its existing portfolio of projects. Other firms' shares in this risk class have generally given a return of 15 per cent per annum and this is taken as the opportunity cost of capital for the investment projects. The risk level for the proposed projects is the same as that of the existing range of activities. Year Project A Project B Project C Project D (RM) (RM) (RM) (38,266.00) (39.500.00) (20,100.00) (19.075.00) 16,500.00 25,750.00 7,000.00 16,000.00 16,500.00 19,500.00 8,000.00 16,500.00 27,500.00 Ignore taxation and inflation. a) The managing director has been on a one-day intensive course to learn about project appraisal techniques. Unfortunately, during the one slot given over to NPV he had to leave the room to deal with a business crisis, and therefore does not understand it. You are required to explain the differences between Net Present Value (NPV) and Internal Rate of Return (IRR) to your managing director. (6 marks) b) He vaguely understands IRR and insists that you use this to calculate which of the four projects should be proceeded with, if there are no limitations on the number that can be undertaken. (16 marks) c) Rank and state which is the best project if they are mutually exclusive (i.e. accepting one excludes the possibility of accepting another), using IRR. (3 marks) d) Use the NPV decision rule to rank the projects and explain why, under conditions of mutual exclusivity, the selected project differs from that under (C). (5 marks) Write a brief conclusion to the managing director, detailing the value of the net present value method for shareholder wealth enhancement and explaining why it may be considered of greater use than IRR