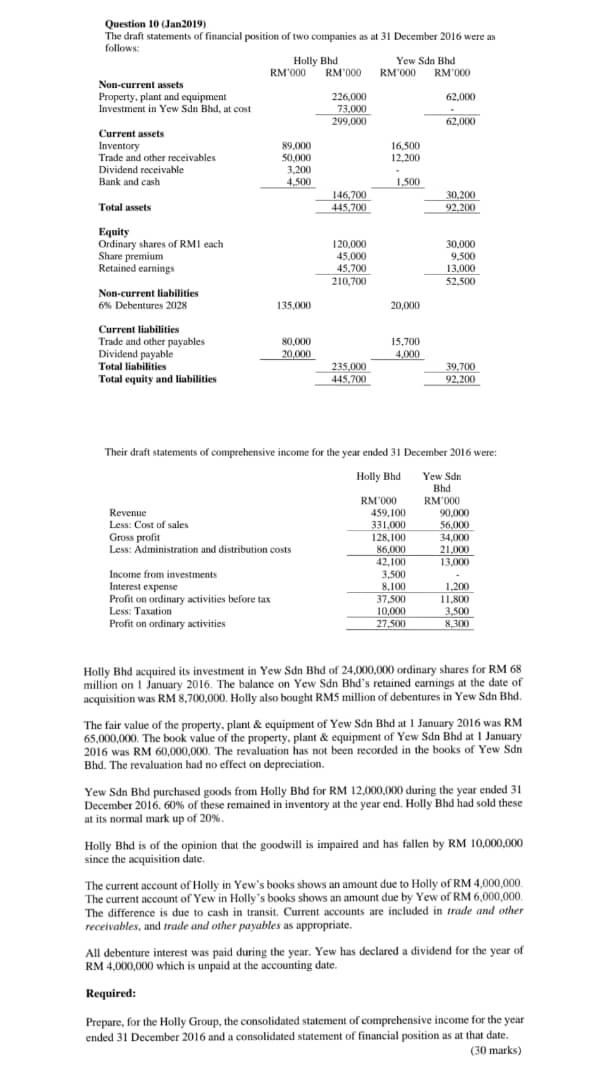

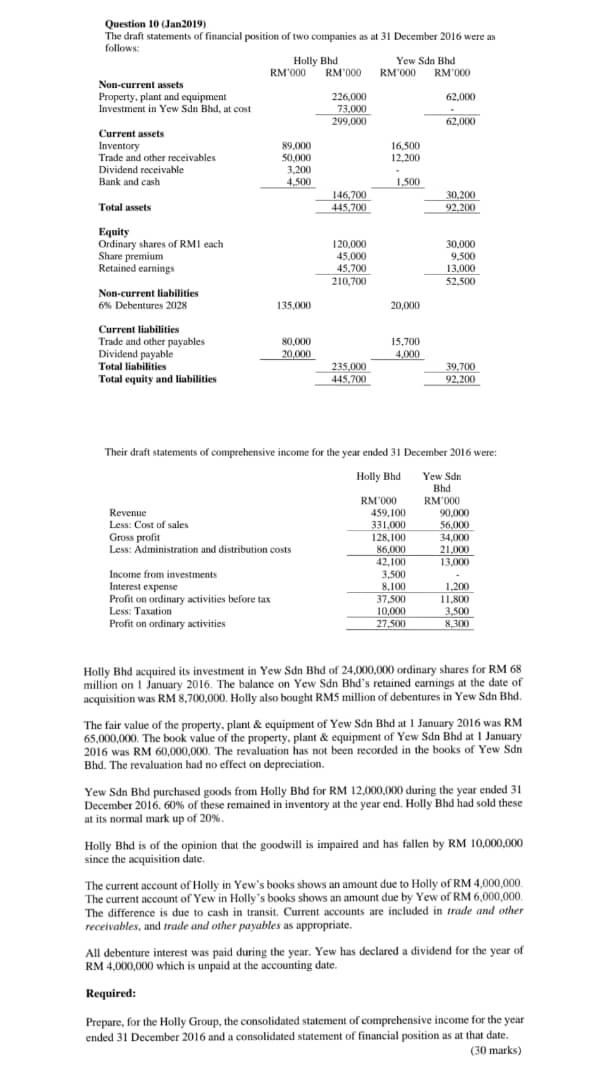

RM 000 RM 000 RM 600 226,000 Question 10 (Jan2019) The draft statements of financial position of two compatties as at 31 December 2016 were as follows: Holly Bhd Yew Sdn Bhd RM 000 Non-current assets Property, plant and equipment 62.000 Investment in Yew Sdn Bhd, at cost 73,000 299,000 62,00) Current assets Inventory 89.000 16 500 Trade and other receivables 50.000 12.200 Dividend receivable 3,200 Bank and cash 4.500 1.500 146,200 30,200 Total assets 445.700 92.200 Equity Ordinary shares of RMI each Share premium Retained earnings 120.000 45,000 45.200 210,700 30.000 9,500 13,000 52.500 Non-current liabilities 6. Debentures 2028 135.000 20,000 Current liabilities Trade and other payables Dividend payable Total liabilities Total equity and liabilities 80.000 20.000 15,700 4,000 235,000 445,700 39,700 92,200 Their draft statements of comprehensive income for the year ended 31 December 2016 were: Holly Bhd Revenue Less: Cost of sales Gross profit Less: Administration and distribution costs RM000 459,100 331.000 128,100 86.000 42,100 3,500 8.100 37.500 10,000 27.500 Yew Sdn Bhd RM 000 20.000 56,000 34,000 21,000 13,000 Income from investments Interest expense Profit on ordinary activities before tax Less: Taxation Profit on ordinary activities 1.200 11,800 3,500 8,300 Holly Bhd acquired its investment in Yew Sdn Bhd of 24,000,000 ordinary shares for RM 68 million on 1 January 2016. The balance on Yew Sdn Bhd's retained earnings at the date of acquisition was RM 8,700,000. Holly also bought RMS million of debentures in Yew Sdn Bhd The fair value of the property, plant & equipment of Yew Sdn Bhd at 1 January 2016 was RM 65,000,000. The book value of the property, plant & equipment of Yew Sdn Bhd at 1 January 2016 was RM 60,000,000. The revaluation has not been recorded in the books of Yew Sdn Bhd. The revaluation had no effect on depreciation. Yew Sdn Bhd purchased goods from Holly Bhd for RM 12,000,000 during the year ended 31 December 2016. 60% of these remained in inventory at the year end. Holly Bhd had sold these at its normal mark up of 20% Holly Bhd is of the opinion that the goodwill is impaired and has fallen by RM 10,000,000 since the acquisition date. The current account of Holly in Yew's books shows an amount due to Holly of RM 4,000,000 The current account of Yew in Holly's books shows an amount due by Yew of RM 6,000,000 The difference is due to cash in transit Current accounts are included in trade and other receivables, and trade and other payubles as appropriate All debenture interest was paid during the year. Yew has declared a dividend for the year of RM 4,000,000 which is unpaid at the accounting date. Required: Prepare for the Holly Group, the consolidated statement of comprehensive income for the year ended 31 December 2016 and a consolidated statement of financial position as at that date. (30 marks) RM 000 RM 000 RM 600 226,000 Question 10 (Jan2019) The draft statements of financial position of two compatties as at 31 December 2016 were as follows: Holly Bhd Yew Sdn Bhd RM 000 Non-current assets Property, plant and equipment 62.000 Investment in Yew Sdn Bhd, at cost 73,000 299,000 62,00) Current assets Inventory 89.000 16 500 Trade and other receivables 50.000 12.200 Dividend receivable 3,200 Bank and cash 4.500 1.500 146,200 30,200 Total assets 445.700 92.200 Equity Ordinary shares of RMI each Share premium Retained earnings 120.000 45,000 45.200 210,700 30.000 9,500 13,000 52.500 Non-current liabilities 6. Debentures 2028 135.000 20,000 Current liabilities Trade and other payables Dividend payable Total liabilities Total equity and liabilities 80.000 20.000 15,700 4,000 235,000 445,700 39,700 92,200 Their draft statements of comprehensive income for the year ended 31 December 2016 were: Holly Bhd Revenue Less: Cost of sales Gross profit Less: Administration and distribution costs RM000 459,100 331.000 128,100 86.000 42,100 3,500 8.100 37.500 10,000 27.500 Yew Sdn Bhd RM 000 20.000 56,000 34,000 21,000 13,000 Income from investments Interest expense Profit on ordinary activities before tax Less: Taxation Profit on ordinary activities 1.200 11,800 3,500 8,300 Holly Bhd acquired its investment in Yew Sdn Bhd of 24,000,000 ordinary shares for RM 68 million on 1 January 2016. The balance on Yew Sdn Bhd's retained earnings at the date of acquisition was RM 8,700,000. Holly also bought RMS million of debentures in Yew Sdn Bhd The fair value of the property, plant & equipment of Yew Sdn Bhd at 1 January 2016 was RM 65,000,000. The book value of the property, plant & equipment of Yew Sdn Bhd at 1 January 2016 was RM 60,000,000. The revaluation has not been recorded in the books of Yew Sdn Bhd. The revaluation had no effect on depreciation. Yew Sdn Bhd purchased goods from Holly Bhd for RM 12,000,000 during the year ended 31 December 2016. 60% of these remained in inventory at the year end. Holly Bhd had sold these at its normal mark up of 20% Holly Bhd is of the opinion that the goodwill is impaired and has fallen by RM 10,000,000 since the acquisition date. The current account of Holly in Yew's books shows an amount due to Holly of RM 4,000,000 The current account of Yew in Holly's books shows an amount due by Yew of RM 6,000,000 The difference is due to cash in transit Current accounts are included in trade and other receivables, and trade and other payubles as appropriate All debenture interest was paid during the year. Yew has declared a dividend for the year of RM 4,000,000 which is unpaid at the accounting date. Required: Prepare for the Holly Group, the consolidated statement of comprehensive income for the year ended 31 December 2016 and a consolidated statement of financial position as at that date. (30 marks)