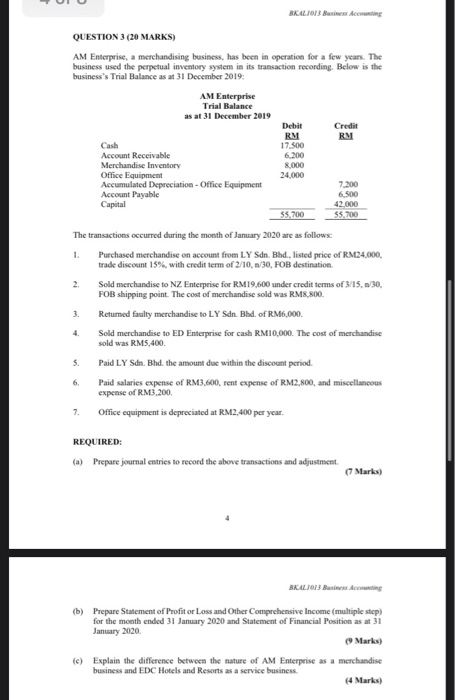

RM 8.000 BKALIO Ming QUESTION 3 (20 MARKS) AM Enterprise, a merchandising business, has been in operation for a few years. The business used the perpetual inventory system in its transaction recording. Below is the business's Trial Balance as at 31 December 2019: AM Enterprise Trial Balance as at 31 December 2019 Debit Credit RM Cash 17.500 Account Receivable 6.200 Merchandise Inventory Office Equipment 24,000 Accumulated Depreciation - Office Equipment 7.200 Account Payable 6.500 Capital 42.000 55,700 55,700 The transactions occurred during the month of January 2020 are as follows: 1. Purchased merchandise on account from LY Sdn. Bhd., listed price of RM24,000, trade discount 15%, with credit term of 2/10, 1/30, FOB destination. 2 Sold merchandise to NZ Enterprise for RM 19,600 under credit terms of 3/15../30. FOB shipping point. The cost of merchandise sold was RM8.800. 3. Returned faulty merchandise to LY Sdn. Bhd. of RM6,000 Sold merchandise to ED Enterprise for cash RM10,000. The cost of merchandise sold was RM5,400 5. Paid LY Sdn. Bhd. the amount due within the discount period. Paid salaries expense of RM3,600, rent expense of RM2,800, and miscellancous expense of RM3.200 7. Office equipment is depreciated at RM2,400 per year. REQUIRED: (a) Prepare journal entries to record the above transactions and adjustment (7 Marks) BALIOI Manting (b) Prepare Statement of Profit or Loss and Other Comprehensive Income (multiple step) for the month ended 31 January 2020 and Statement of Financial Position as at 31 January 2020 Marks) (c) Explain the difference between the nature of AM Enterprise as a merchandise business and EDC Hotels and Resorts as a service business. (4 Marks) RM 8.000 BKALIO Ming QUESTION 3 (20 MARKS) AM Enterprise, a merchandising business, has been in operation for a few years. The business used the perpetual inventory system in its transaction recording. Below is the business's Trial Balance as at 31 December 2019: AM Enterprise Trial Balance as at 31 December 2019 Debit Credit RM Cash 17.500 Account Receivable 6.200 Merchandise Inventory Office Equipment 24,000 Accumulated Depreciation - Office Equipment 7.200 Account Payable 6.500 Capital 42.000 55,700 55,700 The transactions occurred during the month of January 2020 are as follows: 1. Purchased merchandise on account from LY Sdn. Bhd., listed price of RM24,000, trade discount 15%, with credit term of 2/10, 1/30, FOB destination. 2 Sold merchandise to NZ Enterprise for RM 19,600 under credit terms of 3/15../30. FOB shipping point. The cost of merchandise sold was RM8.800. 3. Returned faulty merchandise to LY Sdn. Bhd. of RM6,000 Sold merchandise to ED Enterprise for cash RM10,000. The cost of merchandise sold was RM5,400 5. Paid LY Sdn. Bhd. the amount due within the discount period. Paid salaries expense of RM3,600, rent expense of RM2,800, and miscellancous expense of RM3.200 7. Office equipment is depreciated at RM2,400 per year. REQUIRED: (a) Prepare journal entries to record the above transactions and adjustment (7 Marks) BALIOI Manting (b) Prepare Statement of Profit or Loss and Other Comprehensive Income (multiple step) for the month ended 31 January 2020 and Statement of Financial Position as at 31 January 2020 Marks) (c) Explain the difference between the nature of AM Enterprise as a merchandise business and EDC Hotels and Resorts as a service business. (4 Marks)