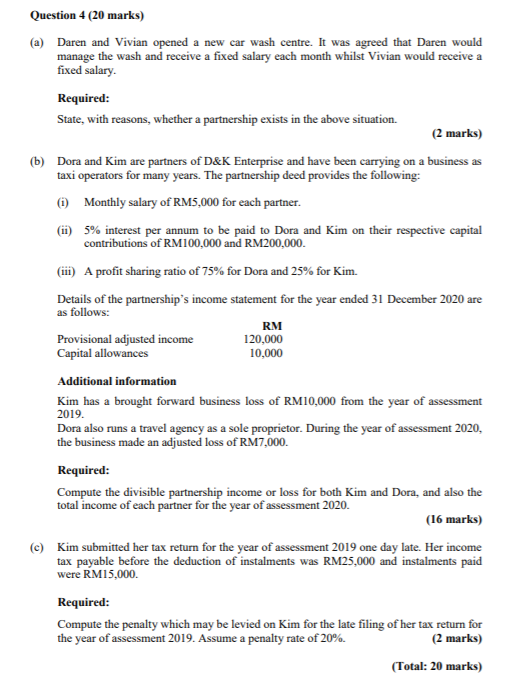

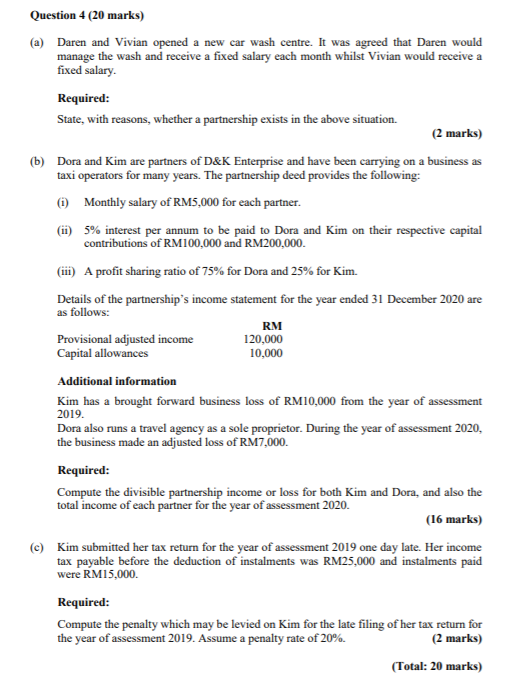

RM Question 4 (20 marks) (a) Daren and Vivian opened a new car wash centre. It was agreed that Daren would manage the wash and receive a fixed salary each month whilst Vivian would receive a fixed salary. Required: State, with reasons, whether a partnership exists in the above situation. (2 marks) (6) Dora and Kim are partners of D&K Enterprise and have been carrying on a business as taxi operators for many years. The partnership deed provides the following: (1) Monthly salary of RM5,000 for each partner. (ii) 5% interest per annum to be paid to Dora and Kim on their respective capital contributions of RM100,000 and RM200,000. (ii) A profit sharing ratio of 75% for Dora and 25% for Kim. Details of the partnership's income statement for the year ended 31 December 2020 are as follows: Provisional adjusted income 120,000 Capital allowances 10,000 Additional information Kim has a brought forward business loss of RM10,000 from the year of assessment 2019. Dora also runs a travel agency as a sole proprietor. During the year of assessment 2020, the business made an adjusted loss of RM7,000. Required: Compute the divisible partnership income or loss for both Kim and Dora, and also the total income of each partner for the year of assessment 2020. (16 marks) (C) Kim submitted her tax return for the year of assessment 2019 one day late. Her income tax payable before the deduction of instalments was RM25,000 and instalments paid were RM15,000 Required: Compute the penalty which may be levied on Kim for the late filing of her tax return for the year of assessment 2019. Assume a penalty rate of 20%. (2 marks) (Total: 20 marks) RM Question 4 (20 marks) (a) Daren and Vivian opened a new car wash centre. It was agreed that Daren would manage the wash and receive a fixed salary each month whilst Vivian would receive a fixed salary. Required: State, with reasons, whether a partnership exists in the above situation. (2 marks) (6) Dora and Kim are partners of D&K Enterprise and have been carrying on a business as taxi operators for many years. The partnership deed provides the following: (1) Monthly salary of RM5,000 for each partner. (ii) 5% interest per annum to be paid to Dora and Kim on their respective capital contributions of RM100,000 and RM200,000. (ii) A profit sharing ratio of 75% for Dora and 25% for Kim. Details of the partnership's income statement for the year ended 31 December 2020 are as follows: Provisional adjusted income 120,000 Capital allowances 10,000 Additional information Kim has a brought forward business loss of RM10,000 from the year of assessment 2019. Dora also runs a travel agency as a sole proprietor. During the year of assessment 2020, the business made an adjusted loss of RM7,000. Required: Compute the divisible partnership income or loss for both Kim and Dora, and also the total income of each partner for the year of assessment 2020. (16 marks) (C) Kim submitted her tax return for the year of assessment 2019 one day late. Her income tax payable before the deduction of instalments was RM25,000 and instalments paid were RM15,000 Required: Compute the penalty which may be levied on Kim for the late filing of her tax return for the year of assessment 2019. Assume a penalty rate of 20%. (2 marks) (Total: 20 marks)